ICICI Personal Loan

ICICI personal loan apply online at Arena Fincorp & get lowest interest rates. You don’t have to go through the complicated process of getting ICICI personal loan. We will do it for you to make things easier and simpler. So that you can focus on what’s more important, building your business.

We have years of experience in providing financial solutions and will happily assist you through the personal loan process, ensuring a smooth and hassle-free experience. We work hard to provide you with the cheapest personal loans in India, allowing you to avail it without paying a fortune of your income in interest payments.

ICICI Personal Loan Interest Rate

The ICICI Personal loan Interest rate (for salaried individuals) ranges from Minimum 10.50% to maximum 16.00%. The final interest rate that you would receive from ICICI might depend on several factors such as your repayment history, CIBIL score, your Income, the loan tenure, loan amount etc.

ICICI Personal Loan EMI Calculator

Use our ICICI personal loan EMI calculator to calculate your personal loan EMI amount through ArenaFincorp.com web interface. Our EMI calculator allows you to understand the breakdown of each component, including the interest and principal loan amount. Simply put, you can effectively undertake your financial planning based on the computations.

Alternatively, you can also calculate your ICICI Personal loan EMI through the following basic formula:

E = [P x R x (1+R) ^N] / [(1+R) ^ (N-1)]

Here,

‘E’ stands for EMI

‘P’ represents the principal loan amount

‘r’ stands for the interest rate

& ‘n’ represents the duration of the loan

ICICI Bank Personal Loan Eligibility

To be eligible for ICICI Personal Loan, you must meet the following eligibility criterias:

Eligibility Criteria For Salaried Individuals

Age

20 years – 58 years

Net Salary

minimum monthly income of Rs.30,000

Total years in job/profession

2 Years

Years in current residence

1 Year

*The minimum salary requirement might be different from one applier to other. (Type of employer, having relationship with ICICI Bank etc.) of the customer can be the factors for this difference.

Eligibility Criteria For Self Employed Individuals

Age

28 years (self employed individuals) and 25 years (for doctors); Maximum age – 65 years

Minimum Turnover

Rs. 40 lakh for non-professionals; Rs. 15 lac for professionals; as per audited financials

Minimum Profit After Tax

Rs. 2 lac for Proprietorship Firm/Self employed Individuals and Rs. 1 lac for non-professionals as per audited financials

Business Stability

In current business for at least 5 years and minimum 3 years for doctors

Existing relationship with ICICI Bank

Minimum 1 year liability relationship (current or savings account) or Asset relationship (loan) either live or closed in the last 36 months; repayment track as required by the bank, to be eligible for ICICI personal loan.

ICICI Personal Loan Documents

You can check the list of ICICI Personal loan Documents, which you would be needing when applying for the loan, below:

Documents Required For Salaried Individuals

- Proof of Identity: Passport/Driving Licence/Voters ID/PAN Card (any one).

- Proof of Residence: Leave and Licence Agreement/Utility Bill (not more than 3 months.

- old/Passport (any one).

- Latest 3 months Bank Statement (where salary/income is credited).

- Salary slips for the last 3 months.

- 2 Passport size photographs.

Documents Required For Self-Employed Individuals

- KYC Documents: Proof of Identity, Address proof and DOB proof.

- Proof of Residence: Leave and Licence Agreement/Utility Bill (not more than 3 months old)/Passport (any one)

- Income proof (audited financials for the last two years).

- Latest 6 months Bank Statement.

- Office address proof.

- Proof of residence or office ownership.

- Proof of continuity of business.

