Axis Bank Personal Loan

Fincorp is renowned for offering the best Axis Bank personal loan in the market. With a strong reputation for reliable financial services, Fincorp has established itself as a trustworthy and customer-centric institution. Their partnership with Axis Bank allows them to provide competitive interest rates, flexible repayment options, and quick loan processing. Whether you need funds for education, medical expenses, wedding, or any other personal requirement, Fincorp ensures a seamless borrowing experience. Their dedicated team of professionals guides you through the entire loan application process, making it convenient and hassle-free. If you’re looking for the best Axis Bank personal loan, Fincorp is the ideal arena to fulfil your financial needs.

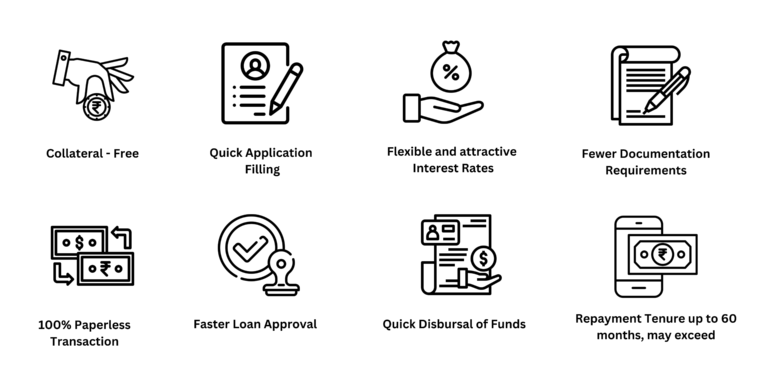

Benefits of Axis Bank Personal Loan

Why Choose Arena Fincorp for Axis Bank Personal Loan?

Reputation: Consider the lender’s reputation in the market. Look for reviews, ratings, and feedback from other customers to gauge their credibility and customer satisfaction.

Interest Rates: Compare the interest rates offered by different lenders, including Axis Bank. Lower interest rates can save you money over the loan tenure.

Loan Amount and Tenure: Check the maximum loan amount and tenure options available. Ensure that they align with your financial requirements and repayment capacity.

Eligibility Criteria: Understand the lender’s eligibility criteria for personal loans. Check if you meet the requirements related to income, employment stability, credit score, and any other specific criteria.

Processing Time: Evaluate the processing time taken by the lender for loan approval and disbursal. Faster processing can be beneficial if you need the funds urgently.

Fees and Charges: Look into the various fees and charges associated with the loan, such as processing fees, prepayment charges, late payment fees, and any other relevant costs. Compare these charges with other lenders to make an informed decision.

Flexible Repayment Options: Consider whether the lender offers flexible repayment options, such as the choice of EMIs (Equated Monthly Instalments) or repayment plans, which can help you manage your finances better

Customer Service: Assess the lender’s customer service quality. Prompt and reliable customer support can be crucial during the loan application process and throughout the tenure.

Additional Benefits: Check if the lender provides any additional benefits or features, such as insurance coverage, top-up loans, balance transfer options, or special offers for existing customers.

Accessibility: Consider the accessibility and convenience of the lender’s services, including online account management, mobile apps, and branch or ATM networks.

