Axis Bank Car Loan

Arena Fincorp is renowned for offering the best ‘Axis Bank car loan‘ services in the market. They have established themselves as a trusted and reliable financial institution, providing excellent options for individuals looking to purchase a car through a loan. With their expertise in the banking sector and strong collaboration with Axis Bank, Arena Fincorp ensures that customers receive competitive interest rates, flexible repayment plans, and a seamless application process. Whether you are a first-time car buyer or looking to upgrade your vehicle, Arena Fincrop is committed to providing the best car loan options tailored to your specific needs, making your car buying journey a smooth and satisfying experience.

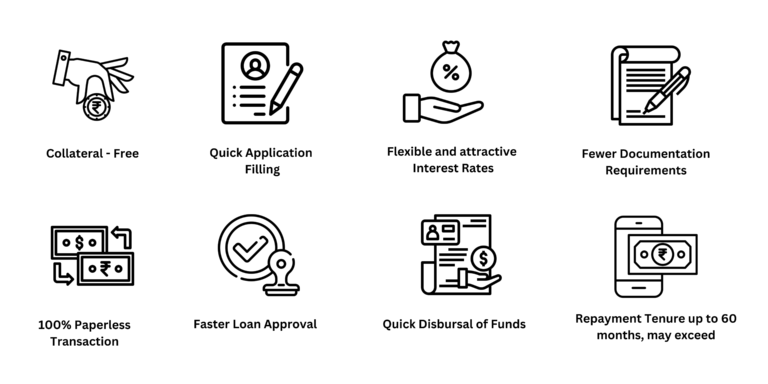

Benefits of Axis Bank Car Loan

Why choose Arena Fincorp for Axis Bank Car loan?

Competitive interest rates: Arena Fincorp provides car loans with competitive interest rates, ensuring that you get a favourable borrowing cost.

Quick loan approval: Arena Fincorp has a streamlined loan approval process, enabling faster loan disbursal compared to traditional banks.

Flexible loan repayment options: They offer flexible repayment options, allowing you to choose a loan tenure that suits your financial situation.

Extensive network: Arena Fincorp has a wide network of branches and partners, making it convenient for customers to access their services across various locations.

Transparent and fair terms: They maintain transparency in loan terms and conditions, ensuring that you understand all aspects of the loan before proceeding.

Dedicated customer support: Arena Fincorp provides dedicated customer support to assist you throughout the loan application and repayment process, addressing any queries or concerns you may have.

Simple documentation: The loan application process with Arena Fincorp involves minimal documentation, saving you time and effort.

Customised loan solutions: They offer personalised loan solutions based on your specific requirements, ensuring that you get a loan tailored to your needs.

Wide range of loan amounts: Arena Fincorp offers car loans for a wide range of amounts, accommodating different budgets and vehicle choices.

Collaborative approach: They have a collaborative approach, working closely with customers to understand their financial goals and provide suitable loan options.

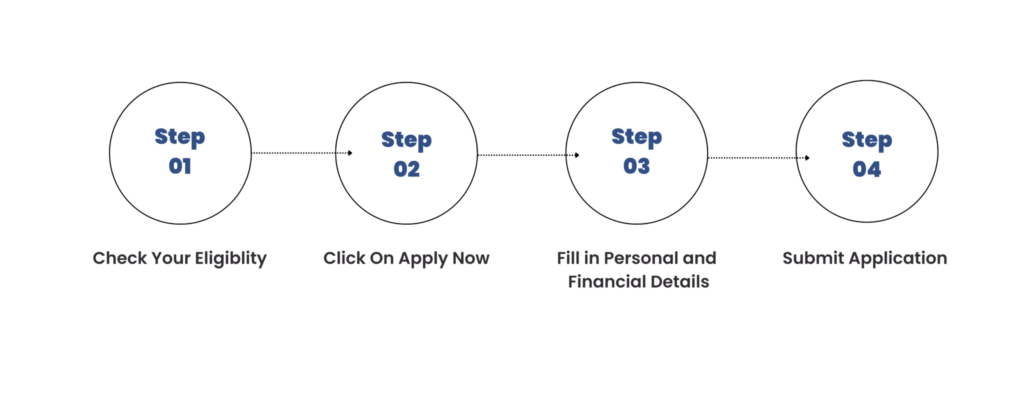

How to Apply for Axis Bank Car Loan on Arena Fincorp

Axis Bank Car Loan Eligibility

Here’s a look at the eligibility conditions for availing an Axis Bank Car Loan:

Salaried individuals

- The applicant must be at least 21 years of age, and the maximum age of eligibility being 70 years.

