Axis Bank Home Loan

Arena Fincorp is a leading financial institution that specialises in providing the best Axis Bank home loan solutions. With their extensive experience and expertise in the mortgage industry, Arena Fincorp understands the unique needs and aspirations of individuals looking to buy or construct their dream homes. They offer a comprehensive range of home loan products from Axis Bank, one of the most reputable and trusted banks in the country. Whether you are a first-time homebuyer or looking to refinance your existing home loan, Arena Fincorp can guide you through the entire process and help you secure the best possible loan terms and interest rates. Their dedicated team of professionals ensures a seamless and hassle-free experience, making Arena Fincorp the preferred choice for anyone seeking an Axis Bank home loan.

Benefits of Axis Bank Home Loan

Why Choose Arena Fincorp for Axis bank Home Loan?

Interest Rates: Compare the interest rates offered by different lenders to ensure you are getting a competitive rate.

Loan Amount: Check if the lender offers the desired loan amount that meets your requirements.

Loan Tenure: Verify if the lender provides flexible loan tenure options that suit your repayment capacity.

Eligibility Criteria: Understand the eligibility criteria set by the lender to determine if you qualify for a loan.

Processing Time: Consider the lender’s efficiency in processing loan applications and disbursing funds.

Customer Service: Look for a lender with a good reputation for providing excellent customer service and support throughout the loan process.

Additional Charges: Assess the various fees and charges associated with the loan, such as processing fees, prepayment charges, and foreclosure charges.

Special Offers: Check if the lender offers any special offers or discounts that can benefit you, such as reduced interest rates or waived processing fees.

Reputation: Research the lender’s reputation in the market, including reviews and feedback from other customers.

Relationship with Builder: If you are availing a loan for a specific property, inquire if the lender has a pre-approved project list, which can streamline the loan approval process

