HDFC Personal Loan

Apply now for HDFC Personal loan at Arena Fincorp & get lowest interest rates. You don’t have to go through the complicated process of getting HDFC personal loan. We will do it for you to make things easier and simpler. So that you can focus on what’s more important, building your business.

We have years of experience in providing financial solutions and will happily assist you through the personal loan process, ensuring a smooth and hassle-free experience. We work hard to provide you with the cheapest personal loans in India, allowing you to avail it without paying a fortune of your income in interest payments.

HDFC Personal Loan Interest Rate

The HDFC Personal loan Interest rate (for salaried individuals) ranges from Minimum 10.50% to maximum 24%. The final interest rate that you would receive from HDFC might depend on several factors such as your repayment history, CIBIL score, your Income, the loan tenure, loan amount etc.

HDFC Personal Loan Eligibility

The following people are eligible to apply for HDFC Personal Loan:

- Employees of private limited companies, employees from public sector undertakings, including central, state and local bodies.

- Individuals between 21 and 60 years of age.

- Individuals who have had a job for at least 2 years, with a minimum of 1 year with the current employer.

- Those who earn a minimum of 25,000 net income per month.

HDFC Personal Loan Documents

You can check the list of HDFC Personal loan Documents, which you would be needing when applying for the loan, below:

- Identity proof / address proof (copy of passport/voter ID card/driving license/Aadhaar Card).

- Bank statement of previous 3 months (Passbook of previous 6 months).

- Two latest salary slip/current dated salary certificate with the latest Form 16.

(No documents required for Pre-Approved personal loan)

