HDFC Home Loan

HDFC Home loan apply online at Arena Fincorp & get lowest interest rates. You don’t have to go through the complicated process of getting HDFC Home loan. We will do it for you to make things easier and simpler. So that you can focus on what’s more important, getting your dream home.

We have years of experience in providing financial solutions and will happily assist you through the home loan process, ensuring a smooth and hassle-free experience. We work hard to provide you with the cheapest home loan in India, allowing you to own your dream home without paying a fortune of your income in interest payments.

HDFC Home Loan Interest Rate

Below mentioned is all the information regarding latest HDFC Home loan interest rate according to CIBIL scores, Standard interest rate, Fixed interest rates.

HDFC Home Loan Interest Rate As Per CIBIL Scores

800

- Salaried: 8.5% onwards

- Self Employed: 8.5% onwards

750-800

- Salaried: 8.5% onwards

- Self Employed: 8.5% onwards

HDFC Home Loan Interest Rate - Standard

Loan up to Rs. 35 Lakhs

- Salaried: 9.25%-9.65%

- Self Employed: 9.40%-9.80%

Loan range between Rs. 35 Lakhs to Rs. 75 Lakhs

- Salaried: 9.50%-9.80%

- Self Employed: 9.65%-9.95%

Loan above Rs. 75 Lakhs

- Salaried: 9.60%-9.90%

- Self Employed: 9.75%-10.05%

HDFC Home Loan Interest Rate - Fixed Rates & Tenure

24 Months Tenure

37 Months Tenure

60 Months Tenure

8.90%-9.15%

120 Months Tenure

11%-12.05%

Full Term Tenure

11.15-11.45%

HDFC Home Loan Eligibility

Check for HDFC Home Loan Eligibility conditions below. You can directly apply for HDFC home loan here.

- You must be an Indian citizen

- You must be between 21 and 65 years

- Your net monthly income has to be at least ₹25,000 if you are salaried

- The minimum PAT (Profit After Tax) must be ₹30,000 for self-employed applicants

- You must have a work experience of at least 2 years if you are a salaried applicant

- Your business must have a vintage of at least 3 years if you are self-employed

- You need to have a stable credit history

HDFC Home Loan Charges

loan processing charges

0.50% – 2.00% of the loan amount or Rs. 3000/- whichever is higher plus applicable taxes (including GST) and other statutory levies, if any.

Administrative Charges

0.25 % of Facility Amount or ₹ 5000/- whichever is lower plus applicable taxes.

Part Prepayment Fees

- Nil for floating interest rates.

- 2% + applicable GST for fixed interest rates.

- 2% for top-up loans if you utilise the amount for business purposes.

- 4% if you repay the entire outstanding principal when you use the amount to buy a property for business purposes.

Statutory / Regulatory Charges

All applicable charges on account of Stamp Duty / MOD / MOE / Central Registry of Securitisation Asset Reconstruction and Security Interest of India (CERSAI) or such other statutory / regulatory bodies and applicable taxes shall be borne and paid (or refunded as the case may be) solely by the customer. You may visit the website of CERSAI for all such charges.

*The facts and figures provided above are indicative and liable to change periodically.

Also check: Home loan interest rate for all banks

HDFC Home Loan Documents Required

These are the required HDFC Home Loan documents Required to submit to avail the home loan from SBI Bank:

Salaried Individuals

- Application form with photograph duly signed.

- Identity, residence and age proof.

- Last 6 months bank statements.

- Last 3 months’ salary-slips.

- Processing fee cheque.

- Form 16/ Income tax Returns.

Self Employed Professional

- Application form with photograph duly signed.

- Identity, residence and age proof.

- Last 6 months bank statements.

- Processing fee cheque.

- Form 16/ Income tax Returns.

- Proof of business existence.

- Education qualification certificate and proof of business existence.

- Last 3 years Income Tax Returns with computation of Income.

- Last 3 years CA Certified/ Audited Balance Sheet and Profit & Loss Account.

Self Employed non professional

- Application form with photograph duly signed.

- Identity, residence and age proof.

- Last 6 months bank statements.

- Processing fee cheque.

- Form 16/ Income tax Returns.

- Proof of business existence.

- Business profile

- Last 3 years Income Tax Returns with computation of Income.

- Last 3 years CA Certified/ Audited Balance Sheet and Profit & Loss Account.

*The above given list is indicative only. Additional documents may be asked for on a case-to-case basis. The facts & figures in this list are liable to change periodically.

Also check: Our HDFC Home loan EMI calculator

Why Choose Arena Fincorp for HDFC Home Loan?

1. Quick approval: We feel proud to say that we are one of the few institutions doing superfast application processing, so that you get to own your dream home faster than ever.

2. 100% transparency: No hidden charges. We’re 100% transparent about the terms of our services.

3. Full Assistance: Rest assured, our experienced team will fully assist you in the entire process from start to finish in getting the best home loan. You just need to breathe and relax while we do the whole work for you.

4. History of Reputation: Having a rich history of providing the best financial solutions, our customers are very happy with working with us & we feel proud to say that they trust us for their future financial needs too.

