Kotak Bank Credit Card Apply

Arena Fincorp is a leading financial institution that offers a wide range of services, including credit cards. Among their offerings, one of the standout options is the Kotak bank credit card. Arena Fincorp provides the best-in-class Kotak credit cards, designed to meet the diverse needs of individuals and businesses. These cards come with a host of features and benefits, such as attractive reward programs, competitive interest rates, convenient payment options, and enhanced security measures. Whether you are looking for a card that offers travel rewards, cashback, or exclusive privileges, Arena Fincorp’s Kotak credit card lineup has something for everyone. With Arena Fincorp expertise in the financial industry and their commitment to customer satisfaction, they ensure that their Kotak credit cards deliver a seamless and rewarding experience for cardholders.

Top Kotak Bank Credit Card on Arena Fincorp

Why choose Arena Fincorp for Kotak Bank Credit Card Loan?

Wide Acceptance: Kotak Credit Cards are widely accepted both in India and internationally, allowing you to make purchases at a vast network of merchants and online platforms

Multiple Card Options: Kotak offers a range of credit cards tailored to suit different lifestyles, needs, and spending habits. This ensures that you can find a card that aligns with your requirements.

Rewards and Benefits: Kotak Credit Cards often come with attractive reward programs, such as cashback, reward points, discounts, and offers on various categories like dining, shopping, travel, and entertainment.

Specialised Cards: Kotak offers specialised credit cards for specific purposes, such as fuel cards, airline co-branded cards, lifestyle cards, and more. These cards provide additional benefits and rewards specific to those categories.

EMI Facilities: Kotak Credit Cards provide the option to convert large purchases into easy monthly instalments with lower interest rates. This feature allows you to manage your expenses better and reduces the burden of immediate payment.

Contactless Payments: Many Kotak Credit Cards are equipped with contactless payment technology, allowing you to make quick and secure transactions with just a tap at compatible point-of-sale terminals.

Online Account Management: Kotak provides a user-friendly online portal and mobile app that enables easy management of your credit card account. You can view transactions, pay bills, redeem rewards, and track expenses conveniently.

Enhanced Security: Kotak employs advanced security measures to protect your credit card against fraud and unauthorised transactions. These include features like chip-and-pin technology, SMS alerts, and zero-liability policies.

Flexibility in Repayment: Kotak offers flexible repayment options, allowing you to pay the minimum amount due or the full outstanding balance as per your convenience. This gives you control over your finances.

Customer Support: Kotak has a dedicated customer support team that is available to assist you with any queries, concerns, or issues related to your credit card. Their support can help ensure a smooth and satisfactory experience.

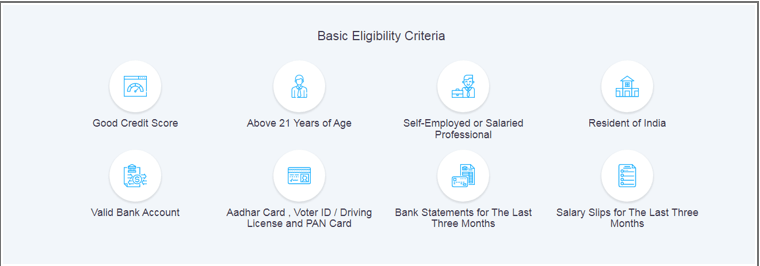

Kotak Mahindra Bank Credit Card Eligibility and Documentation

Kotak Mahindra Bank credit cards are widely accessible. Factors like your nationality, residence, income, credit score and age generally influence the eligibility criteria. However, before applying for an Kotak Mahindra Bank credit card online, glance through their specific requirements and determine if you fit their criteria beforehand.

To get a Kotak credit card, apply through the lender’s website or on Arena Fincorp. However, note the following eligibility criteria to get your credit card hassle-free. These parameters vary for different cards.

Here are a few criteria to note:

- You must be at least 18 years of age

- You must be self-employed or a salaried individual

- You must be an Indian resident

- You must meet the minimum income terms

Once you meet the eligibility criteria, submit the required documents for quick card approval.

- ID proof documents such as Aadhaar card, Passport, PAN Card, Voter ID, etc.

- Address proof documents that include Aadhaar card, Passport, Utility bills, etc.

