HDFC Car Loan

Apply now for HDFC Car loan at Arena Fincorp & get lowest interest rates. You don’t have to go through the complicated process of getting a Car loan from HDFC. We will do it for you to make things easier and simpler. So that you can focus on what’s more important, owning your dream car.

We have years of experience in providing financial solutions and will happily assist you through the car loan process, ensuring a smooth and hassle-free experience. We work hard to provide you with the cheapest car loans in India, allowing you to get your dream car without paying a fortune of your income in interest payments.

HDFC Car Loan Features

- You can avail 100% on road finance for your new car.

- Get loan up to ₹ 3 crore on a wide range of cars and multi-utility vehicles.

- Existing car loan customers can get a top-up loan with no documentation

- HDFC offers Flexible repayment tenures from 12 months to 84 months

- Existing HDFC Bank customers can enjoy preferential pricing with unique schemes designed just for them and can also avail loan in 10 seconds with no documentation.

- In addition to HDFC car loan, the bank also offers funding for comprehensive package insurance product which offers protection to individuals like Permanent Total Disability, Accidental Death and accidental hospitalization etc.

HDFC Car Loan Interest Rate

The latest HDFC Car loan interest rate starts from 8.85% in 2023.

HDFC Car Loan Eligibility

Check for HDFC car loan eligibility conditions below:

Salaried Individuals

- This includes employees of private limited companies, employees from public sector undertakings, including central, state and local bodies.

- Individuals who are a minimum of 21 years of age at the time of applying for the loan, and no older than 60 at the end of the loan tenure.

- Individuals who have had a job for at least 2 years, with a minimum of 1 year with the current employer.

- Those who earn a minimum of Rs. 3,00,000 per year, including the income of the spouse/co-applicant.

- Individuals who have a telephone/post-paid mobile.

Those Who pass the above HDFC Car loan Eligibility criterias above can apply for the loan.

Self Employed Individuals and Professionals (Partnership Firms)

- This includes self-employed partners in the business of manufacturing, trading or services.

- Those who have a minimum turnover of Rs. Rs. 3,00,000 per annum

Self Employed Individuals and Professionals (Private Limited Companies)

- This includes individuals who own a private company in the business of manufacturing, trading or services.

- Should earn at least Rs. Rs. 3,00,000 per annum.

Self Employed Individuals (Public Limited Companies)

- This includes directors in public limited companies that are in the business of manufacturing, trading or services.

- Should earn at least Rs. Rs. 3,00,000 per annum

Self Employed Individuals and Professionals (Sole Proprietorship)

- This includes self-employed sole proprietors in the business of manufacturing, trading or services.

- Individuals who are a minimum of 21 years of age at the time of applying for the loan, and no older than 65 at the end of the loan tenure

- Should earn at least Rs. Rs. 3,00,000 per annum

- Those who have been in business for a minimum of 2 years can apply for the loan.

