SBI Personal Loan

Arena Fincorp is a leading financial services provider that can help you apply for SBI personal loan at lowest interest rates. You don’t have to go through the complicated process of getting a loan from SBI. We will do it for you to make things easier and simpler. So that you can focus on much more important things.

We have years of experience in providing financial solutions and will happily assist you through the personal loan process, ensuring a smooth and hassle-free experience. We work hard to provide you with the cheapest personal loan in India, allowing you to get a personal loan without paying a fortune of your income in interest payments.

SBI Personal Loan Features

Xpress Flexi

- Overdraft facility up to ₹25 lakhs, with reducing Drawing Power

- Facility to deposit surplus funds in the loan account to reduce interest burden

- Auto liquidation at the end of loan tenure

- Minimal documentation

- No annual maintenance charges

- No pre-payment penalty

- Low interest rates

- Low processing charges

- Zero hidden costs.

Xpress Credit

- Loan up to 30 lakhs.

- Interest on daily reducing balance.

- Minimal documentation

- Provision for second Loan

- No security, no guarantor.

- Low interest rates.

- Low processing charges.

- Zero hidden costs.

Xpress Elite

- Loans up to Rs. 35 lakhs.

- Interest on daily reducing balance.

- Minimal documentation.

- Provision for second loan.

- No security, no guarantor.

- Low interest rates.

- Low processing charges.

- No hidden costs.

Real-Time Xpress Credit

- Aadhaar OTP based e-sign of customer.

- Step-by-Step Guided e-mail and SMS Communication System.

- Digitization of entire loan documentation processes viz. loan application, loan agreements, stamping and signature at DDE enables States/ UTs.

- Instant loan disbursement.

SBI Pension Loan

- Low Processing Fees

- No hidden costs

- Quick loan processing

- Easy EMIs through SI

- Minimal documentation.

SBI Personal Loan Fees & Charges

Xpress Flexi

- Processing fee: Up to 1.50% of the Loan Amount (subject to minimum ₹1000/- & maximum ₹15000/-), plus GST (Processing Fee waived up to 31.01.2023 as a special offer)

- Penal Interest: @24% p.a. would be charged over and above the applicable interest rate on overdue amount for the period of default.

Xpress Credit

- Penal Interest: @2% p. m would be charged over and above the applicable interest rate on overdue amount for the period of default.

- Prepayment charges: 3% on prepaid amount. No prepayment/ foreclosure charges if account is closed from the proceeds of a new loan account under same scheme.

Xpress Elite

- Processing fee: Up to 1.50% of the Loan Amount (subject to minimum ₹1000/- & maximum ₹15000/-), plus GST (Processing Fee waived up to 31.03.2022 as a special offer).

- Penal Interest: @2% p. m would be charged over and above the applicable interest rate on overdue amount for the period of default.

- Prepayment charges: 3% on prepaid amount. No prepayment/ foreclosure charges if account is closed from the proceeds of a new loan account under same scheme.

Real-Time Xpress Credit

- Processing Fee: upto 0.75% of the loan amount plus GST.

- Penal Interest: @2% p.m would be charged over and above the applicable interest rate on overdue amount for the period of default.

SBI Pension Loan

- Prepayment charges: 3% on prepaid amount.

- No prepayment/ foreclosure charges if the account is closed from the proceeds of a new loan account under the same scheme.

*The facts and figures provided above are indicative and liable to change periodically.

Also check: Car loan interest rate for all banks

SBI Personal Loan Minimum & Maximum Tenure

Xpress Flexi / Xpress Credit / Xpress Elite / Real-time Xpress Credit

- Minimum: 6 months

- Maximum: 72 months or remaining period of service (whichever is lower)

SBI Pension Loan

- 72 months (Loan to be repaid by 78 years of age)

*The facts and figures provided above are indicative and liable to change periodically.

Also check: Car loan interest rate for all banks

SBI Personal Loan Minimum & Maximum Loan Amount

Xpress Flexi

- Minimum: Rs. 1,00,000

- Maximum: Rs. 25,00,000, subject to 24 times NMI & EMI/NMI Ratio upto 65%

Xpress Credit

- Term Loans Amount

- Minimum Loan Amount – Rs. 25,000

- Maximum Loan Amount – Rs. 20 lakhs / 24 times NMI

2. Overdraft Loans Amount

- Minimum Loan Amount – 5 lakhs

- Maximum Loan Amount – Rs. 20 lakhs / 24 times NMI

- Second Loan is eligible any time after disbursement of first loan, subject to the overall EMI/NMI ratio of 50%.

