HDFC Credit Card

Apply Now for HDFC Credit card at Arena Fincorp. You don’t have to go through the process of getting a credit card from HDFC at all. We will do it for you, so that you can relax & focus on things that are more important to you.

We have years of experience in providing financial solutions and will happily assist you in selecting the best HDFC credit card, ensuring a smooth and hassle-free experience. We work hard to provide you with the best credit cards in India, saving you from the hassle of comparing tons of credit cards from different banks on your own.

Get Credit Cards Superfast

With Arena Fincorp.

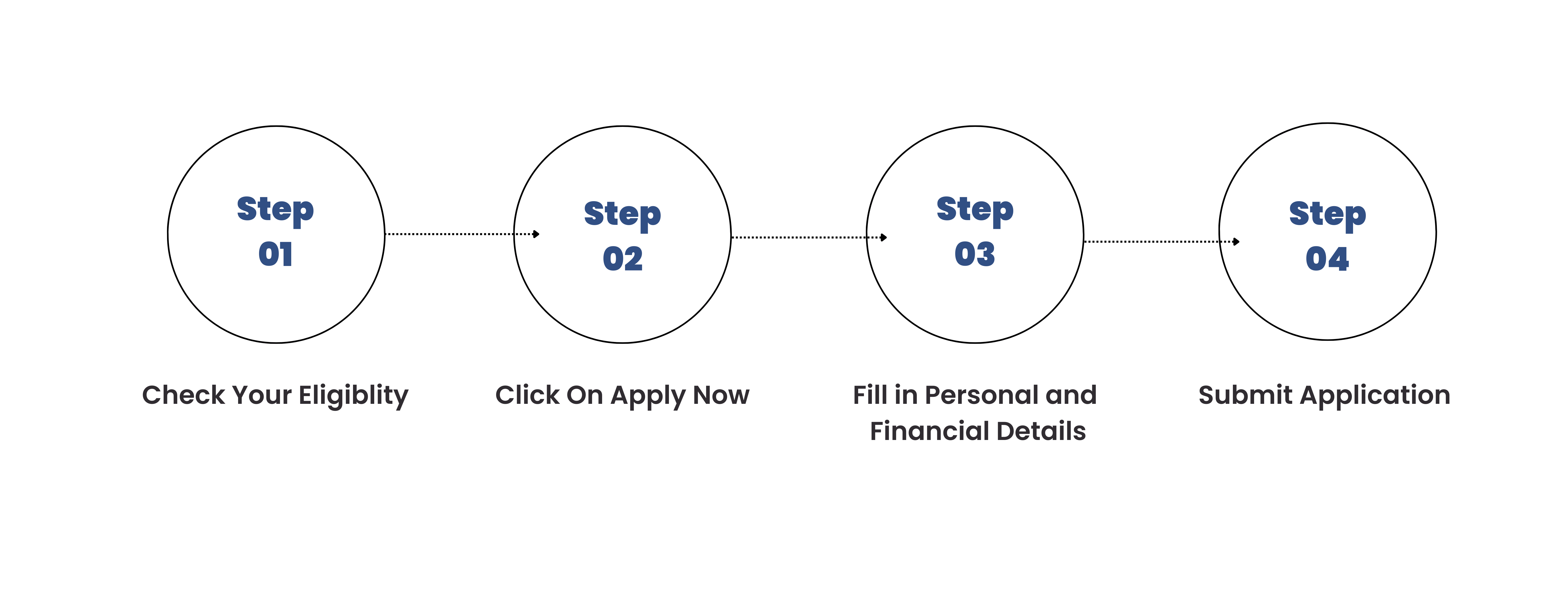

HDFC Credit Card Apply

HDFC credit card apply online at Arena Fincorp. (You can always start your online application and resume it at a later instance at our site.) Here’s our step-by-step guide to apply for HDFC credit card at our site:

- Step 1: Click on Apply Now to open our online application form

- Step2: Fill in a few details and verify the OTP sent to your phone

- Step3: Enter your KYC and income data

- Step4: Choose the loan amount you want to borrow

- Step5: Submit your application

HDFC Credit Card Eligibility

Below is the list of HDFC credit card eligibility conditions that you must pass to successfully avail HDFC credit card:

Age

You should be at least 18 years old.

Nationality

You should be an Indian Resident or a Non-resident Indian (NRI)

Residential Status

You should be a Resident or Non-Resident Indian.

Employment Status

You should be a salaried professional or a self-employed individual.

Annual Income

HDFC Bank determines your eligibility for Credit Card and subsequent credit limit based on your annual income.