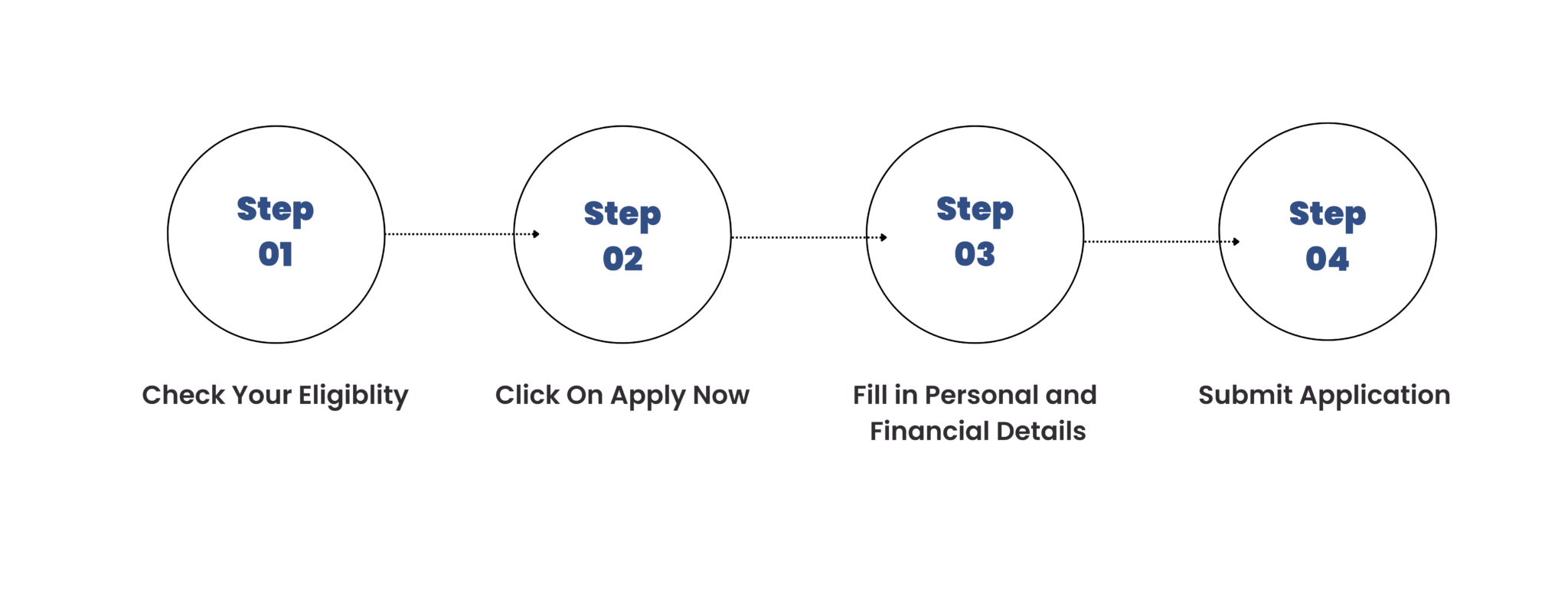

How to Apply for Axis Bank Personal Loan on Arena Fincorp

Axis Bank Personal Loan Details

Here’s a look at the eligibility conditions for availing an Axis Business Loan:

- Nationality: You need to be an Indian citizen.

- Age: Individuals between the age of 21 years and 65 years can avail this loan.

- Income requirements: The business turnover, on an annual basis, should be at least Rs. 30 Lakhs.

Now that you know about the eligibility conditions, here’s a look at the different categories of individuals/business enterprises that are eligible for making a loan application:

- Companies, both private and unlisted public ltd.

- Partnership firms

- Partnerships with limited liability

- Self-employed individuals having business registration

- Hospitals, educational societies etc. that are registered as trusts and societies

If you want to apply for an Axis Business Loan under the Arena Fincorp, here’s a look at the eligibility conditions:

- Nature of business: Small and micro business enterprises engaged in non-agricultural sectors, such as trade, manufacturing or services can apply for the loan.

- Maximum credit requirement: Under the Mudra Yojana, you can apply for a maximum business loan of Rs. 10 Lakhs.

Loan amount

Up to Rs. 40 Lakhs

Interest Rate

10.49% onwards

Tenure

Up to 60 months

Processing fees

1.5% to 2% of the loan amount + GST

Note : The interest rate and charges in the table are indicative and might change as per the bank.

Axis Bank Personal Loan Interest Rate

Axis bank interest rates for personal loan is between 10.49% to 22% per annum with tenures of up to 36 months. The below table mentions personal loan interest rate offered by axis bank for loans with tenure of up to 36 months:

Fixed rate

1 year MCLR

Effective ROI

Spread over 1 year MCLR

Reset

Personal loan

8.90% onwards

10.49% to 22%

4.65% – 13.65%

No Reset

Axis Bank Personal Loan Fees & Charges

The following table mentions Axis Bank loan details pertaining to additional fees and charges:

Swap charges

Rs.500 + GST

Penal interest

24% per annum

Prepayment/part prepayment charges

5% + GST

Duplicate statement issue charges

Rs.200 + GST

Duplicate amortisation schedule charges

Rs.250 + GST

No dues certificate

Rs.50 + GST

Axis Bank Personal Loan Eligibility

- The applicant must be an Indian resident and a salaried individual.

- The age of the applicant must be between 21 and 60 years.