- Second Loan is eligible only on regular EMI repayments of the first loan

Xpress Elite

- Minimum: Rs. 3,00,000

- Maximum: Rs. 35,00,000 / 24 times NMI

Real-Time Xpress Credit

- Minimum Loan amount: Rs. 25000/-

- Maximum Loan Amount: Rs 30,00,000/- for RTXC and Rs 35,00,000/- for RTXC Elite

*The facts and figures provided above are indicative and liable to change periodically.

Also check: Car loan interest rate for all banks

SBI Personal Loan Eligibility

Here’s the list of the eligibility conditions below. Check your eligibility and apply for SBI car loan here.

SBI Xpress Flexi

- Individuals having Diamond & Platinum category Salary Package Account with SBI

- Minimum Net Monthly Salary: ₹50,000/

- Employees working with Central/ State/ Quasi Governments, Defense/ Central Armed Police/ Indian Coast Guard, Central & State PSUs Corporates (Private & Public Ltd.)

Xpress Credit

- Individuals with Salary Account with SBI.

- Minimum monthly income Rs. 15000/.

- EMI/NMI Ratio less than 50%.

- Employees working with – Central/ state/ quasi government, Central PSUS and profit making state PSUS, Educational institutions of national repute, Selected corporates with or without relationship with the bank.)

Xpress Elite

- Individuals having Salary Account with SBI OR any other Bank

- Minimum Net Monthly Income: Rs. 1,00,000/-

- EMI/NMI Ratio <= 60%

- Employees working with Central/ State/ Quasi Governments, Defense/ Central Armed Police/ Indian Coast Guard, Central & State PSUs, Corporates (Private & Public Ltd.),

- Educational institutions of National Repute

Real-Time Xpress Credit

- Govt./ Defense Salary Package account holders with KYC Compliant accounts.

- Minimum Net Monthly Income:

- >=Rs 15000/- for RTXC

- >=Rs 100000/- for RTXC-Elite

- EMI/NMI ratio: For RTXC: < 50%; For RTXC Elite :< 60%

SBI Pension Loan

- EMI/NMP ratio shall not exceed 33% in all the cases for Family Pensioners

- EMI/NMP ratio shall not exceed 50% in all other type of Pensioners.

1. For Central & State Government Pensioners:

- The pensioner should be below 76 years of age.

- Pension payment order is maintained with SBI.

- The pensioner to furnish an irrevocable undertaking not to amend his mandate to the Treasury during the tenure of the loan.

- The Treasury to give consent in writing that it will not accept any request from the pensioner to transfer his pension payment to any other bank till a NOC is issued

- All other terms and conditions of the Scheme will be applicable, including guarantee by the spouse (eligible for family pension) or by a suitable third party.

- Pensioners of Armed Forces, including Army, Navy and Air Force, Paramilitary Forces (CRPF, CISF, BSF, ITBP, etc.), Coast Guards, Rashtriya Rifles and Assam Rifles.

- Pension payment order is maintained with SBI.

- No minimum age bar under the scheme.

- Maximum age at the time of processing the loan should be less than 76 years.

- Family pensioners include authorized members of the family to receive pension after the death of the pensioner.

- Family pensioner should not be more than 76 years of age.

*The facts and figures provided above are indicative and liable to change periodically.

You might be interested in: Check Car loan Eligibility requirements for all Major Banks in India

Why Choose Arena Fincorp for SBI Car Loan?

1. Quick approval: We feel proud to say that we are one of the few institutions doing superfast application processing, so that you get to own your dream car faster than ever.

2. 100% transparency: No hidden charges. We’re 100% transparent about the terms of our services.

3. Full Assistance: Rest assured, our experienced team will fully assist you in the entire process from start to finish in getting the best car loan. You just need to breathe and relax while we do the whole work for you.

4. History of Reputation: Having a rich history of providing the best financial solutions, our customers are very happy with working with us & we feel proud to say that they trust us for their future financial needs too.

5. Simple and easy Process: Our experienced team will happily guide you through the entire car loan application process, making it simple, easy and hassle free to own your dream car.