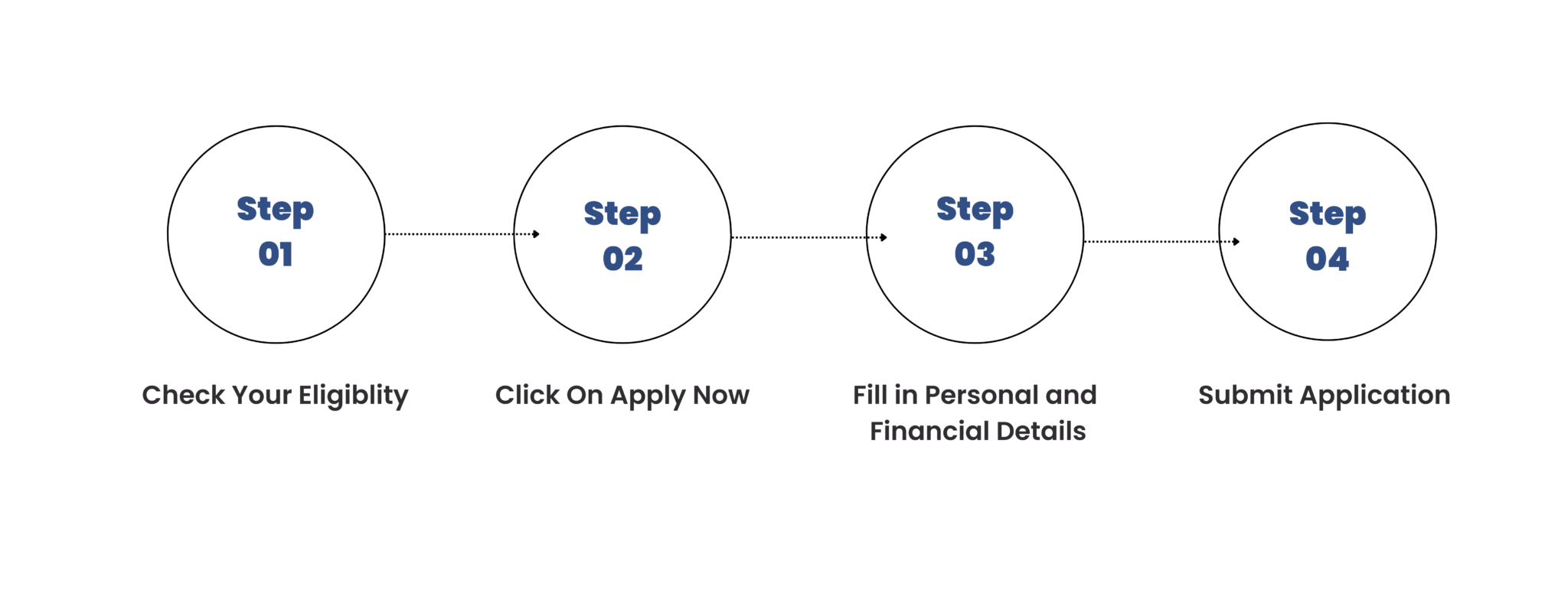

How to Apply for Axis Bank Home Loan on Arena Fincorp?

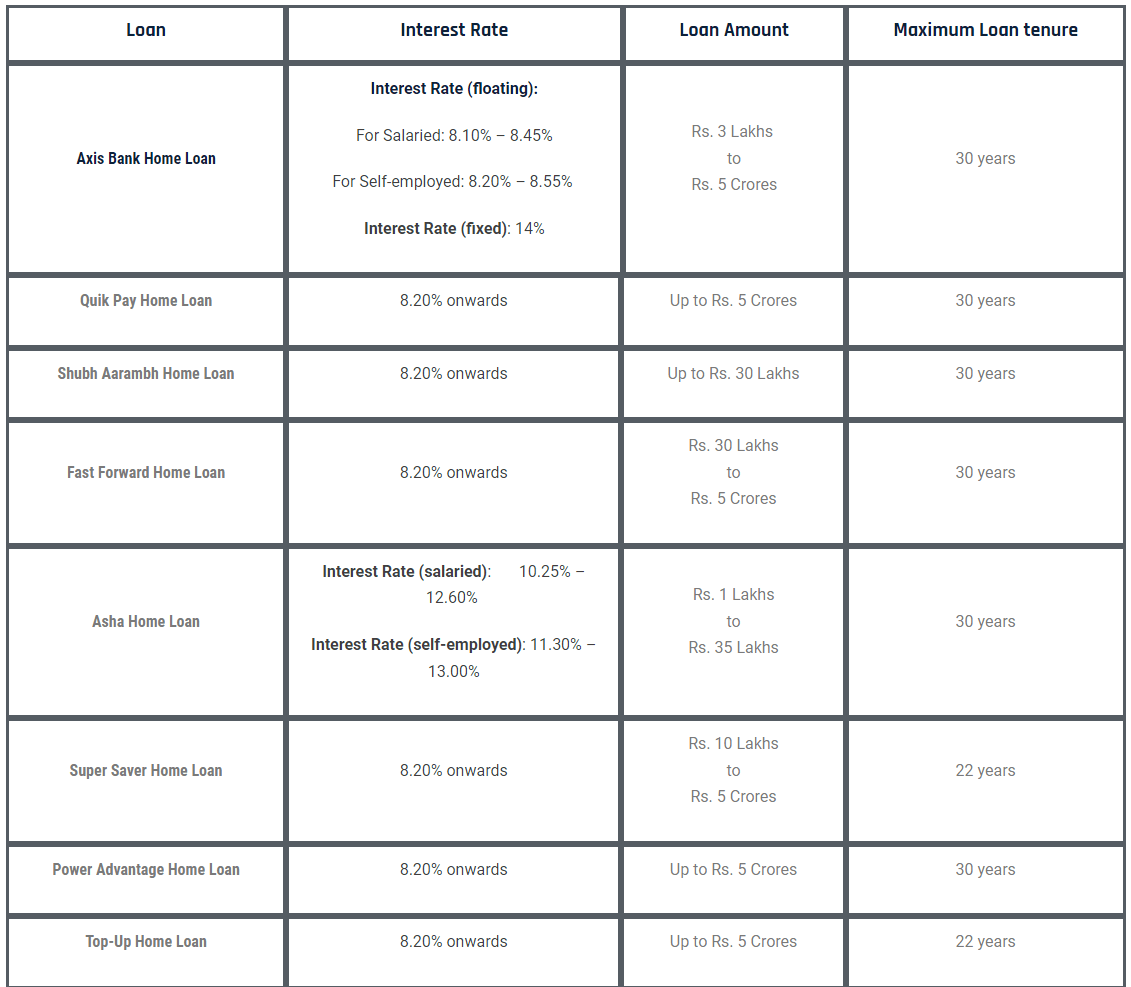

Axis Bank Home Loan Interest Rates

Take a look at the Axis Bank Home Loan interest rates for different home loans they offer:

