Kotak Mahindra Bank Personal Loan

Arena Fincorp is a leading financial institution that excels in providing the best Kotak Mahindra Bank Personal Loan solutions to its customers. With a strong reputation for delivering excellent financial services, Arena Fincrop understands the diverse needs and aspirations of individuals seeking personal loans. They offer a wide range of loan options, flexible repayment terms, and competitive interest rates, ensuring that customers can find a personalised loan solution that suits their specific requirements. Arena Fincrop’s streamlined application process and efficient customer service further enhance the overall experience, making them a preferred choice for individuals looking for the best Kotak personal loan in the market.

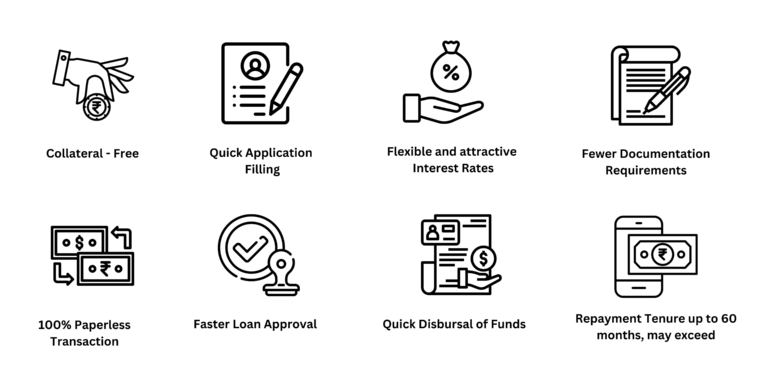

Benefits of Kotak Personal Loan

Why choose Arena Fincorp for Kotak Personal Loan?

Reputation: Look for a lender with a solid reputation and positive customer reviews. Check if they have a strong presence in the lending industry.

Interest Rates: Compare the interest rates offered by different lenders to ensure you’re getting a competitive rate that fits your budget.

Loan Amount and Tenure: Check if the lender offers the loan amount you require and flexible repayment tenure options to suit your financial needs.

Processing Time: Consider the lender’s turnaround time for loan approval and disbursal. Faster processing can be beneficial if you need the funds quickly.

Documentation Requirements: Evaluate the lender’s documentation process. Choose a lender that requires minimal paperwork and offers a hassle-free application process.

Fees and Charges: Take note of any additional fees, such as processing fees, prepayment penalties, or late payment charges. Compare these charges among lenders to find the most favourable terms.

Eligibility Criteria: Understand the lender’s eligibility requirements, such as income criteria, employment stability, credit score, and age limits. Ensure you meet the criteria before applying.

Customer Service: Consider the level of customer service provided by the lender. Responsive customer support can be crucial when you have queries or concerns.

Additional Benefits: Look for any additional perks or benefits offered by the lender, such as the option to apply online, personalised loan offers, or flexible repayment options.

Loan Repayment Options: Check if the lender provides convenient repayment options like auto-debit, online payment portals, or mobile apps to make it easier for you to manage your loan.

