Kotak Bank Professional Loan

Arena Fincorp is a leading financial institution that specializes in providing the best Kotak Bank Professional Loan to its customers. This loan product is specifically designed to cater to the financial needs of professionals, such as doctors, chartered accountants, engineers, and architects, among others. Arena Fincorp understands the unique requirements of professionals and offers a loan that is tailored to meet their specific needs. With competitive interest rates, flexible repayment options, and a quick and hassle-free application process, Arena Fincrop ensures that professionals can access the funds they need to grow their practice, expand their business, or meet any other financial requirements. Whether it’s for purchasing equipment, setting up a new clinic, or renovating an office space, Arena Fincorp is committed to providing the best Kotak Professional Loan to professionals, making their dreams and aspirations a reality.

Benefits of Kotak Bank Professional Loan

Why choose Arena Fincorp for Kotak Bank Professional Loan?

Reputation: Kotak Mahindra Bank is known for its credibility and trustworthiness in the banking sector, providing customers with a sense of security.

Customised Loan Options: Kotak offers professional loans tailored to meet the unique requirements of professionals across various fields, such as doctors, engineers, architects, etc.

Competitive Interest Rates: Kotak strives to provide competitive interest rates on their professional loans, ensuring affordability for borrowers.

Flexible Loan Amount: You can avail yourself of a loan amount based on your specific financial needs, subject to the bank’s policies.

Quick Processing: Kotak Mahindra Bank aims to streamline the loan application and approval process, reducing the waiting time for borrowers.

Minimal Documentation: The bank aims to minimise the paperwork and documentation requirements, making the loan application process more convenient.

Repayment Flexibility: Kotak offers flexible repayment options, allowing you to choose a suitable tenure and repayment schedule based on your financial capacity.

No Prepayment Charges: In some cases, Kotak Mahindra Bank does not levy prepayment charges, giving you the freedom to repay the loan before the end of the tenure without any additional cost.

Online Account Access: Kotak provides online account access, allowing you to conveniently track your loan details, repayment schedule, and other relevant information.

Additional Benefits: Depending on the specific loan product and scheme, Kotak may offer additional benefits such as insurance coverage, credit card offers, and personalised relationship management.

