Axis Bank Professional Loan

Arena Fincorp is a renowned financial institution that offers one of the best professional loans specifically tailored for individuals seeking financial support from Axis Bank. With a solid reputation in the industry, Arena Fincorp understands the unique needs of professionals and provides an excellent platform to secure the Axis Bank professional loan. They offer competitive interest rates, flexible repayment options, and efficient loan processing, ensuring a hassle-free experience for their customers. Additionally, Arena Fincorp provides personalised assistance and guidance throughout the loan application process, ensuring that individuals make informed decisions. Whether you are a self-employed professional or a salaried individual, Arena Fincorp is the ideal partner to help you access the best Axis Bank professional loan that suits your requirements.

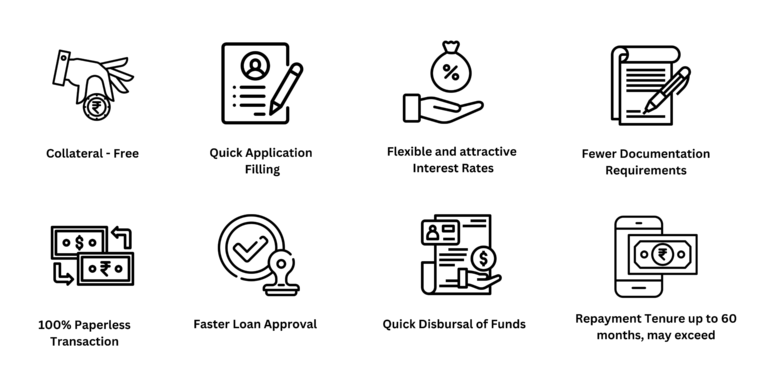

Benefits of Axis Bank Professional Loan

Why Choose Arena Fincorp for Axis Bank Professional?

Reputation: Axis Bank is one of the leading private sector banks in India, known for its strong reputation and customer-centric approach.

Loan Amount: Check if Axis Bank offers a professional loan amount that meets your requirements.

. Competitive Interest Rates: Compare the interest rates offered by Axis Bank with other lenders to ensure they are competitive and favourable.

Flexible Repayment Options: Look for flexible repayment terms that suit your financial situation, such as longer loan tenure or flexible EMI options.

Minimal Documentation: Verify if Axis Bank offers a streamlined documentation process to make the loan application easier and quicker.

Quick Processing: Axis Bank’s efficiency in loan processing can be an advantage, as it ensures faster access to funds

Industry-Specific Features: Determine if Axis Bank’s professional loan offers any specialised features or benefits tailored to your specific profession or industry.

Customer Service: Assess the quality of customer service provided by Axis Bank, such as responsiveness and availability to address any queries or concerns.

Additional Benefits: Check if Axis Bank provides any additional benefits like insurance coverage, top-up loans, or pre-approved offers.

Eligibility Criteria: Review the eligibility criteria set by Axis Bank to ensure you meet the requirements for the professional loan.

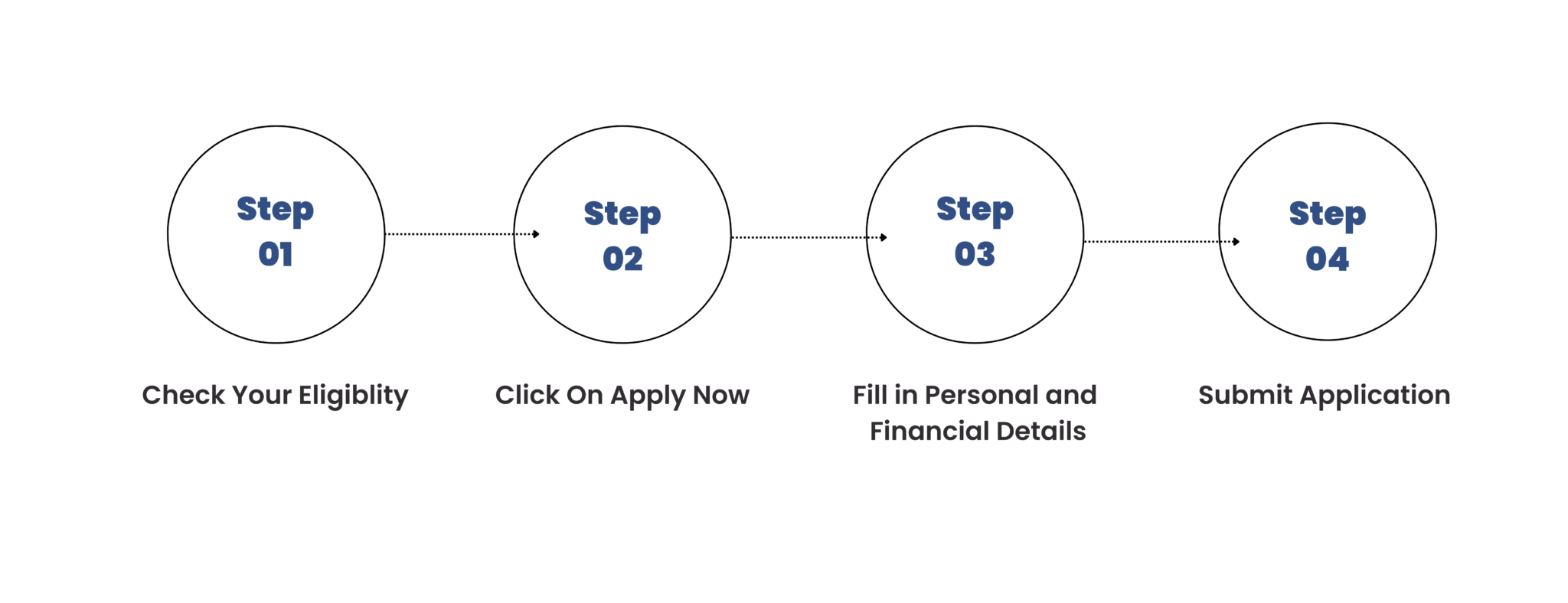

How to Apply for Axis Bank Professional Loan on Arena Fincorp

Axis Bank Professional Loan Interest Rates

Doctors and CAs can easily avail a professional loan on Bajaj Markets to expand their businesses or to meet their working capital needs

