ICICI Car Loan

ICICI Car loan apply now at Arena Fincorp & get lowest interest rates. You don’t have to go through the complicated process of getting an ICICI car loan. We will do it for you to make things easier and simpler. So that you can focus on what’s more important, owning your dream car.

We have years of experience in providing financial solutions and will happily assist you through the car loan process, ensuring a smooth and hassle-free experience. We work hard to provide you with the cheapest car loans in India, allowing you to get your dream car without paying a fortune of your income in interest payments.

ICICI Car Loan Interest Rate

There are different interest rates for different (2) types of car loans. Check for ICICI car loan interest rate below:

New Car Loans

- 12-35 months: 10.00% onwards based on CIBIL score and car segment.

- 36-96 months: 8.85% onwards based on CIBIL score and car model.

Used Car Loans

11.25 % onwards based on CIBIL score and car segment

ICICI Car Loan Eligibility

Check for ICICI car loan eligibility conditions below:

Salaried Individuals

- Age requirements: 25-58 years.

- Income requirements: Gross income of atleast Rs. 2.5 Lakhs per annum.

- Proof of stability: Minimum total work experience of atleast 2 years required & minimum 1 year work experience with the current employer required.

Those Who pass the above ICICI Car loan eligibility criterias above can apply for the loan.

Self Employed Individuals

- Age requirements: 25-58 years.

- Income requirements: Gross income of atleast Rs. 2 Lakhs per annum.

- Proof of stability: Must be in the business for atleast 3 years.

Partnership firms

- Income requirements: Minium (PAT) profit after tax of Rs. 2 Lakhs per annum required.

- Proof of stability: Must be in the business for atleast 3 years.

Private Ltd. / Public company

- The company must be existing for at least 3 years at the time of application of the loan.

- Income requirements: Minium (PAT) profit after tax of Rs. 2 Lakhs per annum required.

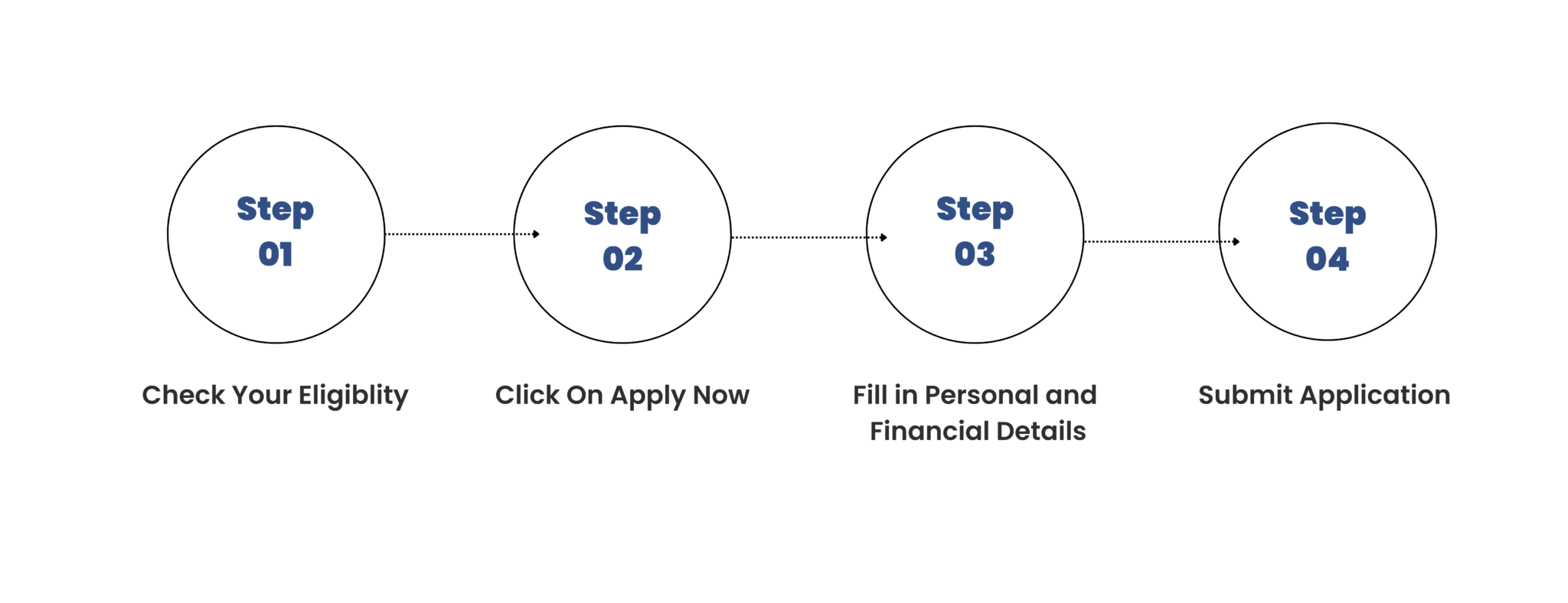

ICICI Car Loan Apply Online

ICICI Car loan apply online at Arena Fincorp. (You can always start your online application and resume it at a later instance at our site.) Here’s our step-by-step guide to apply for ICICI car loan at our site:

- Step 1: Click on Apply Now to open our online application form

- Step2: Fill in a few details and verify the OTP sent to your phone

- Step3: Enter your KYC and income data

- Step4: Choose the loan amount you want to borrow

- Step5: Submit your application

- Step6: Done! Our executives will call you to proceed with the application. Don’t worry, we will take care of the entire loan process for you!

