Axis Bank Business Loan

Arena Fincorp is a renowned financial institution that specialises in providing the best ‘Axis Bank Business Loan‘ solutions. With a strong track record of assisting businesses in achieving their goals, Arena Fincorp understands the unique financial needs of entrepreneurs and offers tailored loan products that cater to their specific requirements. Whether it’s expanding operations, purchasing equipment, managing working capital, or funding other business endeavours, Arena Fincrop ensures that their clients have access to flexible and competitive loan options from Axis Bank. By collaborating with Axis Bank, a trusted and reputable financial institution, Arena Fincrop ensures that businesses receive the best loan terms, competitive interest rates, and a seamless application and approval process. Whether you’re a small startup or an established enterprise, Arena Fincrop can provide the best ‘Axis Bank Business Loan‘ to fuel your business growth and success.

Benefits of Axis Bank Business Loan

Why Choose Arena Fincorp for an Axis Bank Business Loan?

Reputation: Research the lender’s reputation in the market, including their track record and customer reviews.

Additional Services: Consider any additional services or benefits provided by the lender, such as business advisory services, online banking features, or special industry-specific expertise.

Loan Products: Assess the range of loan products offered by the lender and determine if they meet your business’s specific requirements.

Eligibility Criteria: Understand the lender’s eligibility criteria, such as minimum turnover, profitability, and credit score requirements, to ensure you meet their qualifications.

Interest Rates: Compare the interest rates offered by different lenders to ensure you get a competitive rate that suits your financial capabilities.

Customer Service: Look for a lender with excellent customer service that can provide guidance and support throughout the loan process.

Loan Amount and Tenure: Check if the lender offers the desired loan amount and tenure that align with your business needs.

Collateral Requirements: Determine if the lender requires collateral for the loan and evaluate if it aligns with your business’s assets or capabilities.

Application Process: Evaluate the lender’s loan application process, including the required documentation and the ease of applying online or through physical branches.

Flexibility: Consider whether the lender offers flexibility in terms of repayment options, prepayment penalties, or restructuring options.

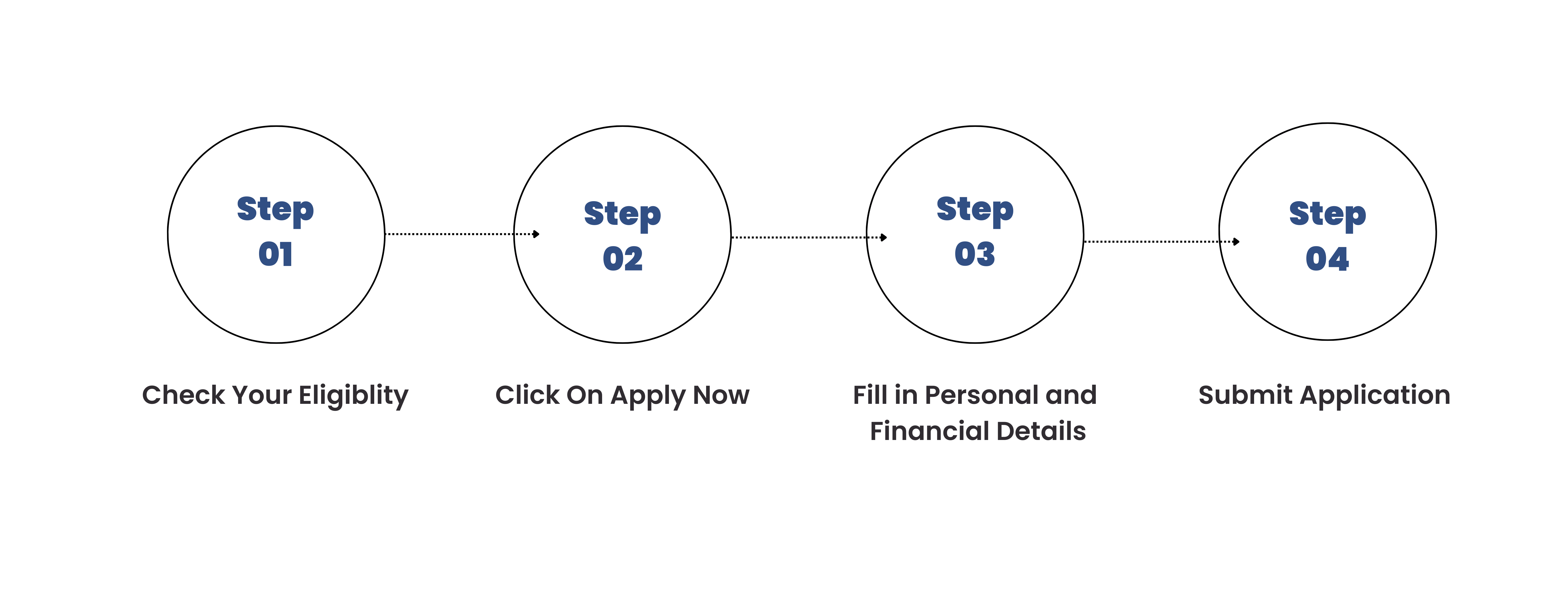

How to Apply for Axis Bank Business Loan on Arena Fincorp

Axis Bank Business Loan Eligibility

Here’s a look at the eligibility conditions for availing an Axis Business Loan:

- Nationality: You need to be an Indian citizen.

- Age: Individuals between the age of 21 years and 65 years can avail this loan.

- Income requirements: The business turnover, on an annual basis, should be at least Rs. 30 Lakhs.

Now that you know about the eligibility conditions, here’s a look at the different categories of individuals/business enterprises that are eligible for making a loan application:

- Companies, both private and unlisted public Ltd.