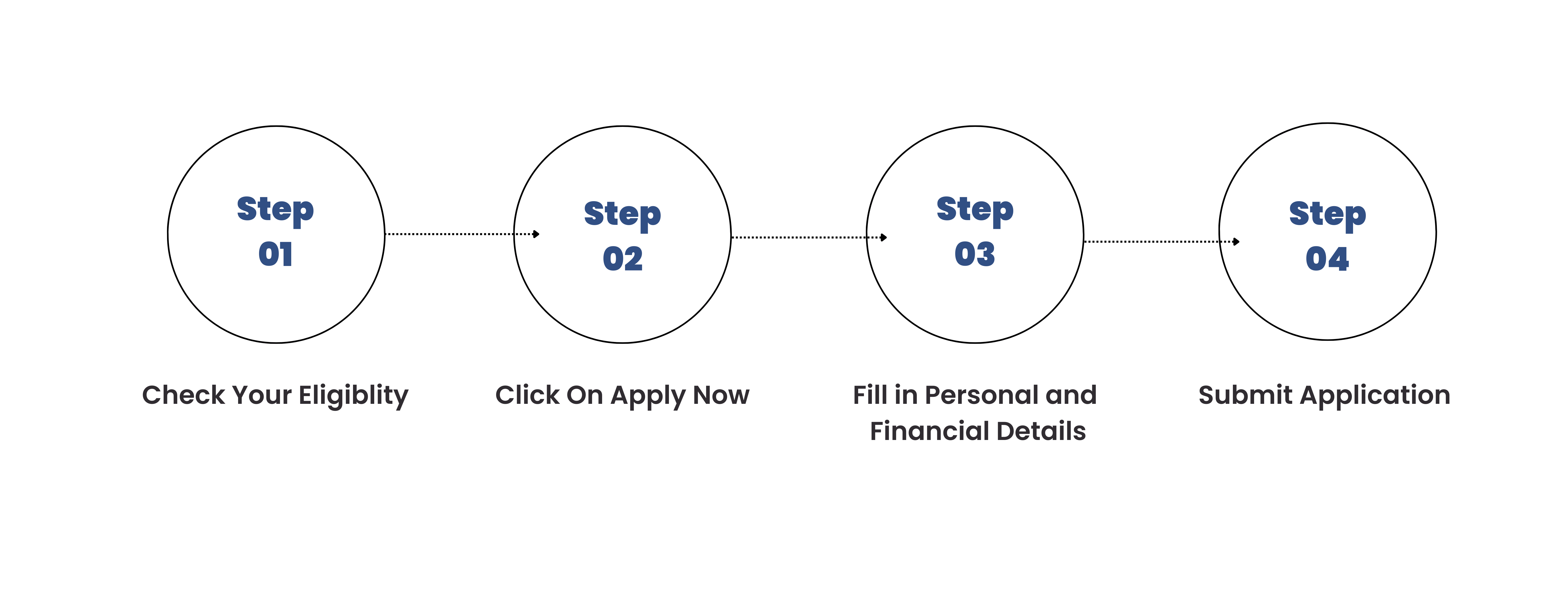

HDFC Personal Loan Apply Online

HDFC personal loan apply online at Arena Fincorp. (You can always start your online application and resume it at a later instance at our site.) Here’s our step-by-step guide to apply for a personal loan online at our site:

Step1: Click on Apply Now to open our online application form

Step2: Fill in a few details and verify the OTP sent to your phone

Step3: Enter your KYC and income data

Step4: Choose the loan amount you want to borrow

Step5: Submit your application.

HDFC Personal Loan Fees & Charges

All HDFC Personal Loan fees & Charges that you need to know, including preclosure charges are mentioned below.

Processing fee / Loan Processing Charges

Up to Rs 4999/-

Stamp Duty & Other Statutory Charges

As per applicable laws of the state

Delayed instalment payment charge

18% p.a plus applicable government taxes on overdue instalment amount

*The facts and figures provided above are indicative and liable to change periodically.

HDFC Business Loan Other Details

Maximum loan Amount

Up to ₹40 lakhs

Loan Tenure

03 Months to 72 Months

*The facts and figures provided above are indicative and liable to change periodically.

How to Calculate HDFC Personal Loan EMI?

To calculate your HDFC Personal loan EMI, you can use the following basic formula:

E = [P x R x (1+R) ^N] / [(1+R) ^ (N-1)]

Here,

‘E’ stands for EMI

‘P’ represents the principal loan amount

‘r’ stands for the interest rate

& ‘n’ represents the duration of the loan

At Arena Fincorp.com, you can find a HDFC personal loan EMI calculator. This tool enables you to calculate your personal loan EMI amount through the web interface. Our EMI calculator allows you to understand the breakdown of each component, including the interest and principal loan amount. Simply put, you can effectively undertake your financial planning based on the computations.

Why Choose Arena Fincorp for HDFC Personal Loan?

1. Quick approval: We feel proud to say that we are one of the few institutions doing superfast application processing, so that you can get your personal loan faster than ever.

2. 100% transparency: No hidden charges. We’re 100% transparent about the terms of our services.

3. Full Assistance: Rest assured, our experienced team will fully assist you in the entire process from start to finish in getting the HDFC personal loan. You just need to breathe and relax while we do the whole work for you.

4. History of Reputation: Having a rich history of providing the best financial solutions, our customers are very happy with working with us & we feel proud to say that they trust us for their future financial needs too.

5. Simple and easy Process: Our experienced team will happily guide you through the entire HDFC personal loan process, making it simple, easy and hassle free to get your personal loan.

Get Your HDFC Personal Loan. Sit Back & Relax While We Do The Work For You.

Related Articles -

https://arenafincorp.com/sbi-home-loan-interest-rate-emi-calculator/

Our Customers Love Us

HDFC Personal Loan FAQs

-

How do I apply for HDFC personal loan online?

To apply for HDFC personal loan, you can get in touch with us or click on the apply now button above.

-

How do I calculate the EMI of my Personal Loan?

To calculate your personal loan EMI, check our EMI calculator above.

-

What is the eligibility criteria for HDFC Personal loan?

The eligibility criteria for HDFC Business loan vary based on factors such your Income, credit history, repayment tenure, loan amount, etc. To know more about it in detail, look at our 'HDFC Personal loan Eligibility' section above.