HDFC Business Loan

Apply now for HDFC Business loan at Arena Fincorp & get lowest interest rates. You don’t have to go through the complicated process of getting HDFC business loan. We will do it for you to make things easier and simpler. So that you can focus on what’s more important, building your business.

We have years of experience in providing financial solutions and will happily assist you through the business loan process, ensuring a smooth and hassle-free experience. We work hard to provide you with the cheapest business loans in India, allowing you to build your business without paying a fortune of your revenue in interest payments.

HDFC Business Loan Interest Rate

The HDFC Business loan Interest rate ranges from Minimum 10.00% to maximum 22.50%. The final interest rate that you would receive from HDFC might depend on several factors such as your CIBIL score, age of your business, operational history of your company etc.

HDFC Business Loan Eligibility

Below is the list of HDFC Business loan Eligibility conditions that you must pass to successfully avail the business loan from the bank.

- Self employed individuals, proprietors, private ltd. co. and partnership firms involved in the business of manufacturing, trading or services.

- The business should have a minimum turnover of ₹40 lakhs.

- Individuals who have been in the current business for a minimum of 3 years, with 5 years total business experience.

- Those whose business has been profit-making for the previous 2 years.

- The business should have a Minimal Annual Income (ITR) of ₹1.5 lakhs per annum.

- The applicant should be at least 21 years at the time of applying for the loan, and should be not older than 65 years at the time of loan maturity, to become eligibile for HDFC Business loan.

HDFC Business Loan Fees & Charges

All HDFC Business Loan fees & Charges that you need to know, including preclosure charges are mentioned below.

Loan processing charges

Up to 2.00% of the loan amount

NIL Processing Fees for loan facility up to ₹5 Lakhs availed by micro and small Enterprises subject to URC submission prior to disbursal

Premature Closure Charges (For Full Payment)

Premature closure Charges (applicable on principal outstanding) post Cooling Period off / look-up Period.

- Up-to 24 EMI repayment – 4% of principal outstanding,

- Post 24 EMI and up to 36 EMI repayment – 3% of principal outstanding,

- Post 36 EMI repayment – 2% of principal outstanding.

Premature Closure Charges (For Part payment)

Partial Premature closure charges (applicable on part payment amount)

- Partial premature payment is allowed post payment of first EMI.

- Post 01 EMI and up to 24 EMI repayment – 4% of part payment amount.

- Post 24 EMI and up to 36 EMI repayment – 3% of part payment amount.

- Post 36 EMI repayment- 2% of part payment amount.

- Partial premature payment for your HDFC business loan is allowed up to 25% of Principal Outstanding, only once in the financial year and twice during the loan tenure.

Loan Closure Letter

NIL Premature Closure Charges for Fixed rate loan facility up to ₹ 50 Lakh availed by Micro & Small Enterprises, Closure from Own Source, and submission of Udyam Registration Certificate prior to disbursal.

Delayed instalment payment charge

18% p.a plus applicable government taxes on overdue instalment amount

Loan cancellation Charges & Rebooking Charges

- Loan cancellation Charges: Loan cancellation for your HDFC business loan is allowed within cooling off/look-up period from the loan disbursement date. In the event of loan cancellation, interest charged from date of disbursement till the date of loan cancellation will be borne by the customer. Processing Fee, Stamp duty, other statutory charges and GST are non-refundable charges and would not be waived/refunded in case of loan cancellation.

- Rebooking Charges: ₹ 1000/- + applicable government taxes

*The facts and figures provided above are indicative and liable to change periodically.