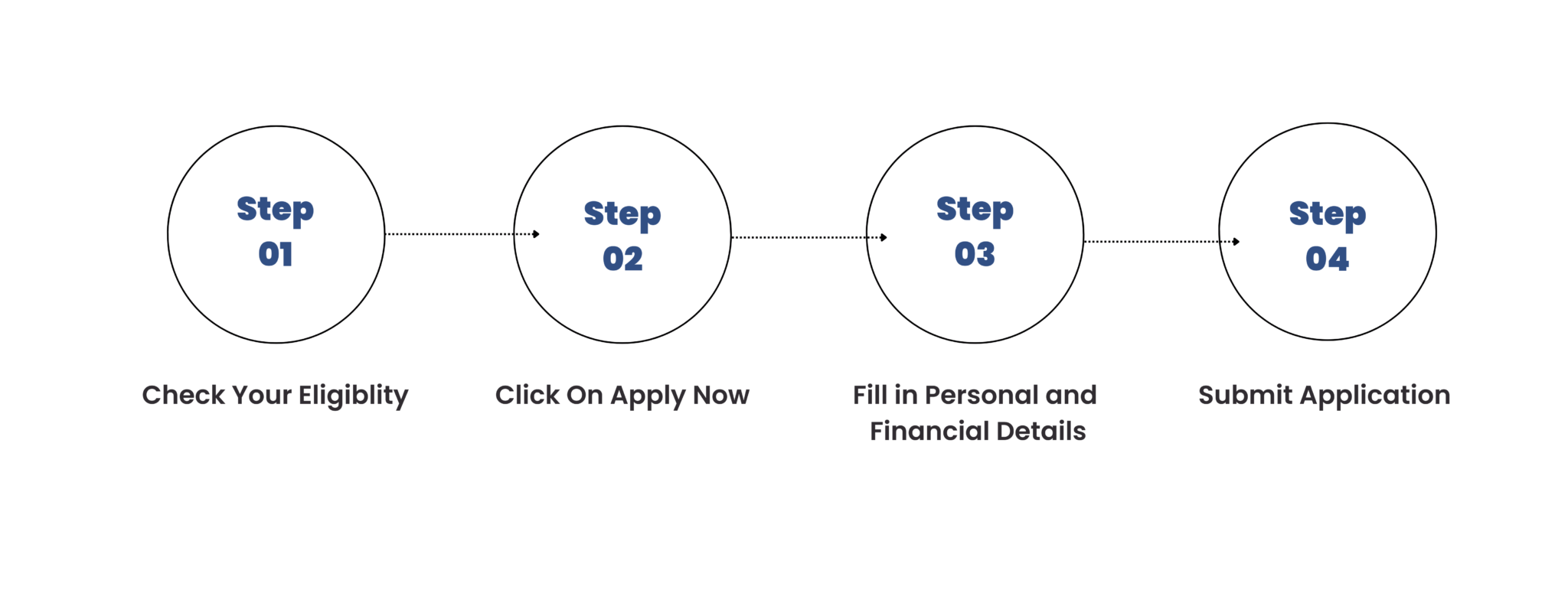

How to Apply for Kotak Bank Professional Loan on Arena Fincorp

Kotak Mahindra Bank Professional Loan interest rate

Doctors and CAs can easily avail a professional loan on Arena Fincorp to expand their businesses or to meet their working capital needs. The rate of interest applicable on professional loans, along with the processing fee and a few other charges, are as follows:

Interest rate

Starting at 16%

Processing fee

Up to 2% of the loan amount

Bounce charges

₹3,000 (Inclusive of applicable taxes)

Penal interest

Any delay in payment of EMI shall attract penal interest at the rate of 2% per month on the EMI outstanding from the date of default until the receipt of the EMI

Outstation collection charges

₹65 + GST

Prepayment/ charges

Term Loan: 4% plus applicable taxes on the outstanding loan amount payable by you on the date of such full prepayment.

Flexi Loan: 4% plus applicable taxes of the total withdrawable amount as per the repayment schedule, on the date of such full prepayment

Part-payment charge

Term Loan: 2% plus applicable taxes on the amount part- prepaid

Nil in case of flexi hybrid loan

Annual Maintenance Charges

Term Loan: Nil

Flexi Hybrid loan: 0.25% plus applicable taxes

**Disclaimer: The rates mentioned are subject to change at the lender’s discretion.

Eligibility Criteria for a Professional Loan

The professional loan eligibility criteria on Arena Fincorp are quite simple. Here are a few essential parameters you must know:

- You must have a professional degree or diploma in your field

- You must be between 25 and 65 years

- You must be a resident of India

- You must be a self-employed individual

Additionally, depending on the type of loan (i.e., doctor or CA loan), you may be asked to meet a certain set of profession-specific criteria.

Documents Required for a Professional Loan

Here is a list of documents you need to furnish when applying for a professional loan:

- Proof of Identity (Passport, PAN card, Aadhaar card)

- Proof of Address (Ration card, Aadhaar card, Utility bills)

- Copies of your professional degrees and diplomas

- Bank statement of your business for the last six months

- Profit and loss statements of your business

- Proof of ownership/lease of a property to set up the practice (if applicable)

How to Apply for Kotak Bank Professional Loan

Follow these steps to apply for a professional loan at Arena Fincorp:

- Step 1: Click on the ‘Apply Now’ on this page.

- Step 2: Fill in a few essential details, such as your profession, mobile number, date of birth, name and pin code

- Step 3: Receive an OTP in your registered number and check your offer

- Step 4: Complete the verification process and submit the required documents upon approval

- Step 5: Get the loan amount credited to your account within a few minutes after the approval of your application

That’s all it takes to apply for a professional loan from the comfort of your home.

Kotak Bank Professional Loan FAQ's

-

What is the Kotak Professional Loan?

The Kotak Professional Loan is a financial product offered by Kotak Mahindra Bank specifically designed for professionals such as doctors, chartered accountants, architects, engineers, and others. It provides them with a loan to meet their professional and personal financial requirements.

-

What are the eligibility criteria for the Kotak Professional Loan?