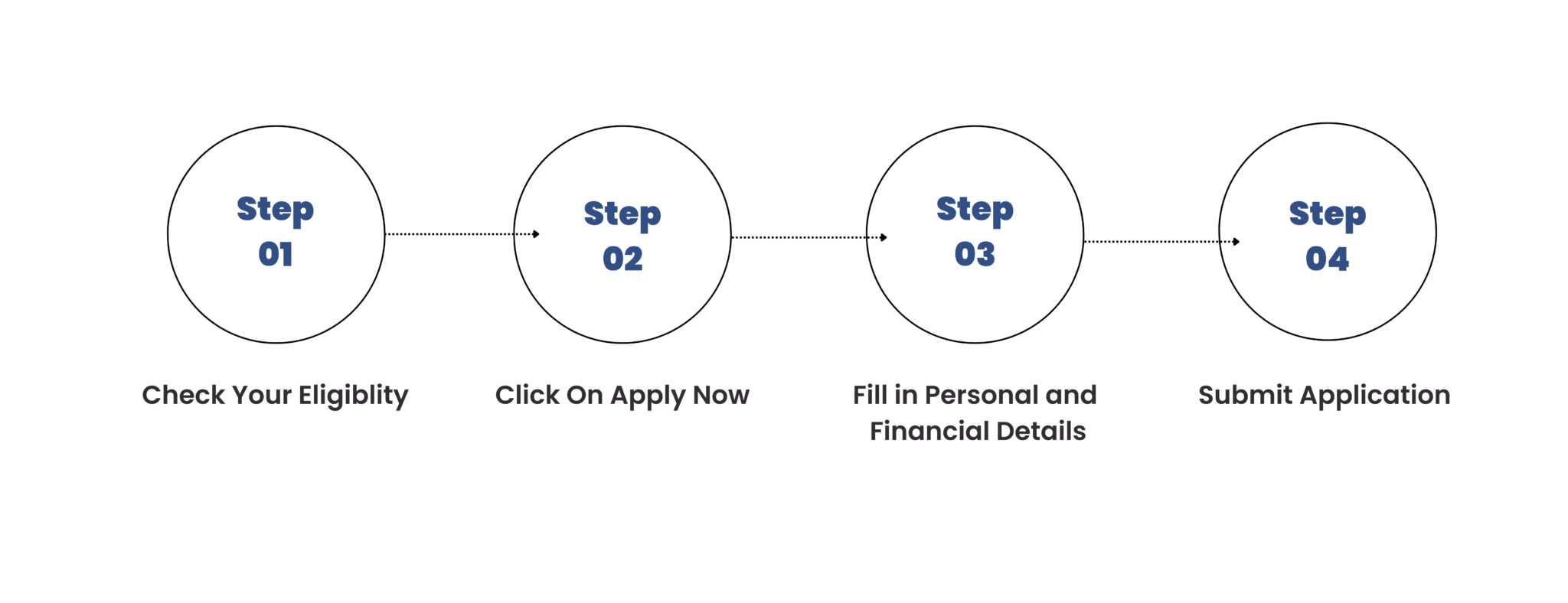

How to Apply for Kotak Mahindra Bank Personal Loan on Arena Fincorp

Kotak Mahindra Bank Personal Loan interest rate

Kotak Mahindra bank personal loan can easily be availed at an interest rate of 10.99% Onwards per annum. You can get a loan from the bank by paying this interest rate, hence fulfilling your dreams. The process to avail the loan is very easy and simple, you can either apply online or visit the branch for the same.

Particulars

Details

Interest Rates

10.99% Onwards

Loan Amount

INR 50,000 – INR 40 Lakhs

Repayment

6 Years

Processing Fee

upto 3% of the loan amount + GST

Kotak Mahindra Bank Personal Loan Eligibility

The Kotak Personal Loan Eligibility Criteria can be met easily. Different types of customers including Salaried, Self Employed & working professionals can apply.

- Age: 21 to 60 years

- Minimum Fixed Monthly Income: Rs. 20,000 for Kotak employees and Rs. 25,000 for corporate salary account holders with Kotak.

- Minimum qualification: Graduation or equivalent.

- Minimum experience: At least 1 year.

- CIBIL score: Minimum 700

- Residence: The applicant should be an active resident for at least 1 year in any of the cities: Mumbai, New Delhi, Bangalore, Chennai, Kolkata, Hyderabad, Pune, Ahmedabad, Noida, Gurgaon, Faridabad, Ghaziabad, Jaipur, Chandigarh and Kochi.

Documents Required for Kotak Personal Loan:

- Application form- duly filled

- 2-3 passport size photos

- Identity Proof (any one): Aadhar Card/ PAN/ Voter’s ID/ Passport/ Driving License

- Address Proof (any one): Passport/ Driving License / Utility Bills like Electricity Bill / Ration Card.

- Income proof for salaried individuals:

- Bank Statements for last 3 months

- Salary Slips for last 3 months

- Income proof for self-employed/business owners:

- Tax Registration/ Company Registration License/ Shop Establishment Proof

- Savings & Current Bank Account Statements for last one year

- Income Tax Returns for last financial year

How to Apply for Kotak Mahindra Bank Personal Loan on Arena Fincorp?

For your convenience, let’s break out the step-by-step process to apply for Kotak Personal Loan on Arena Fincorp Platform. It is fast, easy and reliable.

- Click on Apply Button on the Homepage of the Website.

- Fill the Personal Loan form. Share loan details such as loan amount & tenure, and personal details such as name, city of your residence, employment type, income, & contact information.