HDFC Business Loan Documents

You can check the list of HDFC Business loan Documents, which you would be needing when applying for the loan from HDFC, below:

- PAN Card – For Company/Firm/Individual

A copy of any of the following documents as identity proof:

- Aadhaar Card

- Passport

- Voter’s ID Card

- PAN Card

- Driving License

A copy of any of the following documents as address proof:

- Aadhaar Card

- Passport

- Voter’s ID Card

- Driving License

Bank statement of the previous 6 months

Latest ITR along with computation of income, Balance Sheet and Profit & Loss account for the previous 2 years, after being CA Certified/Audited

Proof of continuation (ITR/Trade license/Establishment/Sales Tax Certificate)

Sole Prop. Declaration Or Certified Copy of Partnership Deed, Certified true copy of Memorandum & Articles of Association (certified by Director) & Board resolution (Original) are also some of the (must have) HDFC Business loan Documents that you would be needing when applying for the loan.

HDFC Business Loan Apply

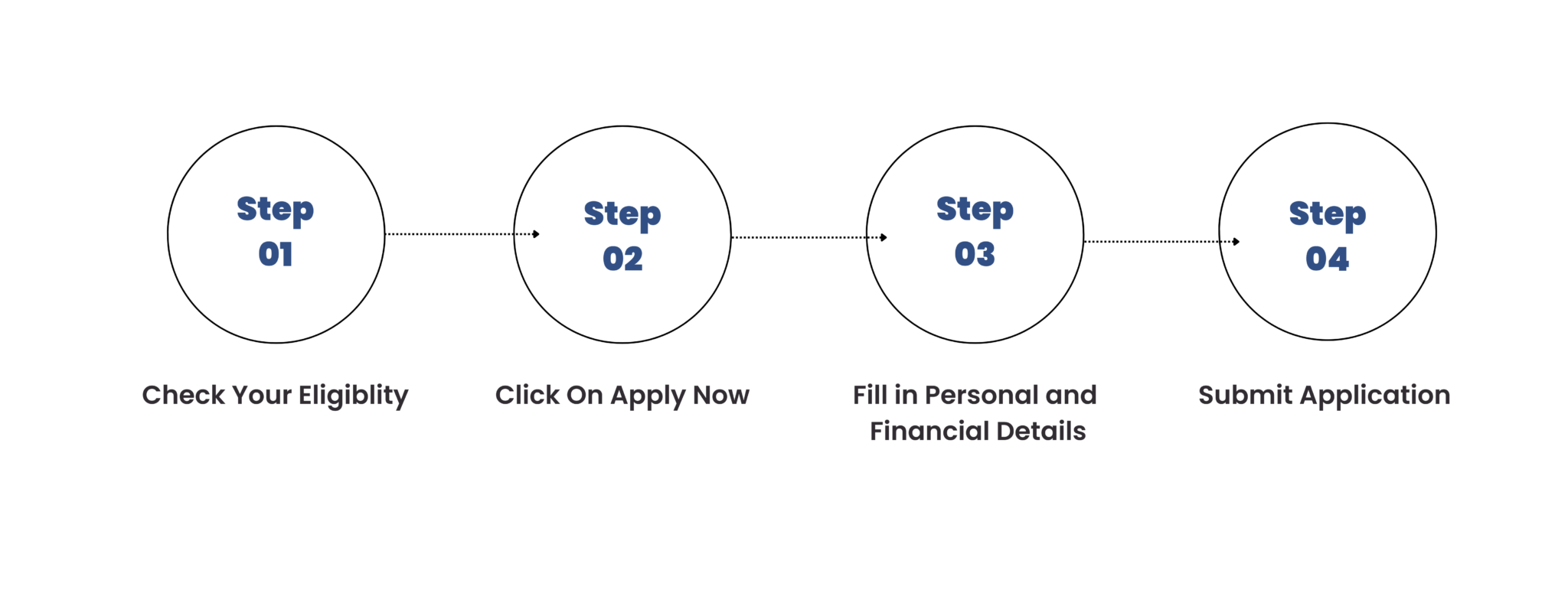

HDFC business loan apply online at Arena Fincorp. (You can always start your online application and resume it at a later instance at our site.) Here’s our step-by-step guide to apply for HDFC business loan at our site:

- Step 1: Click on Apply Now to open our online application form

- Step2: Fill in a few details and verify the OTP sent to your phone

- Step3: Enter your KYC and income data

- Step4: Choose the loan amount you want to borrow

- Step5: Submit your application

HDFC Business Loan Other Details

Maximum loan Amount

You can avail up to ₹50 lakhs (up to ₹75 lakhs in select locations) without any collateral, guarantor or security,

Loan Tenure

The Tenure ranges between 12-48 months

Dropline Overdraft Facility

It provides Overdraft Facility without any security. Limit is set in a separate Current Account which drops monthly till the end of the tenure. Pay the interest only on the amount utilised.

