Kotak Mahindra Car loan

Arena fincorp is a renowned financial institution that offers a wide range of loan products, including their exceptional Kotak Mahindra Car loan. Arena Fincorp has established itself as a leader in the financial industry, providing customers with competitive interest rates, flexible repayment options, and excellent customer service. When it comes to car loans, Arena Fincorp stands out by offering the best deals and tailored solutions to meet the diverse needs of their customers. Whether you’re looking to purchase a new or used car, Arena Fincorp Kotak Car loan provides hassle-free financing with quick approval processes and convenient loan repayment terms. With their commitment to customer satisfaction and expertise in the lending domain, Arena fincorp is undoubtedly a top choice for individuals seeking the best car loan options.

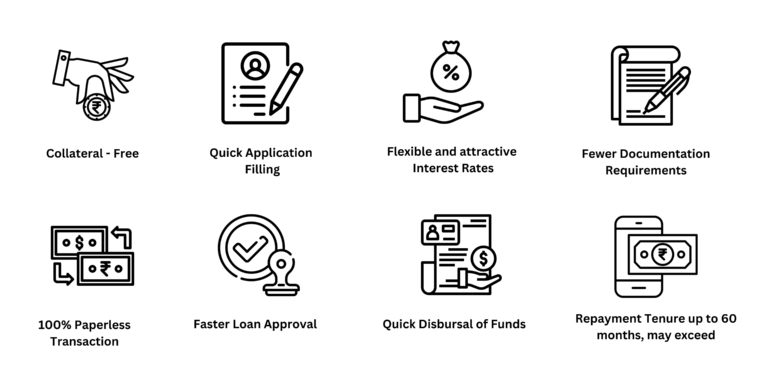

Benefits of Kotak Mahindra Car Loan

Why choose Arena Fincorp for Kotak Car Loan?

Interest Rates: Compare interest rates offered by different lenders to ensure you get a competitive rate that suits your financial situation.

Loan Amount: Check if Arena Fincorp offers the loan amount you need to purchase your desired car. Make sure they cover the entire cost or a significant portion of it.

Loan Tenure: Consider the loan tenure options available. A longer tenure may result in smaller monthly instalments but may cost you more in interest over time.

Eligibility Criteria: Understand the eligibility requirements set by Arena Fincorp to ensure you qualify for the loan. Factors like income, credit score, and employment history may affect your eligibility.

Processing Time: Evaluate the speed at which Arena Fincorp processes loan applications. If you need the loan quickly, choose a lender known for faster processing times.

Customer Service: Look for positive reviews or feedback from existing customers to gauge the quality of customer service provided by Arena Fincorp. Good customer support can make your loan experience smoother.

Prepayment and Foreclosure Charges: Inquire about any prepayment or foreclosure charges associated with the car loan. Some lenders impose penalties for repaying the loan early or in full.

Flexibility in Repayment Options: Check if Arena Fincorp offers flexible repayment options, such as the ability to change the EMI amount or frequency based on your financial circumstances.

Additional Fees and Charges: Understand the complete fee structure, including processing fees, documentation charges, and any other hidden fees. Compare these charges with other lenders.

Reputation and Trustworthiness: Consider the reputation and trustworthiness of Arena Fincorp or any lender you choose. Research their track record, customer reviews, and overall market standing.

