Kotak Mahindra Home Loan

Arena Fincorp is a renowned financial institution that excels in providing the best Kotak Mahindra Home Loan services. With its extensive expertise in the housing finance sector, Arena Fincrop understands the diverse needs and aspirations of individuals looking to purchase or construct their dream homes. Arena Fincorp offers a range of flexible home loan options under the Kotak Home Loan product, catering to various requirements and financial profiles of customers. Whether you are a first-time homebuyer or an experienced property investor, Fincorp ensures a seamless and hassle-free loan application process with competitive interest rates, attractive repayment terms, and personalised customer service. When it comes to home loans, Arena Fincorp through its association with Kotak Mahindra Bank, stands out as a reliable and trustworthy choice, providing the best financial solutions to help you achieve your home ownership goals.

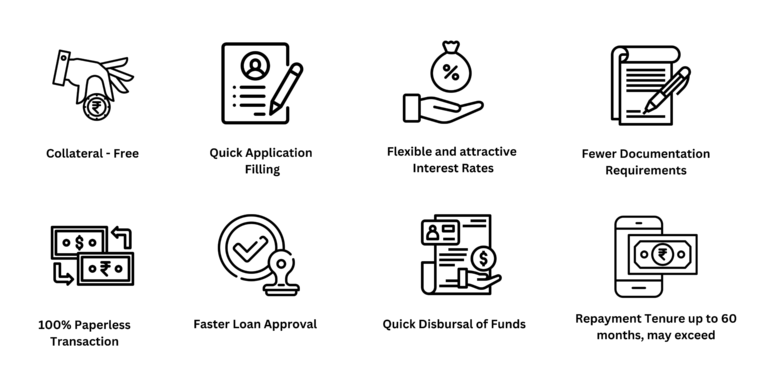

Benefits of Kotak Mahindra Home Loan

Why choose Arena Fincorp for Kotak Mahindra Home Loan?

Reputation and Trust: Kotak Mahindra Bank is a trusted and recognized brand in the banking sector, instilling confidence in customers.

Competitive Interest Rates: Kotak offers competitive interest rates on home loans, allowing borrowers to access funds at affordable rates.

Flexible Loan Options: The bank provides a variety of loan options to suit the diverse needs of customers, such as adjustable and fixed-rate loans.

Quick Loan Processing: Kotak has streamlined loan processing procedures, ensuring a quicker turnaround time for loan approvals.

Transparent Terms and Conditions: The bank maintains transparency in its loan terms and conditions, ensuring borrowers understand their obligations.

Flexible Repayment Options: Kotak offers flexible repayment options, including longer loan tenures, to make repayment convenient for borrowers.

Balance Transfer Facility: Customers who have existing home loans with other banks can transfer their loan to Kotak with ease, taking advantage of lower interest rates or better loan terms.

Dedicated Customer Support: Kotak provides excellent customer support, assisting borrowers at every step of the loan process.

Online Account Management: Kotak offers user-friendly online platforms and mobile apps, allowing borrowers to manage their home loan accounts conveniently.

Additional Benefits: Depending on the specific loan product, Kotak may offer additional benefits such as insurance coverage, preferential interest rates for existing customers, or special offers tied to other banking products.