- The minimum net monthly income of the applicant must be Rs. 15,000.

- The applicant must have a total work experience of at least 3 years.

Axis Bank Personal Loan Documents Required

- Completely filled loan application form

- Identity Proof: A copy of PAN Card/Passport/ Voter ID/ Aadhaar / Driving License

- Address Proof: A copy of PAN Card/Aadhaar Card/ Property purchase Agreement/ Registered Lease Agreement/ Utility Bill (not more than 3 months old)/ Driving License/ Passport

- Income Proof: Latest 2 months pay slip, Latest 2 months bank statement showing salary credits, One year Employment proof (Not required if DOJ mentioned in payslip and working for more than 1 year)

- Duly signed Loan agreement duly signed and Standing Instruction (SI) Request / ECS Forms

How to Apply for Axis Bank Personal Loans

Take a look at the simple steps to apply for the Axis Bank Personal Loan at Arena Fincorp.

- Step 1: Enter your personal and income details in the application form

- Step 2: From the list of Personal Loan partners, select Axis Bank.

- Step 3: Enter the Personal Loan amount and repayment tenure as per your choice.

Upon approval, you will get your money in your bank account almost instantly.

Axis Bank Personal Loans FAQ’s

-

What is Axis Bank's personal loan interest rate?

Axis Bank offers personal loans at competitive interest rates, which vary based on factors such as the loan amount, repayment tenure, and your creditworthiness. It is recommended to check with Axis Bank directly or visit their official website for the most accurate and up-to-date interest rates.

-

What is the maximum loan amount I can get from Axis Bank?

Axis Bank offers personal loans with maximum loan amounts that can vary depending on various factors such as your income, credit history, and repayment capacity. Generally, Axis Bank provides personal loans ranging from a few thousand rupees up to several lakhs, but the exact amount will be determined by the bank based on your eligibility.

-

What is the minimum and maximum repayment tenure for an Axis Bank personal loan?

Axis Bank provides flexible repayment options for personal loans. The minimum and maximum repayment tenures offered by the bank typically range from 12 months (1 year) to 60 months (5 years). The specific repayment tenure will be determined by the bank based on your loan amount and other factors.

-

What are the eligibility criteria for an Axis Bank personal loan?

To be eligible for an Axis Bank personal loan, you generally need to meet certain criteria such as minimum age requirements (usually between 21 and 60 years), a stable source of income, and a good credit history. The specific eligibility criteria may vary, so it is advisable to contact Axis Bank or visit their website for detailed information.

-

How long does it take for Axis Bank to process a personal loan application?

Axis Bank aims to provide quick and efficient loan processing. Once you submit a complete loan application with all the necessary documents, the bank typically reviews and processes the application within a few working days. However, the exact time taken can vary depending on various factors and the bank's internal processes.

-

What documents are required to apply for an Axis Bank personal loan?

To apply for an Axis Bank personal loan, you will generally need to submit documents such as identity proof (e.g., PAN card, Aadhaar card), address proof, income proof (e.g., salary slips, bank statements), and employment details. The specific list of required documents may vary, so it is recommended to check with Axis Bank directly for the updated documentation requirements.

-

Can I prepay or foreclose my Axis Bank personal loan?

Yes, Axis Bank allows you to prepay or foreclose your personal loan. However, prepayment or foreclosure may be subject to certain terms and conditions, including applicable charges or fees. It is advisable to contact Axis Bank or refer to your loan agreement for the exact details regarding prepayment or foreclosure of your personal loan.

-

What is the processing fee for an Axis Bank personal loan?

Axis Bank charges a processing fee for personal loans, which is a percentage of the loan amount. The exact processing fee can vary, and it is recommended to check with Axis Bank or refer to their official website for the current processing fee applicable to personal loans.

-

Can I apply for an Axis Bank personal loan online?

Yes, Axis Bank provides the convenience of applying for a personal loan online. You can visit the Axis Bank website, navigate to the personal loan section, and follow the instructions to fill out the online application form. However, you may still need to provide the required documents offline as per the bank's instructions.

-

What is the customer service contact number for Axis Bank personal loans?

To reach Axis Bank's customer service regarding personal loans, you can dial their toll-free number: 1800 419 5959. It is recommended to verify the contact details by visiting the official Axis Bank website, as they may be subject to change over.

Here’s what our customer have been saying about us