Kotak Mahindra Business Loan

Arena Fincorp is a leading financial institution that offers a wide range of financial solutions, and one of their standout offerings is the Kotak Mahindra Business Loan. When it comes to providing the best business loan options, Arena Fincorp’s Kotak business loan stands out for several reasons. Firstly, Fincorp understands the diverse needs of businesses and tailors their loan offerings accordingly, ensuring that entrepreneurs can find the perfect financing solution for their specific requirements. Secondly, Arena Fincorp’s Kotak business loan offers competitive interest rates and flexible repayment terms, enabling businesses to manage their finances effectively. Additionally, Arena Fincorp provides a streamlined and hassle-free loan application process, ensuring that business owners can access the funds they need quickly and efficiently. With Arena Fincorp expertise and commitment to customer satisfaction, they have established themselves as a reliable and trusted partner for businesses seeking the best Kotak business loan options.

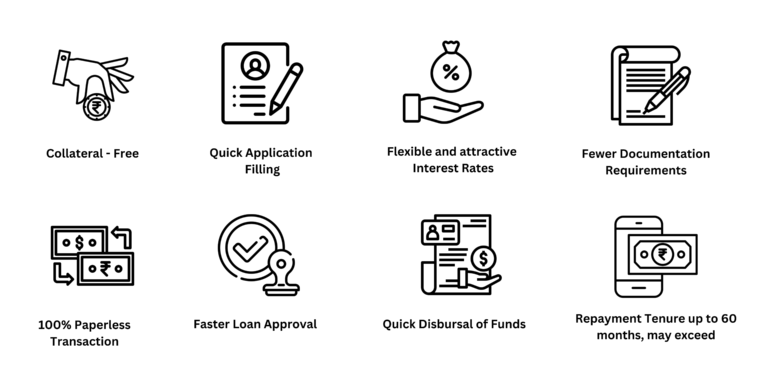

Benefits of Kotak Mahindra Business Loan

Why choose Arena Fincorp for Kotak Mahindra Business Loan?

Reputation: Arena Fincorp has a strong reputation in the financial industry, known for its reliable and trustworthy services.

Experience: The company has extensive experience in providing business loans and understands the unique needs of different businesses.

Competitive interest rates: Arena Fincorp offers competitive interest rates on Kotak Business Loans, helping businesses save money on their loan repayments.

Flexible loan options: They provide a range of loan options, allowing businesses to choose a loan that best suits their specific requirements.

Quick approval process: Arena Fincorp ensures a smooth and efficient loan approval process, reducing the time and effort required to secure a business loan

Dedicated customer support: They have a team of dedicated customer support professionals who are readily available to assist and guide businesses throughout the loan application process

Simple documentation: Arena Fincorp aims to simplify the loan application process by requiring minimal documentation, making it easier for businesses to apply for a Kotak Business Loan.

Customised solutions: They understand that every business is unique and has different financial needs. Arena Fincorp works closely with businesses to create customised loan solutions that align with their specific requirements

Transparent and ethical practices: The company follows transparent and ethical lending practices, ensuring businesses understand the terms and conditions of the loan and are treated fairly throughout the process.

Wide network: Arena Fincorp has a wide network of partner banks and financial institutions, enabling them to provide businesses with access to a range of financial products and services beyond just business loans.