ICICI Car Loan Fees & Charges

Documentation charges

Rs.650/- + applicable GST. Charges NOT to be refunded in case of case cancellation.

Part payment charges

- No prepayment for loan seasoning upto 6 months.

- Part prepayment Charges:

- 6% for loan seasoning upto 12 months.

- 5% for loan seasoning between 13 to 24 months.

- 3% for loan seasoning above 24 months.

Late payment charges

2% per month on overdue EMI

Loan cancellation charges

₹ 2,000 + applicable GST

Prepayment charges (On Foreclosure)

- Upto 12 Months*: 3% + applicable GST.

- 13 to 24 Months*: 2% + applicable GST.

- After 24 Months: Nil prepayment charges.

(Nil Prepayment charges on all fixed rate loans if loan is booked under priority sector lending and Borrower(s) type is Small or Micro & Loan amount is less than or equal to Rs. 50 Lacs. Further, Nil prepayment charges on all floating rate loans to individuals for purposes other than business or if Borrower(s) type is Small or Micro in accordance with MSE Code of Commitment).

*The facts and figures provided above are indicative and liable to change periodically.

Also check: Car loan interest rate for all banks

ICICI Car Loan Documents

Below mentioned list contains all the information about the ICICI Car Loan documents requirement:

Salaried Individuals

- Application form

- Photographs

- Identity proof

- Address proof

- Age proof

- Bank statements

- Signature verification

- Latest salary slip / form 16

- Employment stability proof

Self Employed Professionals

- Application form

- Photographs

- Identity proof

- Address proof

- Age proof

- Bank statements

- Signature verification

- Income tax returns of previous 2 financial years.

- Business stability proof / ownership proof

Self Employed Non-professionals

- Application form

- Identity proof

- Address proof

- Age proof

- Bank statements

- Signature verification

- Income Tax returns of 2 previous financial years along with complete financial/audit report.

- Business stability proof / ownership proof

- Partnership deed and Letter signed by all partners authorising one partner.

- Companies and Societies: Resolution by Board of Directors (or such managing body) and Memorandum and Articles of Association.

*The facts and figures provided above are indicative and liable to change periodically.

Also check: Our SBI Car loan EMI calculator

Why Choose Arena Fincorp for ICICI Car Loan?

1. Quick approval: We feel proud to say that we are one of the few institutions doing superfast application processing, so that you get to own your dream car faster than ever.

2. 100% transparency: No hidden charges. We’re 100% transparent about the terms of our services.

3. Full Assistance: Rest assured, our experienced team will fully assist you in the entire ICICI car loan process from start to finish in getting the best car loan. You just need to breathe and relax while we do the whole work for you.

4. History of Reputation: Having a rich history of providing the best financial solutions, our customers are very happy with working with us & we feel proud to say that they trust us for their future financial needs too.

5. Simple and easy Process: Our experienced team will happily guide you through the entire ICICI car loan process, making it simple, easy and hassle free to own your dream car.

How to Apply for ICICI Car Loan at Arena Fincorp

Related Articles -

https://arenafincorp.com/sbi-home-loan-interest-rate-emi-calculator/

Our Customers Love Us

Loved it! Keeping things simple must be the primary objective of any company, and Arena Fincorp did it brilliantly well!

I'm a businessman. I have so many important things to do rather than spending days researching for the cheapest car loan. Delegating this work to Arena Fincorp saved so much of my time.

Listen, all i would say is don't hesitate. Arena is 100% your choice for your preferred car loan. You just don't know it 🙂

ICICI Car Loan FAQs

-

How do I apply for an instant ICICI car loan online?

To apply for an Instant loan for your dream car, you can get in touch with us by calling us at +91 9251647949 or by mailing us at info@arenafincorp.com or by clicking on the apply now button above.

-

How do I calculate my car loan EMI?

You can calculate the EMI of your car loan by using our Car loan EMI calculator aboce.

-

Can I get a car loan from ICICI if I have a low credit score?

Your ICICI car loan eligibility depends on various factors, including your credit score. While a low credit score may affect your chances of approval, it does not necessarily disqualify you from getting a car loan. ICICI may consider other factors like income, employment stability, and collateral to assess your loan application.

-

What is the loan to buy a new car from ICICI?

The tenure ranges from minimum 1 year to 7 years maximum to secure a loan for a new car.Loved it! Keeping things simple must be the primary objective of any company, and Arena Fincorp did it brilliantly well!