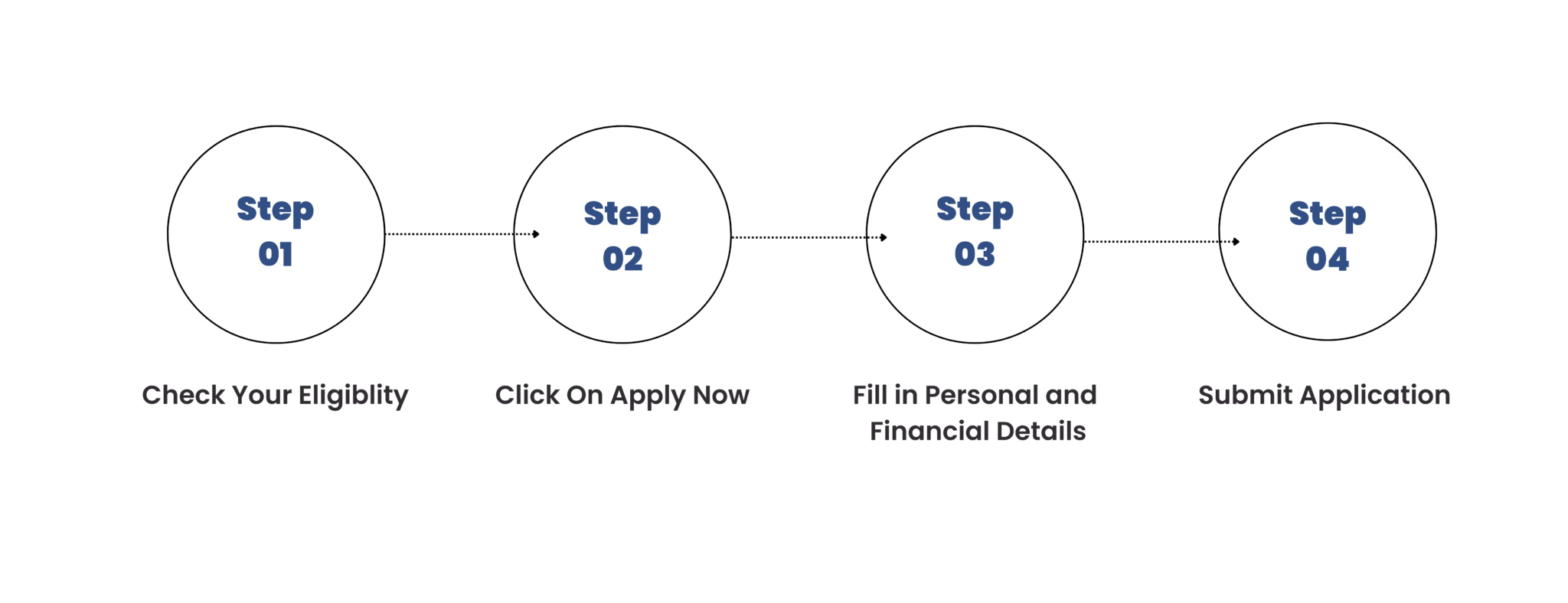

HDFC Car Loan Apply

For HDFC Car loan apply online at Arena Fincorp. (You can always start your online application and resume it at a later instance at our site.) Here’s our step-by-step guide to apply for HDFC business loan at our site:

- Step 1: Click on Apply Now to open our online application form

- Step2: Fill in a few details and verify the OTP sent to your phone

- Step3: Enter your KYC and income data

- Step4: Choose the loan amount you want to borrow

- Step5: Submit your application

HDFC Car Loan Fees & Charges

Documentation charges

Rs.650/- Charges NOT to be refunded in case of case cancellation.

Premature Closure Charges (For Full Payment)

- 6% of Principal Outstanding for pre-closures within 1 year.

- 5% of Principal Outstanding for pre-closures within 13 – 24 months from 1st EMI.

- 3% of Principal Outstanding for pre-closures post 24 months from 1st EMI.

- NIL Premature Closure Charges(For Full Payment) for Fixed rate loan facility up to Rs. 50 Lakh availed by Micro & Small Enterprises and Closure from Own Source.

Premature Closure Charges (For Part Payment)

- Part payment will be allowed twice only during loan tenure.

- Part payment is allowed only once a year.

- At any point of time, part payment will not increase beyond 25% of Principal Outstanding.

- 5% on the part payment amount in case part prepayment is within 24 months from 1st EMI.

- 3% on the part payment amount in case part prepaymet is post 24 months from 1st EMI.

- NIL Premature Closure Charges (For Part Payment) for Fixed rate loan facility up to Rs. 50 Lakh availed by Micro & Small Enterprises and Closure from Own Source.

Processing fees (Non – refundable)

- 0.5% of Loan Amount subject to minimum of Rs.3500/- and maximum of Rs.8000/-

- NIL Processing Fees for loan facility up to Rs. 5 Lakh availed by Micro & Small Enterprises subject to URC submission prior to disbursal.

Delayed Instalment payment charge

18% p.a.(1.50% per month) plus applicable government taxes on overdue instalment amount

*The facts and figures provided above are indicative and liable to change periodically.

Also check: Car loan interest rate for all banks

*The facts and figures provided above are indicative and liable to change periodically.