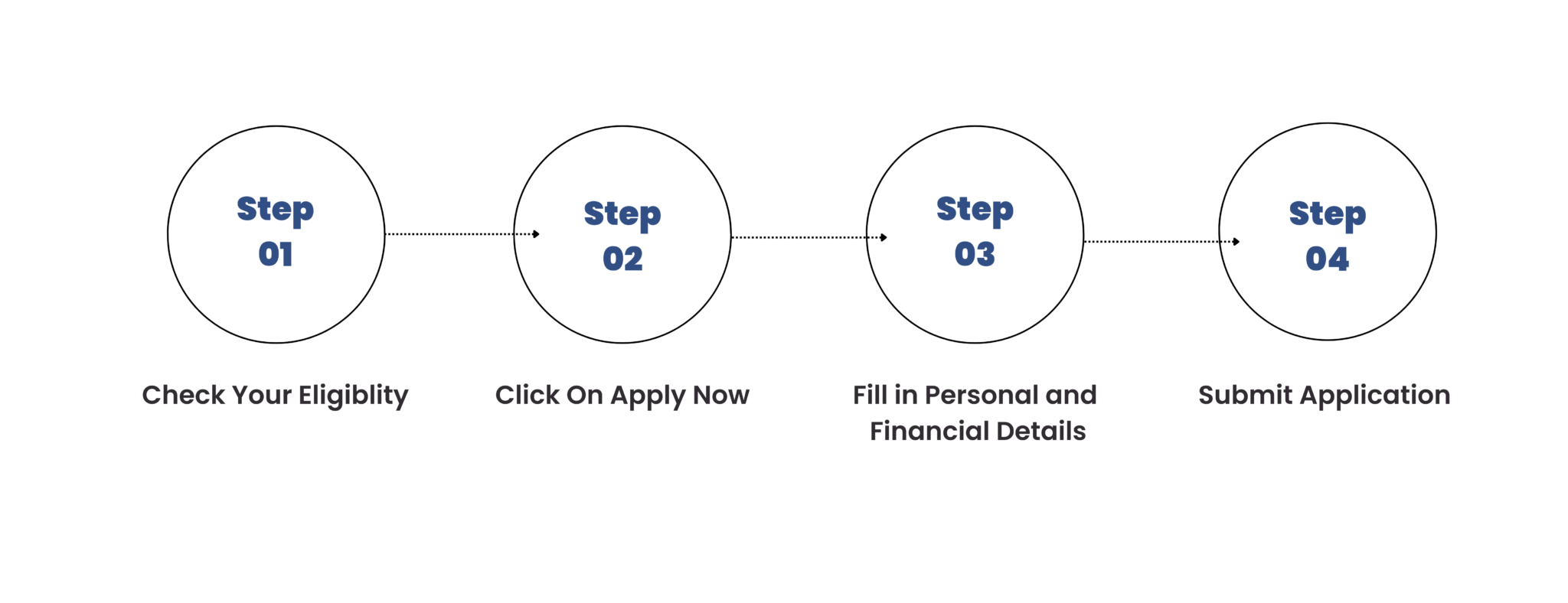

How to Apply for Kotak Mahindra Business Loan on Arena Fincorp

Kotak Mahindra Business Loan Interest Rate

One of the most important parameters that you should be aware of when you are applying for a loan is the Kotak Mahindra Bank Business loan interest rate. The bank charges interest at affordable rates starting as low as 16% per annum. In addition to this, there is a processing fee that goes up to 2% of the loan amount. Aside from the Kotak Business Loan interest rate and the processing fees, there are no other hidden charges that you need to worry about.

Here are the details tabulated below for your convenience.

Particulars

Rate

Interest rate on business loans

Starts at 16% per annum

Processing fees

2% of the loan amount

**Disclaimer: Interest rates and charges are subject to market conditions and the bank’s discretion.

How to Apply for Kotak Mahindra Business Loan?

It’s very easy to apply for a Kotak Mahindra Bank Business Loan. You just need to follow the steps given below.

- Visit the website of Kotak Mahindra Bank and head to the ‘Business’ section.

- From the ‘Explore Products’ dropdown list, choose ‘Business Loans.’

- Click on the ‘Apply Now’ option.

- Then, select whether or not you are an existing Kotak customer.

- If you are, you need to enter the details required, such as your registered mobile number, date of birth or CRN, and the captcha shown.

- If you are not an existing Kotak customer, you will be taken to a different page with an application form.

- Here, you need to enter the details required, like your name, mobile number, email address, age, gender and PAN number.

- You also need to enter the details pertaining to your business, such as the type of business, your business vintage, its annual turnover and whether or not you own any property. You also need to select the city in which your business operates.

- Once you’ve entered these details, check the box to agree to the terms and conditions.

- Then, click the ‘Apply Now’ option.

- A representative from Kotak Mahindra Bank will then get in touch with you shortly.

Documents Required for Kotak Bank Loan Application

When you apply for a Kotak Business Loan , you need to submit the following documents.

- Proof of identity: PAN card, driving licence, passport, voter’s ID or Aadhaar card

- Proof of address: Passport, driving licence, voter’s ID, Aadhaar card, utility bill, bank statement or updated bank account passbook that is no more than 3 months old

- Proof of ownership: Agreement copy, electricity bill, maintenance bill with share certificate, municipal tax bill or share certificate

- Proof of business continuity: Shop and Establishment certificate or GST registration

- Firm constitution: MOA, partnership deed or GST registration certificate

Kotak Mahindra Business Loan FAQ's

-

What is a Kotak Business Loan?