Axis Bank Home Loan Interest Rates

Take a look at the Axis Bank Home Loan interest rates for different home loans they offer:

Loan

Interest Rate

Loan Amount

Maximum Loan tenure

Axis Bank Home Loan

Interest Rate (floating):

For Salaried: 9.00% – 9.40%

For Self-employed: 9.10% – 9.40%

Interest Rate (fixed): 14%

Rs. 3 Lakhs

to

Rs. 5 Crores

30 years

Quik Pay Home Loan

8.20% onwards

Up to Rs. 5 Crores

30 years

Shubh Aarambh Home Loan

8.20% onwards

Up to Rs. 30 Lakhs

30 years

Fast Forward Home Loan

8.20% onwards

Rs. 30 Lakhs

to

Rs. 5 Crores

30 years

Asha Home Loan

Interest Rate (salaried): 10.50% – 12.85%

Interest Rate (self-employed): 12.00% – 13.30%

Rs. 1 Lakhs

to

Rs. 35 Lakhs

30 years

Super Saver Home Loan

8.20% onwards

Rs. 10 Lakhs

to

Rs. 5 Crores

22 years

Top-Up Home Loan

8.20% onwards

Up to Rs. 5 Crores

22 years

Power Advantage Home Loan

8.20% onwards

Up to Rs. 5 Crores

30 years

*Interest rates and charges are subject to market conditions and bank’s discretion.

Axis Bank Home Loan Fees and Charges

Axis Bank charges certain other fees like processing fees which are charged above and over the loan amount, foreclosure fee to close the loan and prepayment fee for prepaying the loan before the tenure ends. Here are the different charges levied by the Axis Bank when you avail an Axis Bank Home Loan.

Charges

Amount (exclusive of GST)

Processing Charges

Up to 1% of the loan amount, subject to a minimum of Rs. 10,000.

Prepayment Charges

2% of the principal outstanding in case of fixed interest rates.

Valuation fee in Construction Linked Loan cases

24% per annum, 2% per month

Switching Fees

When the effective interest rate is revised, 0.5% of the outstanding principal, with a minimum of Rs. 10,000 should be paid.

Switching Fees for changing from floating rate to fixed rate

1% on the outstanding loan amount

Switching Fees for changing from fixed rate to floating rate

2% on the outstanding loan amount

Cheque Return charges

Rs. 500 each time

Issuance charges for Duplicate Statement

Rs. 250 each time

Swap charges for Cheque/Instrument

Rs. 500 each time

Duplicate interest certificate issuance charges

Rs. 250 each time

How to Apply for Axis Bank Home Loan

You can apply for an Axis Bank Home Loan both online and offline.

1. How to apply for Axis Home Loan online?

- Visit the Axis Bank official website and go to the Home Loan section.

- Click on ‘APPLY ONLINE’.

- If you are an existing customer, log in to your account.

- Enter your name, email ID , mobile number, city, state, employment type and other details asked for.

- Tick the terms and conditions box and click on ‘SUBMIT’.

- Verify your account with the OTP sent to your mobile number.

- From there, an Axis Bank professional will guide you through the next stages via phone call or email.

2. How to apply for Axis Home Loan offline?

- Locate the nearest Axis Bank branch and meet an Axis Bank executive.

- Fill out the relevant form handed over to you carefully.

- Carry relevant documents with you.

- Submit your application form and the rest of the documents to the bank staff.

- The bank staff will verify and check the documents and will help you to complete the Home Loan process.