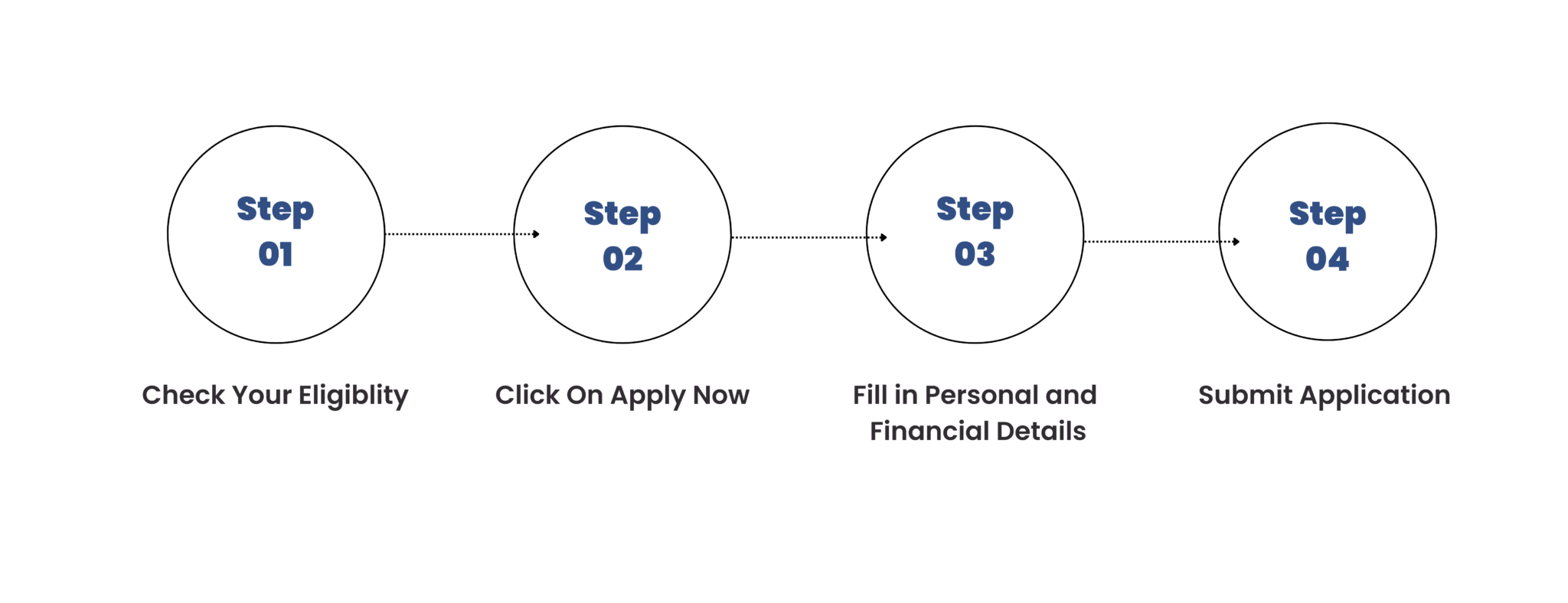

How to Apply for Kotak Mahindra Home Loan on Arena Fincorp

Kotak Mahindra Home Loan Interest Rates

Interest rate plays a crucial role in the home loan process. Applicants look for home loan options that offer competitive interest rates which are budget-friendly and do not burn a hole in their pockets. Kotak bank offers different interest rates to self-employed and salaried individuals as per their financial capabilities. There are separate Kotak home loan rates applicable for home loan balance transfer cases.

Kotak Mahindra home loan interest rates for Salaried and Self-employed Individuals:

Category

Interest Rates

Salaried

7.99 % – 8.05% (per annum)

Self-employed

8.05% – 8.60% (per annum)

Also checkout this for loan calculate: Kotak home loan interest rate in detail.

Kotak Mahindra home loan interest rates for home loan balance transfer cases:

Category

Interest Rates

Salaried

8.00 % (per annum)

Self-employed

8.00 % (per annum)

Kotak Home Loan Eligibility

There are certain home loan eligibility parameters that you must fulfil to get instant approval of a Kotak home loan. The bank has a different set of rules for salaried and self-employed individuals –

Salaried Individuals

- You must be between 18 – 60 years of age.

- You should have a minimum monthly income of Rs. 20,000.

- You should have a CIBIL score of 750 or above.

- You should not have any defaulter record in banks or financial institutions.

- You should hold a Bachelor’s degree in case you are employed in a private company or MNC.

Self-Employed Individuals

- You must be between 18 – 65 years of age.

- You should have a minimum monthly income of Rs. 20,000.

- You should have a CIBIL score of 750 or above.

- You should not have any defaulter record in banks or financial institutions.

How to Apply for Kotak Home Loan Online

Follow these quick and simple steps to apply for a Kotak home loan online:

- Step 1: Visit the official portal of Kotak Mahindra Bank.

- Step 2: Go to the loans section and tap on ‘Home Loan’.

- Step 3: Next, click on ‘Apply Now’.

- Step 4: You will be redirected to a page where the application form will be visible. Fill in all the required and recheck them.

- Step 5: Attach all the required documents along with the form.

- Step 6: Click on ‘Submit’.

- Step 7: Your application will be successfully submitted, and your form will be reviewed. In case your form does not have any point of default, it will be accepted.

- Step 8: Once approved, the funds will be instantly transferred after mandatory paperwork.