A Kotak Business Loan is a financial product offered by Kotak Mahindra Bank that provides funds to businesses for various purposes, such as expansion, working capital, equipment purchase, or business growth.

-

What are the eligibility criteria for a Kotak Business Loan?

The eligibility criteria for a Kotak Business Loan may vary based on factors such as the nature of your business, financial stability, creditworthiness, and loan amount required. Generally, businesses should have a certain minimum annual turnover and a specific number of years of operation to qualify for the loan.

-

What is the maximum loan amount I can get with a Kotak Business Loan?

The maximum loan amount that you can get with a Kotak Business Loan depends on various factors, including your business's financial health, repayment capacity, and the specific loan product you choose. It is advisable to consult with Kotak Mahindra Bank or visit their website for precise information.

-

What is the interest rate for a Kotak Business Loan?

The interest rate for a Kotak Business Loan may vary based on multiple factors, such as the loan amount, tenure, type of business, credit profile, and prevailing market conditions. It is recommended to contact Kotak Mahindra Bank directly or visit their website for the most up-to-date interest rate information.

-

What is the repayment period for a Kotak Business Loan?

The repayment period or tenure for a Kotak Business Loan can range from a few months to several years, depending on the loan amount and the specific product you choose. Kotak Mahindra Bank provides flexible repayment options to suit different business requirements.

-

Can I prepay or foreclose my Kotak Business Loan?

Yes, Kotak Mahindra Bank allows prepayment or foreclosure of a business loan. However, prepayment charges or fees may apply, which can vary based on the loan product and terms. It is recommended to check the loan agreement or consult with the bank for the exact details.

-

What collateral or security is required for a Kotak Business Loan?

The collateral or security requirement for a Kotak Business Loan may vary based on the loan amount, business type, and the specific loan product. Generally, both secured and unsecured loan options are available. Secured loans may require collateral such as property, inventory, or other business assets.

-

What documents are required to apply for a Kotak Business Loan?

The documentation required for a Kotak Business Loan may include business registration documents, financial statements, income tax returns, bank statements, KYC documents of the business owners, and other specific documents as per the loan requirements. It is advisable to check with Kotak Mahindra Bank for the complete list of documents.

-

Can I apply for a Kotak Business Loan online?

Yes, Kotak Mahindra Bank provides an online application facility for business loans. You can visit their official website or use their mobile app to apply for a business loan. The online application process is designed to be convenient and time-saving.

-

How long does it take for Kotak Mahindra Bank to process a business loan application?

The time taken to process a Kotak Business Loan application can vary based on various factors, including the completeness of documentation, loan amount, and the complexity of the case. Kotak Mahindra Bank aims to process loan applications efficiently and provides timely updates to applicants throughout the process.

Here's what our customer have been saying about us

"I recently applied for a business loan with Arena Fincorp and I must say that the process was incredibly smooth and hassle-free. The team at Arena Fincorp guided me through every step and helped me secure a Kotak business loan that perfectly suited my needs. Highly recommended!"

Rahul bansal

"I had a fantastic experience with Arena Fincorp when I approached them for a Kotak business loan. The staff was knowledgeable, professional, and always available to address my queries. They understood my business requirements and provided me with a tailored loan solution. I am extremely satisfied with their service."

Mohit rana

"Arena Fincorp exceeded my expectations when it came to securing a Kotak business loan. They not only offered competitive interest rates but also had flexible repayment options. The application process was seamless, and their team provided regular updates, ensuring a transparent and efficient experience. I would definitely choose them again for any future financial needs."

Suresh

"I can't thank Arena Fincorp enough for their exceptional service in helping me obtain a Kotak business loan. From the initial consultation to the disbursal of funds, their team was professional, responsive, and went above and beyond to ensure a smooth process. I highly recommend their services to any business owner in need of financial support."

Tanisha

"Arena Fincorp truly understands the needs of small businesses. They were instrumental in securing a Kotak business loan for my venture, providing me with the necessary funds to expand and grow. Their personalised approach, attention to detail, and commitment to customer satisfaction make them stand out in the industry. I am grateful for their support and would undoubtedly choose them again."

Neha Kumari