- Latest salary slips as proof of income

- Latest ITR copies for self-employed

- Latest bank statements

How to Apply for a Kotak Bank Credit Card?

You can compare and apply for Kotak Credit Cards online at Paisabazaar. The steps for the same are mentioned below:

- ENTER YOUR MOBILE NUMBER

To start your Kotak Bank credit card application process, provide your mobile number in the credit card form. - VERIFY OTP AND CHECK AVAILABLE OFFERS

Provide your OTP for verification to check pre-approved offers. - SELECT PREFERRED Kotak CREDIT CARD

Compare available options as per your eligibility and select the best Kotak Bank credit card that suits your requirement. - APPLY AND PROVIDE DOCUMENTS

Apply for the suitable credit card and provide documents for smooth processing of the application.

Kotak Bank Credit Cards FAQ’s

-

What are the benefits of having a Kotak Credit Card?

Kotak Credit Cards offer various benefits such as reward points, cashback, discounts on shopping, dining privileges, airport lounge access, and exclusive offers on travel bookings.

-

How can I apply for a Kotak Credit Card?

- You can apply for a Kotak Credit Card online by visiting the official website of Kotak Mahindra Bank or by visiting a Kotak Mahindra Bank branch near you.

-

What is the credit limit on a Kotak Credit Card?

The credit limit on a Kotak Credit Card is determined by the bank based on various factors like your income, credit history, and creditworthiness.

-

How can I check my Kotak Credit Card balance?

You can check your Kotak Credit Card balance through Kotak Mahindra Bank's net banking portal, mobile banking app, by calling the customer service helpline, or by visiting an ATM.

-

How can I redeem the reward points earned on my Kotak Credit Card?

You can redeem your Kotak Credit Card reward points for a wide range of options such as airline miles, gift vouchers, merchandise, cashback, and bill payments, through the Kotak Mahindra Bank rewards program.

-

Is there an annual fee for Kotak Credit Cards?

Kotak Credit Cards have different variants, some of which may have an annual fee while others may offer a waiver on the fee based on spending criteria. The specific details can be found on the Kotak Mahindra Bank website or by contacting their customer service.

-

Can I convert my Kotak Credit Card purchases into EMIs?

Yes, Kotak Credit Cardholders can convert their purchases into easy monthly instalments (EMIs) by contacting the bank's customer service or through the net banking/mobile banking facility.

-

What should I do if my Kotak Credit Card is lost or stolen?

If your Kotak Credit Card is lost or stolen, immediately report it to Kotak Mahindra Bank's customer service helpline. They will guide you through the process of blocking your card and issuing a replacement.

-

How can I make payments towards my Kotak Credit Card bill?

You can make payments towards your Kotak Credit Card bill through various methods such as net banking, mobile banking, NEFT/RTGS transfer, autopay, or by visiting a Kotak Mahindra Bank branch.

-

What is the customer service contact number for Kotak Credit Cards?

You can contact Kotak Mahindra Bank's customer service helpline at the toll-free number provided on the back of your Kotak Credit Card or check their website for the updated contact information.

Here's what our customer have been saying about us

"I recently applied for a Kotak credit card through Arena Fincorp, and I must say I had a fantastic experience. The team at Arena Fincorp guided me through the entire application process and helped me choose the right card that suited my needs. They were prompt, professional, and provided excellent customer service."

Rahul bansal

"I highly recommend Arena Fincorp for anyone looking to apply for a Kotak credit card. The process was seamless, and the team was knowledgeable and efficient. They answered all my queries and made sure I understood the terms and conditions associated with the card. Overall, a great experience!"

Mohit rana

"I had a great experience with Arena Fincorp while applying for a Kotak credit card. The team was friendly and responsive, and they made the whole application process hassle-free. I received my card in a timely manner, and their customer support was always available to assist me whenever I had any questions."

. Suresh

"I am extremely satisfied with the services provided by Arena Fincorp for my Kotak credit card application. The team was highly professional, and they helped me choose a card with attractive rewards and benefits. Their attention to detail and prompt communication made the entire process a breeze. I couldn't be happier!"

Aman

"Arena Fincorp exceeded my expectations when I applied for a Kotak credit card. They provided personalised assistance, and their expertise in financial products was evident. They guided me through the application, helped me understand the features of the card, and ensured that I had a smooth experience. I would definitely recommend their services to others."

Neha Kumari