HDFC Credit Card Features

Check below the list of HDFC credit card features that the bank is offering to its credit card holders:

Welcome benefits

You can enjoy exclusive benefits upon signing up and transacting with an HDFC’s Credit Card. They also offer benefits on annual spends exceeding specific amounts.

SmartEMI

You can convert credit card spends of INR 2,500 or more into SmartEMIs post your purchases. You will get competitive interest rates and flexible repayment tenures on offline and online Credit Card purchases converted into SmartEMI.

Contactless Payments

Make payments quickly, confidently, and securely with HDFC’s contactless Credit Cards. You Just need to tap your card to pay at retail outlets in seconds.

Foreign Currency Markup

When you shop, you can save more on your overseas spends. HDFC levys a low foreign currency markup on overseas purchases on select credit Cards.

Insurance Benefits

Select credit cards offered by HDFC come with complimentary insurance benefits. You can be eligibilie to get air accidental cover and emergency overseas hospitalisation cover worth several lakhs.

Revolving Credit Facility

You can leverage revolving credit facilities at nominal interest rates on HDFC credit cards.

HDFC Credit Card Fees And Charges

Here’s the list of HDFC credit card fees and charges for some of the most commonly applied for credit cards, mentioned below:

HDFC MoneyBack + Credit Card

- Joining/Renewal Membership Fee – ₹500/- + Applicable Taxes

- (None, if you spend ₹50,000 or more in a year before your Credit Card renewal date, as you will get your renewal fee waived off).

HDFC Millenia Credit Card

- Joining/Renewal Membership Fee – ₹500/- + Applicable Taxes.

- (None, if you spend ₹50,000 or more in a year before your Credit Card renewal date, as you will get your renewal fee waived off).

HDFC Regalia Credit Card

- Joining/ Renewal Membership Fee – Rs. 2500/- + Applicable Taxes.

HDFC Freedom Credit Card

- Joining/Renewal Membership Fee – ₹500/- + Applicable Taxes.

- (None, if you spend ₹50,000 or more in a year before your Credit Card renewal date, as you will get your renewal fee waived off).

*The facts and figures provided above are indicative and liable to change periodically.

Why Choose Arena Fincorp for HDFC Credit Card?

1. Quick approval: We feel proud to say that we are one of the few institutions doing superfast application processing, so that you get a HDFC credit card faster than ever.

2. 100% transparency: No hidden charges. We’re 100% transparent about the terms of our services.

3. Full Assistance: Rest assured, our experienced team will fully assist you in the entire process from start to finish in getting the best credit card. You just need to breathe and relax while we do the whole work for you.

4. History of Reputation: Having a rich history of providing the best financial solutions, our customers are very happy with working with us & we feel proud to say that they trust us for their future financial needs too.

5. Simple and easy Process: Our experienced team will happily guide you through the entire credit card process, making it simple, easy and hassle free to get your favorite HDFC credit card faster than ever.

How to Apply for HDFC credit card on Arena Fincorp

Get Your Favorite Credit Card. Sit Back & Relax While We Do The Work For You.

I'm really happy that I chose Arena Fincorp for my financial needs. I got approval of credit card with their help within 48 hours!

I'm 21. Recently Graduated. I don't have much experience with banks. Arena Fincorp's staff gave hand-holding support in getting HDFC Credit Card. Because that's where my salary account is. They helped me learn so much about credit card. I'd recommend them to everyone 10/10.

Received Quality service. I just needed to provide my documents and they processed my credit card application superfast! I must say it's much more efficient than applying for credit card from HDFC on your own.

Kudos to these folks. Getting my credit card was superfast! Never experienced a credit card process this fast to be honest. Good job!

HDFC Credit Card FAQs

-

How do I apply for HDFC credit card online?

To apply for HDFC credit card online, you can get in touch with us at info@arenafincorp.com or call us at +91 9251647949 / click on the apply now button above .

-

Can I withdraw cash from an ATM using my credit card? Does it attract additional charges?

Yes, you can use your credit card to withdraw cash from an ATM. However, you withdrawing cash using a credit card incurs additional charges which may range anywhere from 2.5 – 3.5%.

-

How can I find out which Credit Card am I eligible for?

You can easily check your eligibility for your choice of credit card by reaching out to us at info@arenafincorp.com or by calling us at +91 9251647949. We're happy to help you in every stage of your credit card journey.

-

What are co-branded credit cards? Should I apply for one?

Co-branded credit cards are those that are introduced in partnership with well-known businesses and give additional privileges when customers use the particular brands’ products or services.