HDFC Car Loan Documents

Below mentioned list contains all the information about the HDFC Car Loan documents requirement:

Salaried Individuals

1. Any of the following documents as identity & Address Proof

- Valid Passport

- Permanent Driving license [recent, legible, laminate]

- Voters ID Card

- Job card issued by NREGA

- Letter issued by the National

- Population Register containing details of name & address

- Aadhar Card (only if Submitted voluntarily & backed by Aadhar consent Letter. 1st 8 digits of Aadhar Number on physical copy to be redacted) Aadhar Card can be Physical Aadhar or Print out of e- Aadhar (not older than 30 days from the date of application).

2. Latest salary slip and Form 16 as income proof

3. Bank statement of the previous 6 months

Self Employed Individuals

(Sole Proprietorship)

1. Any of the following documents as identity & Address Proof:

- Valid Passport

- Permanent Driving license [recent, legible, laminate]

- Voters ID Card

- Job card issued by NREGA

- Letter issued by the National

- Population Register containing details of name & address

2. Latest Income Tax Returns (ITR) as income proof

3. Bank statement of the previous 6 months

Self Employed Individuals

(Partnership Firms)

1. All the following documents as income proof:

- Audited Balance Sheet

- Profit & Loss Account of the previous 2 years

- Company ITR for the previous 2 years

2. Any of the following documents as address proof:

- Telephone Bill

- Electricity Bill

- Shop & Establishment Act Certificate

- SSI Registered Certificate

- Sales Tax Certificate

3. Bank statement of the previous 6 months

Self Employed Individuals

(Private Limited Companies)

1. All the following documents as income proof:

- Audited Balance Sheet

- Profit & Loss Account of the previous 2 years

- Company ITR for the previous 2 years

2. Any of the following documents as address proof:

- Telephone Bill

- Electricity Bill

- Shop & Establishment Act Certificate

- SSI Registered Certificate

- Sales Tax Certificate

3. Bank statement of the previous 6 months

Self Employed Individuals

(Public Limited Companies)

1. All the following documents as income proof:

- Audited Balance Sheet

- Profit & Loss Account of the previous 2 years

2. Any of the following documents as address proof:

- Telephone Bill

- Electricity Bill

- Shop & Establishment Act Certificate

- SSI Registered Certificate

- Sales Tax Certificate

3. Bank statement of the previous 6 months

*The facts and figures provided above are indicative and liable to change periodically.

Also check: Our SBI Car loan EMI calculator

Why Choose Arena Fincorp for HDFC Car Loan?

1. Quick approval: We feel proud to say that we are one of the few institutions doing superfast application processing, so that you get to own your dream car faster than ever.

2. 100% transparency: No hidden charges. We’re 100% transparent about the terms of our services.

3. Full Assistance: Rest assured, our experienced team will fully assist you in the entire HDFC car loan process from start to finish in getting the best car loan. You just need to breathe and relax while we do the whole work for you.

4. History of Reputation: Having a rich history of providing the best financial solutions, our customers are very happy with working with us & we feel proud to say that they trust us for their future financial needs too.

5. Simple and easy Process: Our experienced team will happily guide you through the entire HDFC car loan process, making it simple, easy and hassle free to own your dream car.

How to Apply for HDFC Car Loan at Arena Fincorp

I'm really happy that I chose Arena Fincorp for my financial needs. I got a loan with their help within 48 hours!

I'm 21. Recently Graduated. I don't have much experience with banks. Arena Fincorp's staff gave hand-holding support in getting HDFC overdraft loan. Because that's where my salary account is. They helped me learn so much about loans. I'd reccomend them to everyone 10/10.

Received Quality service. I just needed to provide my documents and they processed my loan application superfast! I must say it's much more efficient than applying for loan from HDFC on your own.

Kudos to these folks. Getting my overdraft loan was superfast! Never experienced a loan process this fast to be honest. Good job!

HDFC Car Loan FAQs

-

How do I apply for an instant HDFC car loan online?

To apply for an Instant loan for your dream car, you can get in touch with us or click on the apply now button above .

-

How do I calculate my car loan EMI?

You can calculate the EMI of your car loan by using our Car loan EMI calculator.

-

Can I get a car loan from HDFC if I have a low credit score?

Your HDFC car loan eligibility depends on various factors, including your credit score. While a low credit score may affect your chances of approval, it does not necessarily disqualify you from getting a car loan. HDFC may consider other factors like income, employment stability, and collateral to assess your loan application.