- An OTP (one time password) will be sent to your mobile number.

- Use OTP to login to the website and access the list of most suitable Personal Loan products for your profile & requirement.

- Compare available deals or directly apply for Kotak Personal Loan. Click on the eConnect with Bank button.

- Your query will be instantly shared with the bank.

- A loan representative will call you to follow up on this request.

- She will guide you for next steps, documentation and loan processing.

- MMM Loan assistance is absolutely free of cost and there is no charge to apply for any loan from this website.

Kotak Mahindra Bank Personal Loan FAQ's

-

What is the eligibility criteria for a Kotak Mahindra Bank Personal Loan?

To be eligible for a Kotak Mahindra Bank Personal Loan, you need to be between 21 and 58 years of age and have a stable source of income.

-

What is the maximum loan amount I can get from Kotak Mahindra Bank Personal Loan?

The maximum loan amount you can get from Kotak Personal Loan depends on various factors such as your income, credit score, and repayment capacity. It is best to check with Kotak Mahindra Bank directly for specific details.

-

What is the interest rate offered on Kotak Personal Loan?

The interest rate on Kotak Personal Loan varies and is determined based on factors such as your credit score, loan amount, and tenure. It is recommended to check with Kotak Mahindra Bank for the current interest rates.

-

What is the repayment tenure for Kotak Personal Loan?

Kotak Personal Loan offers flexible repayment tenure ranging from 1 year to 5 years. You can choose a tenure that suits your financial situation and repayment capacity.

-

Is collateral required for Kotak Personal Loan?

No, Kotak Personal Loan is an unsecured loan, which means you do not need to provide any collateral or security to avail the loan.

-

Can I prepay or foreclose my Kotak Personal Loan?

Yes, you can prepay or foreclose your Kotak Personal Loan. However, certain terms and conditions may apply, and there might be prepayment charges involved. It is advisable to contact Kotak Mahindra Bank for specific details.

-

How long does it take for Kotak Personal Loan to get approved?

The approval time for Kotak Personal Loan can vary depending on various factors. It generally takes a few working days for the loan to be processed and approved, provided you submit all the required documents and meet the eligibility criteria

-

Can self-employed individuals apply for Kotak Personal Loan?

Yes, self-employed individuals can apply for Kotak Personal Loan. However, they need to meet the eligibility criteria set by the bank and provide the necessary documents to support their income and business stability.

-

What documents are required to apply for Kotak Personal Loan?

The common documents required to apply for Kotak Personal Loan include identity proof, address proof, income proof (such as salary slips or bank statements), and photographs. The specific document requirements may vary, so it's best to check with Kotak Mahindra Bank for the complete list.

-

How can I apply for a Kotak Personal Loan?

You can apply for a Kotak Personal Loan by visiting the official website of Kotak Mahindra Bank or by visiting their nearest branch. Alternatively, you may also be able to apply online through their internet banking or mobile banking platforms, if available.

Here's what our customer have been saying about us

"I had a wonderful experience with Arena Fincorp when applying for a Kotak personal loan. The team was extremely helpful and guided me through the entire process. The loan was disbursed quickly, and the interest rate offered was competitive. Highly recommend their services!"

Rahul bansal

"Arena Fincorp made the Kotak personal loan application process hassle-free. Their staff was prompt in responding to my queries and provided me with all the necessary information. The documentation was handled efficiently, and I received the loan amount in a timely manner. Thank you for the excellent service!"

Mohit rana

"I am delighted with the services provided by Arena Fincorp for my Kotak personal loan. Their staff was professional, knowledgeable, and assisted me in choosing the best loan option that suited my requirements. The loan was processed smoothly, and I appreciate their transparency throughout the entire process. I would definitely choose them again in the future."

Suresh

"I had a great experience with Arena Fincorp while availing a Kotak personal loan. The team was friendly, approachable, and patiently addressed all my concerns. They provided me with a customised loan solution that perfectly matched my financial needs. The entire process was streamlined, and I received the loan amount on time. Highly satisfied!"

Tanisha

"I would like to express my gratitude to Arena Fincorp for their outstanding service in helping me obtain a Kotak personal loan. From the initial consultation to the final disbursal, everything was handled efficiently and professionally. The staff was courteous, and they kept me informed at every step of the process. I would highly recommend their services to anyone seeking a personal loan."

Neha Kumari