The eligibility criteria for the Kotak Professional Loan may vary, but generally, applicants should be self-employed professionals with a minimum age of 25 years and a maximum age of 65 years. They should have a minimum number of years of professional practice and meet the bank's income and credit score requirements.

-

What is the maximum loan amount available under the Kotak Professional Loan?

The maximum loan amount available under the Kotak Professional Loan depends on various factors such as the applicant's income, creditworthiness, and the bank's policies. Generally, loan amounts can range from a few lakhs to several crores.

-

Can I use the Kotak Professional Loan for personal purposes?

Yes, the Kotak Professional Loan can be used for both professional and personal purposes. Professionals can utilise the loan amount for business expansion, setting up a clinic/office, purchasing equipment, renovating premises, meeting working capital requirements, or any other legitimate professional need. They can also use the loan amount for personal expenses like home renovation, education, marriage, or any other personal financial requirement.

-

What is the interest rate charged on the Kotak Professional Loan?

The interest rate on the Kotak Professional Loan may vary based on several factors such as the loan amount, tenure, applicant's creditworthiness, and prevailing market conditions. It is advisable to check with Kotak Mahindra Bank or visit their website to get the most accurate and up-to-date information on interest rates.

-

What is the repayment tenure for the Kotak Professional Loan?

The repayment tenure for the Kotak Professional Loan generally ranges from 12 months to 84 months (1 to 7 years). The actual tenure offered to an applicant depends on their profile, loan amount, and other factors as determined by the bank.

-

Is collateral required for the Kotak Professional Loan?

The requirement of collateral for the Kotak Professional Loan may vary based on the loan amount and the applicant's creditworthiness. For lower loan amounts, collateral may not be required. However, for larger loan amounts, the bank may ask for collateral or suitable security to mitigate the risk.

-

Can I prepay the Kotak Professional Loan?

Yes, you can prepay the Kotak Professional Loan. However, prepayment terms and conditions may apply, including prepayment charges. It is recommended to review the loan agreement or consult with Kotak Mahindra Bank to understand the specific prepayment terms applicable to your loan.

-

How can I apply for the Kotak Professional Loan?

To apply for the Kotak Professional Loan, you can visit the official website of Kotak Mahindra Bank and navigate to the loan section. There, you can find the application form and submit it online. Alternatively, you can visit the nearest Kotak Mahindra Bank branch and inquire about the loan application process

-

What documents are required to apply for the Kotak Professional Loan?

The specific documentation requirements may vary, but typically, you will need to provide proof of identity, proof of address, proof of income, bank statements, professional degree certificates, and other relevant documents as per the bank's requirements. It is advisable to check with Kotak Mahindra Bank or refer to their website for the complete list of documents needed.

Here's what our customer have been saying about us

"I recently availed the Kotak Professional Loan from Arena Fincorp, and I must say the entire process was smooth and hassle-free. The loan officer was highly professional and guided me throughout the application process. I received the funds in a timely manner, and the interest rates were competitive. I would highly recommend Arena Fincorp for their excellent service."

Rahul bansal

"I am extremely satisfied with Arena Fincorp's Kotak Professional Loan. The loan terms were flexible, and the repayment options were convenient. The customer service team was responsive and addressed all my queries promptly. The loan helped me finance my professional needs effectively. Thank you, Arena Fincorp!"

Mohit rana

"Arena Fincorp exceeded my expectations with their Kotak Professional Loan. The documentation process was straightforward, and the loan officer provided personalised assistance, ensuring a seamless experience. The loan amount was disbursed quickly, enabling me to meet my professional obligations. I am grateful for their efficient services."

Suresh

"I had a fantastic experience with Arena Fincorp's Kotak Professional Loan. The interest rates were competitive, and the repayment tenure was flexible, allowing me to manage my finances comfortably. The loan application was processed swiftly, and the customer support team was friendly and helpful throughout. I would definitely choose Arena Fincorp again in the future."

Tanisha

"I would like to express my gratitude to Arena Fincorp for their excellent Kotak Professional Loan. They understood my professional needs and offered a tailored loan solution. The entire loan process was transparent, and I was kept informed at every stage. The professionalism exhibited by Arena Fincorp's team was commendable. I highly recommend their services to professionals seeking financial assistance."

Neha Kumari