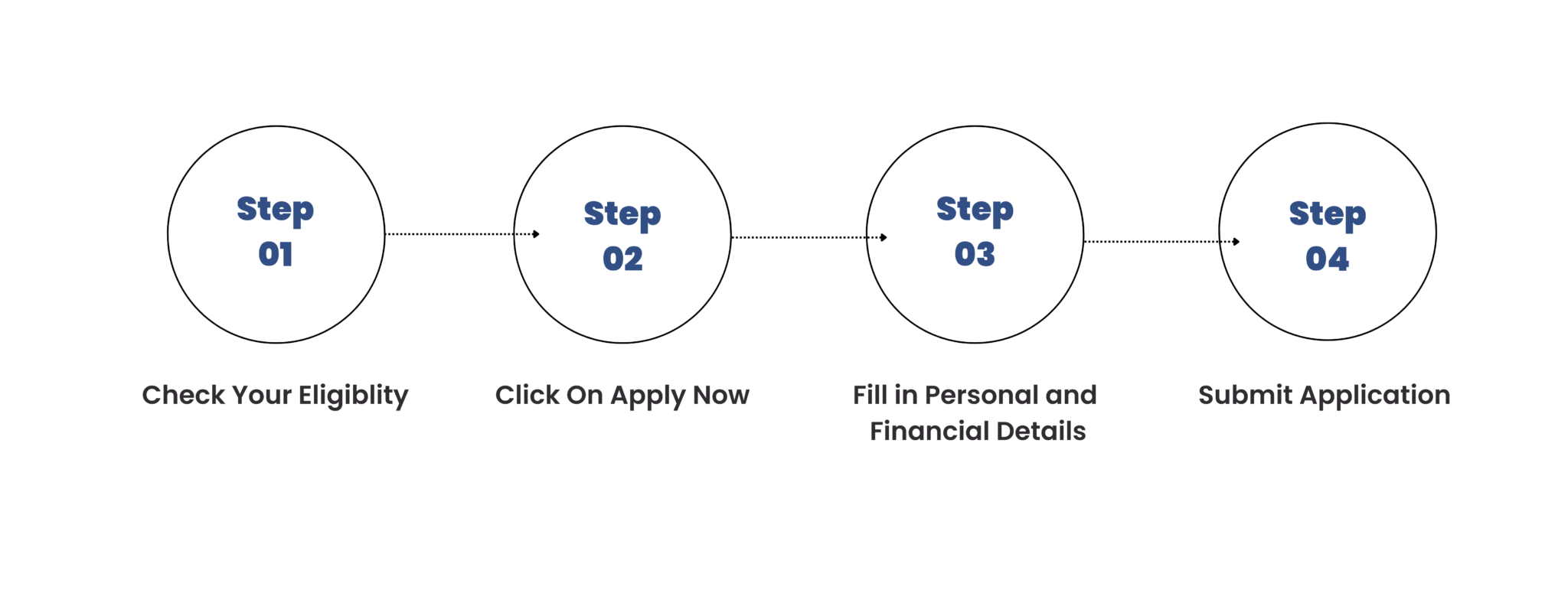

How to Apply for Kotak Car Loan on Arena Fincorp

Kotak Car Loan Interest Rates

Kotak Mahindra Bank offers their customers car loans. Kotak Mahindra Bank interest rates of which depend on factors like the loan amount, repayment tenure, and credit score. Customers looking to purchase either a new car or a pre-owned car can apply for a car loan with Kotak Mahindra Bank.

Kotak Mahindra Car Loan:

Features

Car Loan

Rate of interest

7.70% p.a. to 25% per annum

Loan tenure

Up to 7 years

Loan amount

Up to 90% of the value of the car; Minimum loan amount – Rs.75,000

Prepayment charges

5.21% + taxes

Eligibility for Kotak Mahindra Prime Limited Car Loans

- All Indian Residents

- Minimum residence stability of 1 year

- Minimum employment stability of 1 year

Salaried Individuals

- Minimum age of Applicant: 21 years

- Maximum age of Applicant at loan maturity: 60 years

- Minimum Income of Rs 15000 per month

Self Employed

- Minimum age of Applicant: 21 years

- Maximum age of Applicant at loan maturity: 65 years

- Minimum employment: At least 1 year in business

Documents required for Self Employed Applicant to Apply for KMPL

- KMPL App. Form duly filled by you

- Latest Salary Slip showing statutory deductions

- Form 16 / IT Returns

- Proof of Residence (copy of electricity/ telephone bill/ Passport /Voter’s ID/ Lease deed/ Rent agreement copy/Property Registration Document in the name of the Customer)

- Verification from your Banker/Voters ID/IT PAN card/IT Return/Driving License/Passport

- P&L A/C and B/S for the last 2 years certified by CA

- Copies of Income Tax Returns for the last two years

- Photograph (one signed by the customer).

Kotak Mahindra Car Loan FAQ's

-

What is Kotak Car Loan?