Kotak Home Loan FAQ's

-

What is a Kotak Home Loan?

Kotak Home Loan is a financial product offered by Kotak Mahindra Bank, providing individuals with the funds needed to purchase or construct a home.

-

What are the eligibility criteria for Kotak Home Loan?

The eligibility criteria for Kotak Home Loan may include factors such as age, income, employment stability, credit score, and property value. Specific requirements may vary, so it's best to check with Kotak Mahindra Bank for detailed information.

-

What is the maximum loan amount I can get with Kotak Home Loan?

The maximum loan amount offered by Kotak Home Loan depends on factors like your income, repayment capacity, and the value of the property. Generally, the bank may finance up to a certain percentage of the property value.

-

What is the interest rate for Kotak Home Loan?

The interest rate for Kotak Home Loan is subject to change and may vary based on factors such as the loan amount, repayment tenure, credit score, and market conditions. It's advisable to check the bank's website or contact their representatives for the current interest rates.

-

Can I transfer my existing home loan to Kotak Mahindra Bank?

Yes, Kotak Mahindra Bank offers the facility of home loan balance transfer. You can transfer your existing home loan to Kotak Mahindra Bank to take advantage of potentially lower interest rates or better terms and conditions.

-

Are there any processing fees associated with Kotak Home Loan?

Yes, there are processing fees and other charges applicable to Kotak Home Loan. These fees vary and are usually a percentage of the loan amount. It's recommended to inquire with the bank for the exact fees and charges.

-

Can I prepay or foreclose my Kotak Home Loan?

Yes, Kotak Mahindra Bank allows prepayment or foreclosure of home loans. However, certain terms and conditions may apply, including prepayment charges in some cases. It's advisable to review the loan agreement or consult with the bank for specific details.

-

What is the maximum repayment tenure for Kotak Home Loan?

The maximum repayment tenure for Kotak Home Loan typically ranges from 20 to 30 years, depending on various factors such as your age and loan amount. Longer tenures can help reduce the equated monthly instalment (EMI) amount but may result in higher interest payments.

-

Can I get a top-up loan with my Kotak Home Loan?

Yes, Kotak Mahindra Bank offers top-up loans to eligible customers who have an existing home loan with them. A top-up loan allows you to borrow additional funds over and above your existing home loan amount, usually at a slightly higher interest rate.

-

How can I apply for Kotak Home Loan?

You can apply for Kotak Home Loan through various channels, such as the bank's website, mobile app, or by visiting a Kotak Mahindra Bank branch. The application process typically involves submitting the required documents, such as proof of income, identity, address, and property details, along with the filled application form.

Here's what our customer have been saying about us

"I recently availed a Kotak Home Loan through Arena Fincorp, and I must say the experience was excellent. The team at Arena Fincorp was highly professional and guided me through the entire process. They made the loan application hassle-free, and I received the loan approval in a timely manner. I would highly recommend their services."

Rahul bansal

"I would like to express my gratitude to Arena Fincorp for their exceptional assistance in obtaining a Kotak Home Loan. The staff was extremely knowledgeable and proactive in addressing all my queries and concerns. They provided me with clear information about the loan terms and ensured a smooth documentation process. I am thoroughly satisfied with their services and would definitely choose them again in the future."

Mohit rana

"I recently approached Arena Fincorp for a Kotak Home Loan, and I am extremely pleased with their services. The team was prompt in responding to my loan application and provided personalised guidance throughout. They helped me understand the various options available and assisted me in selecting the best loan plan suitable for my requirements. I am grateful for their support and highly recommend their services."

Suresh

"I had a wonderful experience dealing with Arena Fincorp while availing a Kotak Home Loan. The staff was courteous, patient, and readily available to address my concerns. They provided me with regular updates on the loan progress, ensuring transparency and trust. The loan was processed smoothly, and I received the funds on time. I am grateful to Arena Fincorp for their efficient and reliable services."

Tanisha

"Arena Fincorp exceeded my expectations when it came to availing a Kotak Home Loan. Their team demonstrated a high level of professionalism and competence. They guided me through the entire loan application process, explaining each step in detail. The staff was prompt in their responses and went above and beyond to ensure a hassle-free experience. I am extremely satisfied with their services and would highly recommend them for anyone seeking a home loan."

Neha Kumari