ICICI Bank Personal Loan Apply Online

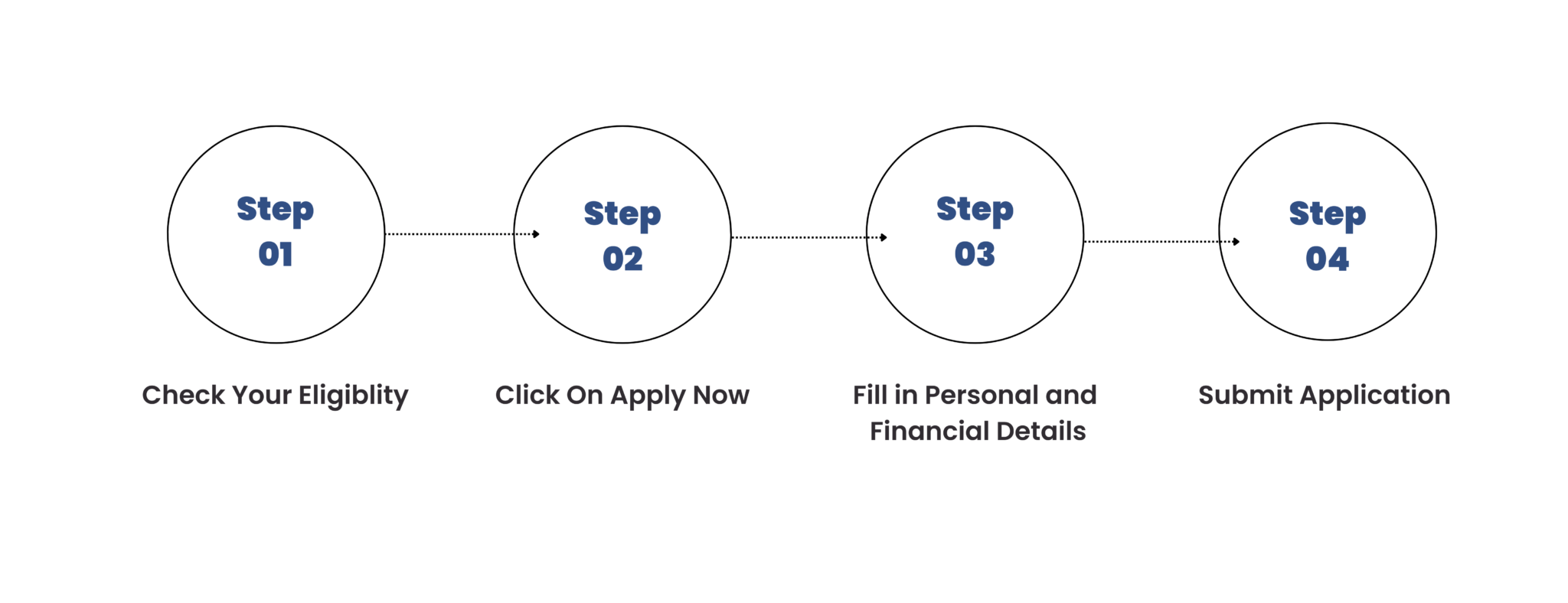

ICICI personal loan apply online at Arena Fincorp. (You can always start your online application and resume it at a later instance at our site.) Here’s our step-by-step guide to apply for a personal loan online at our site:

Step1: Click on Apply Now to open our online application form

Step2: Fill in a few details and verify the OTP sent to your phone

Step3: Enter your KYC and income data

Step4: Choose the loan amount you want to borrow

Step5: Submit your application.

Step6: Done! Our expert team will call you for the loan application. Don’t worry, our team will handle the entire process for you

ICICI Personal Loan Fees & Charges

All ICICI Personal Loan fees & Charges that you need to know, including preclosure charges are mentioned below.

Processing fee / Loan Processing Charges

Upto 2.50% of loan amount plus applicable taxes

Prepayment Charges

For salaried customers, 3% plus applicable taxes on principal outstanding after payment of 1st EMI and Nil if 12 or more EMIs are paid. For MSE classified customers, charges are Nil after payment of the 1st EMI for Loan amount upto 50 lakhs.

Additional Interest on late payment

24% per annum

Loan Cancellation Charges

₹3000/- plus applicable taxes

EMI Bounce Charges

₹500/- per bounce plus applicable taxes

*The facts and figures provided above are indicative and liable to change periodically.

Why Choose Arena Fincorp for ICICI Personal Loan?

1. Quick approval: We feel proud to say that we are one of the few institutions doing superfast application processing, so that you can get your personal loan faster than ever.

2. 100% transparency: No hidden charges. We’re 100% transparent about the terms of our services.

3. Full Assistance: Rest assured, our experienced team will fully assist you in the entire process from start to finish in getting your favourite personal loan. You just need to breathe and relax while we do the whole work for you.

4. History of Reputation: Having a rich history of providing the best financial solutions, our customers are very happy with working with us & we feel proud to say that they trust us for their future financial needs too.

5. Simple and easy Process: Our experienced team will happily guide you through the entire personal loan process, making it simple, easy and hassle free to get your personal loan.

Get Your ICICI Personal Loan. Sit Back & Relax While We Do The Work For You.

Related Articles -

https://arenafincorp.com/sbi-home-loan-interest-rate-emi-calculator/

Our Customers Love Us

ICICI Personal Loan FAQs

-

How do I apply for ICICI personal loan online?

To apply for ICICI personal loan, you can get in touch with us by calling us at +91 9251647949 or by mailing us at info@arenafincorp.com or by clicking on the apply now button above.

-

How do I calculate the EMI of my ICICI Personal Loan?

To calculate your personal , check our EMI calculator above.

-

What is the eligibility criteria for ICICI Personal loan?

The eligibility criteria for ICICI personal loan vary based on factors such your Income, credit history, repayment tenure, loan amount, etc. To know more about it in detail, look at our 'ICICI Bank Personal loan Eligibility' section above.