Kotak Car Loan is a financial product offered by Kotak Mahindra Bank that allows individuals to purchase a car by providing them with the necessary funds. It is a type of secured loan where the car acts as collateral for the loan amount.

-

What are the eligibility criteria for Kotak Car Loan?

The eligibility criteria for Kotak Car Loan may vary, but generally, individuals between the age of 21 and 65 years with a stable income and good credit history are eligible. The bank may also consider other factors such as employment stability and previous loan repayment history.

-

How can I apply for a Kotak Car Loan?

You can apply for a Kotak Car Loan online through the bank's official website or by visiting a Kotak Mahindra Bank branch. The bank will require you to submit the necessary documents such as proof of identity, address, income, and car-related documents.

-

What is the maximum loan amount I can get for a car loan from Kotak?

The maximum loan amount you can get for a car loan from Kotak Mahindra Bank depends on various factors such as your income, creditworthiness, and the value of the car. Generally, banks offer up to 85% to 100% of the on-road price of the car as a loan amount.

-

What is the interest rate for Kotak Car Loan?

The interest rate for Kotak Car Loan may vary depending on factors such as the loan amount, tenure, and your credit profile. It is recommended to check the current interest rates offered by Kotak Mahindra Bank at the time of applying for the loan

-

What is the tenure for Kotak Car Loan?

The tenure for Kotak Car Loan can range from 1 year to 7 years, depending on the terms and conditions set by the bank. You can choose a suitable tenure based on your repayment capacity and financial goals.

-

Is there a processing fee for Kotak Car Loan?

Yes, Kotak Mahindra Bank charges a processing fee for car loans. The fee amount may vary and is typically a percentage of the loan amount. It is advisable to check the current processing fee applicable at the time of applying for the loan.

-

Can I prepay or foreclose my Kotak Car Loan?

Yes, you can prepay or foreclose your Kotak Car Loan. However, some banks may impose prepayment charges, which are a percentage of the outstanding loan amount. It is advisable to check the prepayment terms and charges with the bank before making any early repayments.

-

What happens if I default on my Kotak Car Loan?

If you default on your Kotak Car Loan by not making timely repayments, it can negatively impact your credit score and may lead to penalties or legal actions by the bank. It is crucial to communicate with the bank in case of financial difficulties and explore possible solutions to avoid defaulting on the loan.

-

Can I transfer my existing car loan to Kotak Mahindra Bank?

Yes, Kotak Mahindra Bank offers the option to transfer your existing car loan from another bank to Kotak. This process is known as a car loan balance transfer. By transferring the loan, you may avail benefits such as lower interest rates or better terms, depending on the bank's offerings and your eligibility.

Here's what our customer have been saying about us

"I recently availed a car loan from Arena Fincorp for my new vehicle, and I must say I am extremely satisfied with their services. The Kotak car loan offered by Arena Fincorp provided me with competitive interest rates and flexible repayment options. The entire loan process was smooth and hassle-free. Highly recommended!"

Rahul bansal

"I had a wonderful experience with Arena Fincorp and their Kotak car loan. The team was very professional and guided me through every step of the loan application. They offered me a great interest rate and ensured that the loan was processed quickly. I am now a proud car owner, thanks to Arena Fincorp!"

Mohit rana

"I would like to express my gratitude to Arena Fincorp for their excellent service in providing the Kotak car loan. The staff was friendly, knowledgeable, and helped me choose the best loan option based on my financial situation. The loan approval was quick, and the documentation process was hassle-free. I highly recommend Arena Fincorp for anyone looking for a car loan."

Suresh

"Arena Fincorp exceeded my expectations with their Kotak car loan services. They offered me a competitive interest rate and flexible repayment options that suited my budget perfectly. The customer service was top-notch, and the loan approval process was quick and efficient. I am delighted with my experience and would definitely choose Arena Fincorp for future financial needs."

Tanisha

"I recently availed a Kotak car loan from Arena Fincorp, and I'm absolutely delighted with the overall experience! From the initial inquiry to the final disbursal, the entire process was seamless. The loan terms were explained to me clearly, and the interest rate was reasonable. Arena Fincorp's professionalism and customer-centric approach have definitely won me over. I highly recommend their services."

Neha Kumari