5. Simple and easy Process: Our experienced team will happily guide you through the entire home loan process, making it simple, easy and hassle free to own your dream home.

HDFC Home Loan Apply Online

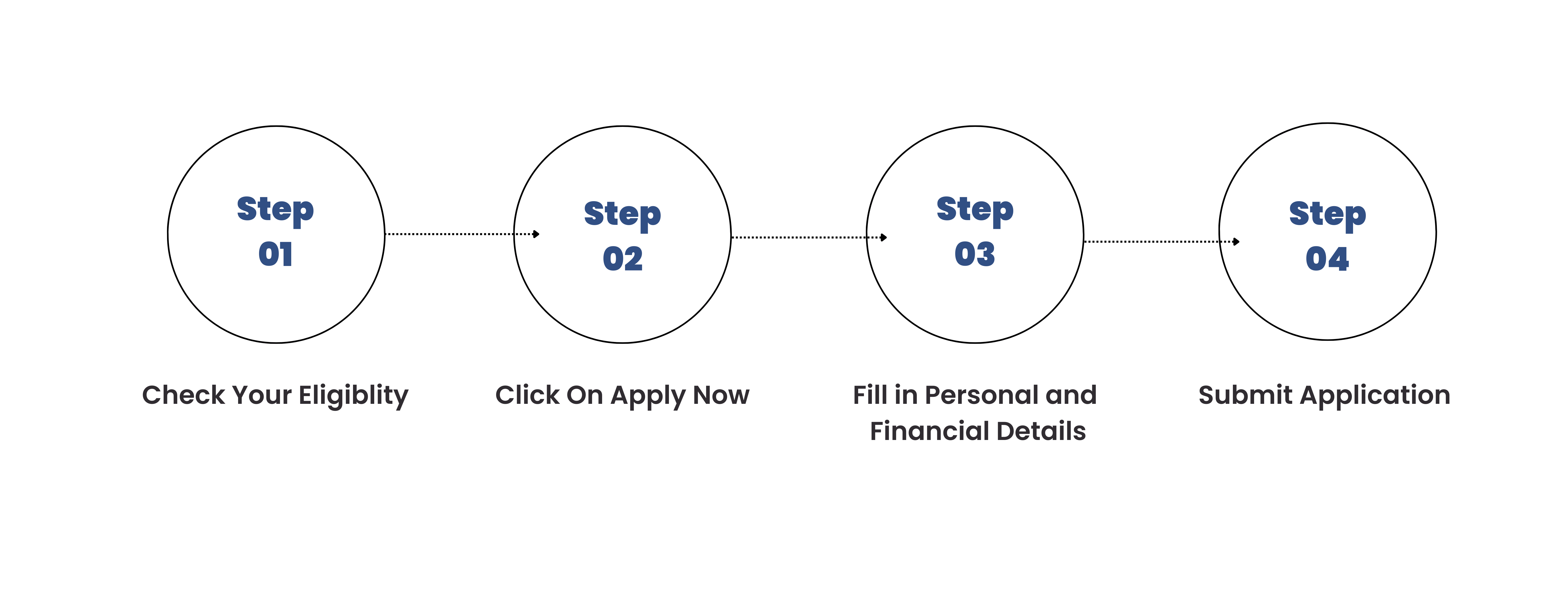

HDFC Home loan apply online at Arena Fincorp. (You can always start your online application and resume it at a later instance at our site.) Here’s our step-by-step guide to apply for HDFC Home loan at our site:

- Step 1: Click on Apply Now to open our online application form

- Step2: Fill in a few details and verify the OTP sent to your phone

- Step3: Enter your KYC and income data

- Step4: Choose the loan amount you want to borrow

- Step5: Submit your application

How to Apply for HDFC Home Loan at Arena Fincorp

Our Customers Love Us

I must say, taking help of Arena Fincorp for my HDFC Home loan was well worth it. I wonder how much work it would've been if i were to do it alone.

The expert guidance from Arena saved me tons of money. I got the loan with lowest interest rates & of the maximum tenure. Really happy with Arena Fincorp.

Amazing staff. They were there to help me in every step of my loan taking journey. They helped me with so many things that i could've easily missed if i were to do it all by myself.

It was a Great Experience. They just got a repeat customer. I will take my car loan too from Arena Fincorp.

SBI Home Loan FAQs

-

How do I apply for an instant HDFC Home loan online?

To apply for an Instant loan for your dream home, you can get in touch with us or click on the apply now button above .

-

How do I calculate my HDFC Home loan EMI?

You can calculate the EMI of your home loan by using our HDFC Home loan EMI calculator.

-

What is the maximum loan amount offered by HDFC for home loans?

The maximum loan amount offered by HDFC for home loans depends on various factors, such as your income, credit history, and other details. Generally, the maximum amount for home loan you can avail from HDFC is 10Cr.

-

Can I get a home loan from HDFC if I have a low credit score?

Your HDFC home loan eligibility depends on various factors, including your credit score. While a low credit score may affect your chances of approval, it does not necessarily disqualify you from getting a home loan. HDFC may consider other factors like income, employment stability, and collateral to assess your loan application.