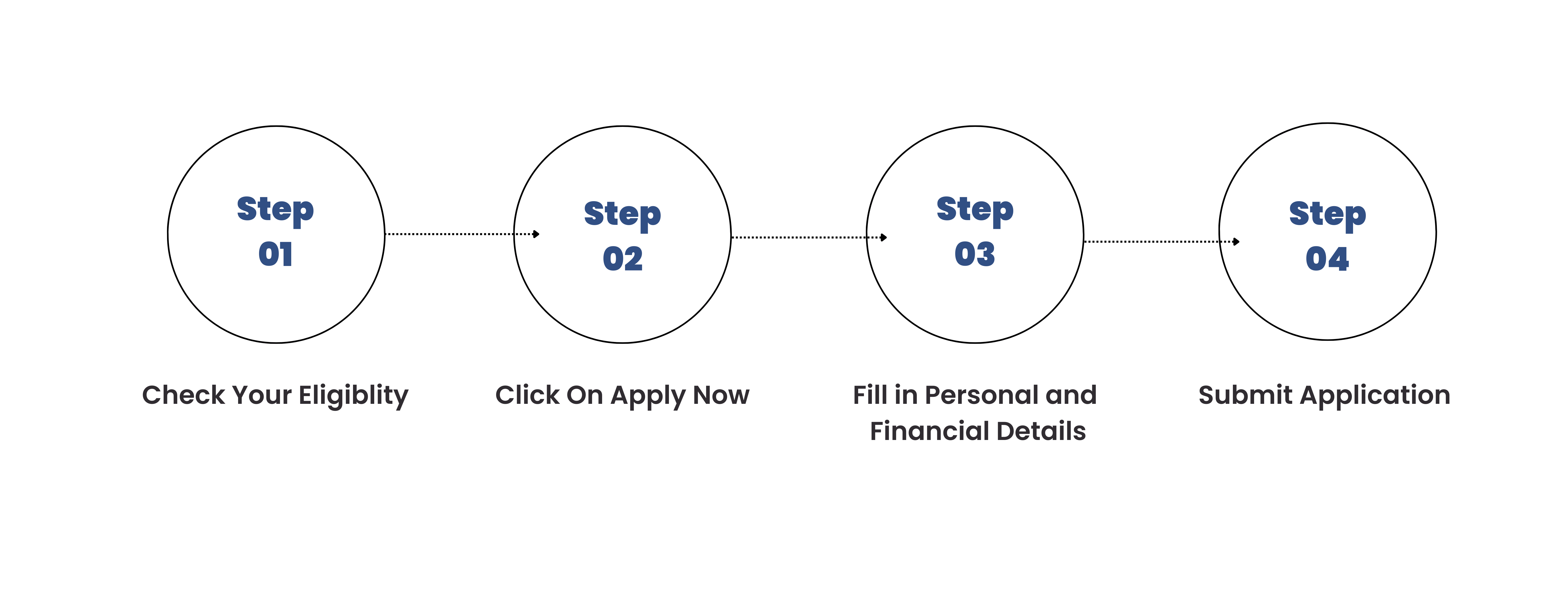

How to Apply for SBI Car Loan at Arena Fincorp

Get Your Personal Loan Quickly. Sit Back & Relax While We Do The Work For You.

Related Articles -

https://arenafincorp.com/sbi-home-loan-interest-rate-emi-calculator/

Our Customers Love Us

Arena Fincrop provided a seamless SBI car loan experience, with expert guidance, competitive interest rates, and flexible repayment options. Highly recommended.

Arena Fincorp's SBI car loan services are highly satisfactory, with efficient application and disbursement, knowledgeable staff, and prompt queries. I didn't expect them to make things this simpler!

I'm a businessman. I have so many important things to do rather than spending days researching for the cheapest car loan. Delegating this work to Arena Fincorp saved so much of my time.

Someone who is always confused about which bank to choose for any of my loans, this company helped me a lot in deciding! Not only that, but they operated my entire loan process to avail the loan for me. I didn't have to do any work!

Arena Fincorp provided a hassle-free SBI car loan experience, offering customer-centric approach and tailored options to meet individual needs, making the purchase process smooth.

SBI Personal Loan FAQs

-

How do I apply for an instant SBI Personal loan online?

To apply for an Instant personal loan, you can get in touch with us or click on the apply now button above.

-

What is the maximum loan amount offered by SBI for personal loans?

The maximum loan amount offered by SBI for car loans depends on various factors, such as your income, credit history, and the type of car you intend to purchase. Generally, SBI offers car loans ranging from a minimum of Rs. 25,000 to a maximum of several lakhs.

-

What is the repayment period for SBI car loans?

SBI car loans typically come with a repayment period of up to 7 years. However, the exact tenure may vary depending on the specific terms and conditions of the loan, the loan amount, and your repayment capacity.

-

Can I get a car loan from SBI if I have a low credit score?

Your SBI car loan eligibility depends on various factors, including your credit score. While a low credit score may affect your chances of approval, it does not necessarily disqualify you from getting a car loan. SBI may consider other factors like income, employment stability, and collateral to assess your loan application.