The rate of interest applicable on professional loans, along with the processing fee and a few other charges, are as follows:

Interest rate

Starting at 14%

Processing fee

Up to 2% of the loan amount

Bounce charges

₹3,000 (Inclusive of applicable taxes)

Penal interest

Any delay in payment of EMI shall attract penal interest at the rate of 2% per month on the EMI outstanding from the date of default until the receipt of the EMI

Outstation collection charges

₹65 + GST

Prepayment/ charges

Term Loan: 4% plus applicable taxes on the outstanding loan amount payable by you on the date of such full prepayment

Flexi Loan: 4% plus applicable taxes of the total withdrawable amount as per the repayment schedule, on the date of such full prepayment.

Part-payment charge

Term Loan: 2% plus applicable taxes on the amount part- prepaid

Nil in case of flexi hybrid loan

Annual Maintenance

Charges

Term Loan: Nil

Flexi Hybrid loan: 0.25% plus applicable taxes

Disclaimer: The rates mentioned are subject to change at the lender’s discretion

Eligibility Criteria for a Professional Loan

The professional loan eligibility criteria on Bajaj Markets are quite simple. Here are a few essential parameters you must know:

- You must have a professional degree or diploma in your field

- You must be between 25 and 65 years

- You must be a resident of India

- You must be a self-employed individual

Additionally, depending on the type of loan (i.e., doctor or CA loan), you may be asked to meet a certain set of profession-specific criteria.

Documents Required for a Professional Loan

Here is a list of documents you need to furnish when applying for a professional loan:

- Proof of Identity (Passport, PAN card, Aadhaar card)

- Proof of Address (Ration card, Aadhaar card, Utility bills)

- Copies of your professional degrees and diplomas

- Bank statement of your business for the last six months

- Profit and loss statements of your business

- Proof of ownership/lease of a property to set up the practice (if applicable)

How to Apply for a Professional Loan

Follow these steps to apply for a professional loan at Bajaj Markets.

- Step 1: Click on the ‘Apply Now’ on this page.

- Step 2: Fill in a few essential details, such as your profession, mobile number, date of birth, name and pin code

- Step 3: Receive an OTP in your registered number and check your offer

- Step 4: Complete the verification process and submit the required documents upon approval

- Step 5: Get the loan amount credited to your account within a few minutes after the approval of your application

That’s all it takes to apply for a professional loan from the comfort of your home.

FAQ’s

-

What is an Axis Bank Professional Loan?

Axis Bank Professional Loan is a type of loan offered by Axis Bank specifically designed for professionals, such as doctors, engineers, architects, chartered accountants, and others. It provides financial assistance for professional needs like setting up a clinic, purchasing equipment, expanding a practice, or meeting other professional requirements.

-

What is the maximum loan amount available under Axis Bank Professional Loan?

The maximum loan amount offered under Axis Bank Professional Loan may vary depending on factors such as your income, profession, and repayment capacity. It is best to contact Axis Bank directly or visit their website for detailed information on the maximum loan amount available.

-

What is the repayment tenure for Axis Bank Professional Loan?

The repayment tenure for Axis Bank Professional Loan typically ranges from 12 months to 60 months (1 to 5 years). The actual repayment tenure offered to you may depend on various factors, including the loan amount and your repayment capacity

-

Can I prepay or foreclose my Axis Bank Professional Loan?

Yes, Axis Bank generally allows prepayment or foreclosure of Professional Loans. However, certain terms and conditions may apply, including prepayment charges or fees. It is advisable to contact Axis Bank directly or refer to the loan agreement for specific details on prepayment or foreclosure options.

-

Can I use an Axis Bank Professional Loan for personal purposes?

No, Axis Bank Professional Loan is specifically designed to cater to the professional needs of individuals from various fields. It is intended to be used for professional purposes, such as expanding a practice, purchasing equipment, or setting up a clinic.

Here's what our customer have been saying about us

"I recently availed a professional loan from Arena Fincorp through Axis Bank, and I am extremely satisfied with their service. The loan process was smooth, and the team at Arena Fincorp guided me through each step. Highly recommended!"

Rahul bansal

"I had a wonderful experience getting a professional loan from Arena Fincorp in association with Axis Bank. The interest rates were competitive, and the loan terms were flexible. The staff was knowledgeable and responsive, making the entire process hassle-free. Thank you!"

Mohit rana

"I would like to express my gratitude to Arena Fincorp and Axis Bank for their professional loan services. The loan application was processed quickly, and the documentation requirements were minimal. I appreciate their efficiency and professionalism."

. Suresh

. "I recently approached Arena Fincorp for a professional loan facilitated by Axis Bank, and I must say I'm impressed. They offered me a tailored loan solution that perfectly met my business needs. The interest rates were reasonable, and the repayment options were convenient. Kudos to the team!"

Aman

"I am a happy customer of Arena Fincorp and Axis Bank, as they provided me with a professional loan when I needed it the most. Their customer service was outstanding, with prompt responses to my queries and a personal touch. I would definitely recommend their loan services to others."

Neha Kumari