- Dropline Overdraft Facility up to ₹1 lakh – ₹25 lakhs

- No guarantor/ security required

- Tenure ranging from 12-48 months

- Attractive rate of interest

- No foreclosure / part closure shall be permitted during the first 6 months of the limit setting

*The facts and figures provided above are indicative and liable to change periodically.

How to Calculate HDFC Business Loan EMI?

To calculate your HDFC business loan EMI, you can use the following basic formula, i.e.

E = [P x R x (1+R) ^N] / [(1+R) ^ (N-1)]

Here,

‘E’ stands for EMI

‘P’ represents the principal loan amount

‘r’ stands for the interest rate

& ‘n’ represents the duration of the loan

At Arena Fincorp.com, you can find a HDFC business loan EMI calculator. This tool enables you to calculate the HDFC business loan EMI amount through the web interface. Our EMI calculator allows you to understand the breakdown of each component, including the interest and principal loan amount. Simply put, you can effectively undertake your financial planning based on the computations.

Why Choose Arena Fincorp for HDFC Business Loan?

1. Quick approval: We feel proud to say that we are one of the few institutions doing superfast application processing, so that you can build your business faster than ever.

2. 100% transparency: No hidden charges. We’re 100% transparent about the terms of our services.

3. Full Assistance: Rest assured, our experienced team will fully assist you in the entire process from start to finish in getting the best business loan. You just need to breathe and relax while we do the whole work for you.

4. History of Reputation: Having a rich history of providing the best financial solutions, our customers are very happy with working with us & we feel proud to say that they trust us for their future financial needs too.

5. Simple and easy Process: Our experienced team will happily guide you through the entire HDFC business loan process, making it simple, easy and hassle free to build your dream business.

HDFC Business Loan Apply

Build Your Dream Business. Sit Back & Relax While We Do The Work For You.

I'm really happy that I chose Arena Fincorp for my financial needs. I got a loan with their help within 48 hours!

I'm 21. Recently Graduated. I don't have much experience with banks. Arena Fincorp's staff gave hand-holding support in getting HDFC Business loan. Because that's where my salary account is. They helped me learn so much about loans. I'd reccomend them to everyone 10/10.

Received Quality service. I just needed to provide my documents and they processed my loan application superfast! I must say it's much more efficient than applying for loan from HDFC on your own.

Kudos to these folks. Getting my overdraft loan was superfast! Never experienced a loan process this fast to be honest. Good job!

HDFC Business Loan FAQs

-

How do I apply for HDFC business loan online?

To apply for HDFC business loan to build your dream business, you can get in touch with us or click on the apply now button above .

-

What if I need a higher amount of loan amount as compared to my pre-approved offer loan?

You can connect with us for this, We're here to help you with everything related to your HDFC business loan. There will be an additional set of documents that will be required for processing the case for a higher loan amount for which we will guide you. Loan amount will be subject to eligibility as per documents.

-

What is the eligibility criteria for HDFC Business loan?

The eligibility criteria for HDFC Business loan vary based on factors such as the nature of the business, financial stability, credit history, and repayment capacity. Generally, businesses should have a good track record, meet the minimum turnover requirements, and have a satisfactory credit score.

-

Can I prepay or foreclose my HDFC Business loan?

Yes, HDFC allows prepayment or foreclosure of business loans. However, certain terms and conditions may apply, including prepayment charges or penalties. You can check our 'HDFC Business Loan Fees & Charges' Section to know more in detail.