Documents Required for Axis Bank Home Loan

Here is the complete list of required documents you need to apply for Axis Bank Home Loan:

Mandatory Documents

Application form and PAN Card

Proof of Identity

Passport/Aadhaar Card/Driving Licence/Voter ID/GOI issued Photo ID/Govt Employee ID

Proof of Address

Passport/Aadhaar Card/Driving Licence/Voter ID/Govt Employee ID/Electricity Bill/Gas Bill/Telephone Bill (Landline)/Property Tax Receipt

Date of Birth Proof

Birth Certificate/Aadhaar Card with DOB/SSC Marksheet/Passport

Signature Proof

Passport/PAN Card/Banker’s verification

Proof of Income

For Salaried Employees:

- 3 months pay slip

- 6 months bank statement showing salary credits

- 2 yrs Form 16

For Self-employed:

- 2 yrs ITR

- Computation of Income

- Balance sheet with CA seal and sign

- 6 months bank statements of personal and business accounts

- Business continuity proof

Property Documents

According to the bank’s policy

Axis Bank Home Loan FAQ’s

-

What is the minimum and maximum loan amount offered by Axis Bank for home loans?

Axis Bank offers home loans starting from a minimum of Rs. 3 lakhs up to a maximum of Rs. 5 crores, depending on the applicant's eligibility.

-

What is the maximum loan tenure for Axis Bank home loans?

The maximum loan tenure for Axis Bank home loans is typically up to 30 years, subject to the applicant's age and eligibility.

-

Can I transfer my existing home loan to Axis Bank?

Yes, Axis Bank provides the option to transfer your existing home loan from another financial institution to Axis Bank. This is known as a home loan balance transfer.

-

What is the interest rate for Axis Bank home loans?

The interest rates for Axis Bank home loans vary depending on various factors, such as the loan amount, tenure, applicant's profile, and prevailing market conditions. It is advisable to check with Axis Bank or visit their website for the latest interest rate information.

-

What are the eligibility criteria for Axis Bank home loans?

The eligibility criteria for Axis Bank home loans include factors like the applicant's age, income, employment stability, credit history, and property value. The bank assesses these factors to determine the loan amount and interest rate.

-

Are there any processing fees associated with Axis Bank home loans?

Yes, Axis Bank charges a processing fee for home loans. The exact fee amount may vary, and it is advisable to check with the bank for the current charges.

-

Can I avail of a top-up loan on my existing Axis Bank home loan?

Yes, Axis Bank provides the facility of a top-up loan on existing home loans. This allows borrowers to avail additional funds for purposes such as home renovation, education, or any other personal requirement.

-

Does Axis Bank offer home loan schemes for first-time homebuyers?

Yes, Axis Bank offers special home loan schemes for first-time homebuyers, such as the Pradhan Mantri Awas Yojana (PMAY). These schemes provide certain benefits and subsidies to eligible applicants.

-

Can I apply for an Axis Bank home loan online?

Yes, Axis Bank provides the convenience of applying for a home loan online through their official website. The bank also has a user-friendly online application process.

-

What documents are required to apply for an Axis Bank home loan?

The documents required for an Axis Bank home loan may include proof of identity, address, income, employment details, property documents, bank statements, and any other specific documents as requested by the bank. The exact list of documents may vary based on the applicant's profile and the loan amount.

Here's what our customer have been saying about us

"I had a great experience with Arena Fincorp and Axis Bank while applying for a home loan. The interest rates offered were competitive, and the team provided clear guidance throughout the process. They were prompt in responding to my queries and made the entire experience hassle-free. Thank you, Arena Fincorp and Axis Bank, for helping me achieve my dream of owning a home."

Mohit rana

"I would like to express my gratitude to Arena Fincorp and Axis Bank for their excellent service in providing a home loan. The team was efficient and proactive, ensuring a seamless experience from application to disbursement. They explained the terms and conditions clearly and were transparent throughout. I am a happy customer and would definitely recommend their services."

. Suresh

"I am highly impressed with the home loan services offered by Arena Fincorp in collaboration with Axis Bank. The documentation process was convenient, and the staff was supportive and courteous. They offered me a loan with attractive interest rates and flexible repayment options. I am thankful to Arena Fincorp and Axis Bank for their professionalism and promptness."

Aman

"Arena Fincorp and Axis Bank made my home loan journey a breeze. From the initial application to the final disbursement, the entire process was quick and efficient. The team was knowledgeable, and they guided me through every step. I am extremely satisfied with the service provided, and I would gladly recommend Arena Fincorp and Axis Bank for home loans."

Neha Kumari