- Partnership firms

- Partnerships with limited liability

- Self-employed individuals having business registration

- Hospitals, educational societies etc. that are registered as trusts and societies

If you want to apply for an Axis Business Loan under the Arena Fincorp, here’s a look at the eligibility conditions:

- Nature of business: Small and micro business enterprises engaged in non-agricultural sectors, such as trade, manufacturing or services can apply for the loan.

- Maximum credit requirement: Under the Mudra Yojana, you can apply for a maximum business loan of Rs. 10 Lakhs.

How to apply for Axis Bank Business Loan

You can make an application for the Axis Bank business loan online or make a physical visit to a branch and complete the application process offline. Read on to know about both the methods:

Axis Bank Business Loan application online

Here’s a step-by-step guide to help you understand the process of making an online application for an Axis Business loan:

Step 1: On the Axis Bank’s official web portal, select the option of ‘Business Loan.’

Step 2: You can now see the features of the business loan from Axis Bank.

Step 3: Once you scroll to the end of the page, you can select the option of ‘Apply Now.’

Step 4: You will now reach a page requiring you to provide personal details, like name, city, phone number, loan amount, and so on.

Step 5: You now have to select the option of ‘Submit.’

Step 6: Once you have submitted the online form, a bank representative or official will contact you shortly. Next, you will be asked to submit the mandated documents. The loan application will then be verified. Upon successful authentication, the loan amount will be disbursed.

Axis Bank Business Loan application offline

If you want to make an offline application, you can visit the nearest Axis Bank and contact the designated official. Do remember to carry a copy of your identity and address proof along with your PAN card.

How to apply for Axis Bank Business Loan

Particulars

Details

Axis Bank Business Loan interest rate

Starting from 17% onwards

Requirement of collateral

No

Processing fee

2% of the total loan amount along with the applicable taxes

Foreclosure charges

4% of the outstanding amount (on the principal component of the loan) for foreclosing the loan between 24 months and 36 months.

3% of the principal outstanding amount for foreclosing the loan above 36 months.

Prepayment charges

Zero

Minimum loan amount

Rs. 50,000

Maximum loan amount

Rs. 75 Lakhs

Maximum repayment tenure

Rs. 75Lakhs

Maximum repayment tenure

5 years

Disclaimer: Interest rates and charges are subject to market conditions and bank’s discretion.

How to apply for Axis Bank Business Loan

To avail an Axis Bank Business Loan, you have to submit various documents. Here’s a look:

- Application form: You have to submit the form online or offline after filling in the requisite details.

- Photographs: You have to submit copies of your recent passport-size photographs.

- PAN details: You have to compulsorily submit a copy of your Permanent Account Number (PAN) card.

- KYC documents: To complete the mandatory Know Your Customer (KYC) process, you can submit documents, like Aadhaar, Voter’s Id, Driving License, Passport, and so on.

- Income proof: You have to submit the recent ITR and bank statement for the last 12 months. Also, you have to submit certified copies of your balance sheet and profit and loss account.

- Proof of business establishment: You have to submit proof of your business establishment, such as a certificate of registration, partnership agreement etc. Also, the bank can ask to provide proof regarding the age and address of your business venture.

- Miscellaneous documents: Axis Bank can also ask you to submit additional documents regarding your business enterprise.

Axis Business Loan FAQ's

-

What types of business loans does Axis Bank offer?

Axis Bank offers a wide range of business loans, including term loans, working capital loans, equipment financing, trade finance, and business overdraft facilities.

-

What is the eligibility criteria for an Axis Bank business loan?

The eligibility criteria for an Axis Bank business loan vary depending on factors such as the type of loan, business vintage, annual turnover, and financial stability. It's best to contact Axis Bank directly or visit their website for detailed eligibility requirements.

-

What is the maximum loan amount I can get from Axis Bank for my business? Payment tenure for Axis Bank Business Loan?

The maximum loan amount depends on several factors, including the type of loan, the borrower's creditworthiness, and the business's financials. Axis Bank offers customised loan solutions based on individual business requirements.

-

What is the interest rate for Axis Bank business loans?

Axis Bank offers competitive interest rates for business loans, which are subject to change based on market conditions and the borrower's profile. It's advisable to check with the bank for the current interest rates.

-

What is the repayment tenure for Axis Bank business loans?

The repayment tenure for Axis Bank business loans can vary based on the loan type and purpose. Typically, the repayment tenure ranges from 1 year to 5 years for most business loans.

Here's what our customer have been saying about us

"I recently availed a business loan from Arena Fincorp through Axis Bank, and I must say I am extremely satisfied with their service. The loan application process was smooth, and the representatives were helpful and knowledgeable. I highly recommend their services for anyone seeking a business loan."

Rahul bansal

"I had a great experience with Arena Fincorp and Axis Bank while applying for a business loan. They provided me with competitive interest rates and flexible repayment options. The entire process was quick, and their team was responsive to all my queries. I am grateful for their support and would definitely choose them again."

Mohit rana

"I am very impressed with the seamless collaboration between Arena Fincorp and Axis Bank for business loans. The loan application was hassle-free, and the documentation process was efficient. They understood my business needs and tailored the loan to meet them. I appreciate their professionalism and would recommend their services to fellow entrepreneurs."

. Suresh

"Arena Fincorp, in partnership with Axis Bank, exceeded my expectations when it came to availing a business loan. Their customer service was top-notch, and the loan terms were favourable. They provided me with personalised guidance throughout the process, and I felt valued as a customer. I'm extremely satisfied with their services."

Aman

"I would like to express my gratitude to Arena Fincorp and Axis Bank for their exceptional support during my business loan application. They offered competitive interest rates, and the loan approval was swift. The team was friendly, responsive, and provided clear explanations for all my queries. I am delighted with their services and would recommend them without hesitation."

Neha Kumari