- Net annual salary of Rs.2.4 lakh p.a.

- The applicant must be employed for a minimum of 1 year.

- The income eligibility criteria will depend on the Form 16 and the salary slip submitted.

Self-employed individuals

- The minimum age of the applicant must be 18 years and the maximum age being 75 years.

- The minimum net annual business must be Rs.18 lakh for selected car models, while for other models, the minimum net annual business income must be Rs.2 lakh.

- The applicant must be employed for a minimum of 3 years.

- The income eligibility criteria will depend on the latest income tax returns.

Self-employed non individuals

- The minimum net annual business must be Rs.18 lakh for selected car models, while for other models, the minimum net annual business income must be Rs.2 lakh.

- The applicant must be employed for a minimum of 3 years.

- The applicant will have to furnish IT returns for at least 2 years along with the audited financials of 2 years along with the calculated income.

Priority customers

- Customers with a vintage of 6 months.

- The applicant must have an Average Quarterly Balance of Rs.1 lakh for the last 2 quarters.

- The maximum loan amount that can be availed must be equivalent to 3 times the Average Quarterly Balance for the last 2 quarters.

How to apply for Axis Bank Car Loan?

- Visit Arena Fincorp and fill a form.

- Wait for a call from our Relationship Manager, who will guide you throughout the process.

- You can compare different offers from banks and choose the one which suits your needs.

Thus, easily Apply For a Car Loan through Dialabank and enjoy the best offers.

Documentation Required:

- Application form

- Passport size photographs

- KYC documents

- Office Business Proof

- Income proof

- Bank statement

- Age proof

- Sign verification proof

- Additional documents

Axis Bank Car Loan FAQ’s

To be eligible for an Axis Bank car loan, you need to meet certain criteria such as being a salaried individual, self-employed professional, or a business entity, having a minimum age of 21 years, and meeting the income requirements set by the bank.

Axis Bank provides car loans with maximum loan amounts ranging from Rs. 1 lakh to Rs. 1 crore, depending on various factors such as your income, repayment capacity, and the value of the car.

The interest rate for Axis Bank car loans can vary based on factors like the loan amount, tenure, type of car, and your credit profile. It is advisable to contact the bank or visit their website to get the most up-to-date information on the interest rates.

Axis Bank offers flexible repayment tenures for car loans, which can range from 12 months to 84 months (1 to 7 years). The actual tenure available to you will depend on factors such as the loan amount, your income, and the type of car.

Yes, Axis Bank allows prepayment and foreclosure of car loans. However, certain terms and conditions may apply, and the bank may charge a prepayment or foreclosure fee. It is recommended to check with the bank for the specific details and charges.

The documents required for an Axis Bank car loan typically include identity proof, address proof, income proof, bank statements, and details related to the car you wish to purchase. The specific documents may vary based on your employment type and the loan amount.

Yes, Axis Bank provides the facility to apply for a car loan online through their official website. You can fill out the application form, upload the necessary documents, and track the status of your loan application through the online portal.

Yes, Axis Bank offers the option to transfer your existing car loan from another bank to Axis Bank. This can be done to avail of better interest rates, flexible repayment options, or other benefits offered by Axis Bank. You will need to meet certain eligibility criteria and provide the required documents for the loan transfer process.

Yes, Axis Bank offers car loan financing for both new and used cars. However, the eligibility criteria, loan amount, and interest rates may vary for used car loans compared to new car loans. It is recommended to check with the bank for the specific details.

Axis Bank may charge processing fees, documentation charges, stamp duty, and other applicable fees for car loans. These charges can vary and may be subject to change. It is advisable to check with the bank for the most accurate and up-to-date information regarding the charges associated with the car loan.

Here's what our customer have been saying about us