SBI Car Loan

Arena Fincorp is a leading financial services provider that can help you apply for SBI car loan at lowest interest rates. You don’t have to go through the complicated process of getting a loan from the State Bank of India. We will do it for you to make things easier and simpler, so that you can focus on what’s more important, getting your dream car.

We have years of experience in providing financial solutions and will happily assist you through the car loan process, ensuring a smooth and hassle-free experience. We work hard to provide you with the cheapest car loan in India, allowing you to own your dream car without paying a fortune of your income in interest payments.

SBI Car Loan Features

- Multiple Options to choose from: State bank Of India offers multiple Car loan options to choose from for financing the purchase of both new as well as used cars.

- Interest is calculated on daily reducing balance: Another added advantage of SBI car loans is that the customers are charged interest at daily reducing balance.

- Lowest Interest Rates: SBI is one of the banks which offers one of the lowest car loan interest rate in India. The rates offered by SBI are very lucrative and are typically lower than it’s competitor banks. Their rate typically ranges between 10.40% and 10.45%.

- No-foreclosure Charges: Certain SBI car loan schemes offer no fore-closure charges; which mean car loan borrowers do not need to pay extra for pre-paying the borrowed car loan amount.

- No advance EMI: The State Bank of India car loan borrowers enjoy flexible options to pay EMIs. Car loans provided by SBI come with hassle free options as per which the customer does not have to pay advance EMI at the time of taking the car loan. Furthermore, they even get the liberty to pay off their EMIs at any time during the month. To know more about the EMI amount for your car loan, check out our SBI car loan emi calculator.

- Financing the Car’s ‘On-Road’ Price: State Bank of India finances car loan of a borrower on 85% of On-Road price that includes cost of registration/annual maintenance contract/total service package/cost of accessories /charges for insurance and extended warranty.

- Repayment tenure: The State Bank of India has designed the car loan product keeping the convenience of the borrowers in mind. For the same, the bank offers the longest car loan repayment period of 7 years or 84 months.

- Optional SBI life cover: Along with the Car Loan, the State Bank of India even offers an option of choosing SBI RiNn by paying a little extra cost to protect your family from the loan liabilities in case of any unfortunate event.

SBI Car Loan Interest Rates and Fees

Interest Rate

9.20% – 9.70%

Processing Fee

Rs. 1,000 – Rs. 1,500 + GST.

Repayment Tenure

Up to 7 years

Financing

90% of ‘on-road’ price

Maximum Loan Amount

For Government Employees: 40 times of monthly income.

For Professionals: 4 times of gross taxable income.

*The facts and figures provided above are indicative and liable to change periodically.

Also check: Car loan interest rate for all banks

SBI Car Loan Eligibility

Here’s the list of the eligibility conditions below. Check your eligibility and apply for SBI car loan here.

Age Group

Category

Income Criteria

Max. Loan Amount

Age: 21 to 65 years

An employee of Central/State government, public/private limited company

A net annual income of Rs. 2,50,000 of the applicant and/or the co-applicant

48 times of the net monthly income

Age: 21 to 65 years

Professionals, self-employed, businessmen, proprietary/partnership firms

Net Profit or Gross Taxable income of Rs. 4,00,000

4 times of Net Profit or Gross Taxable income as per the filed ITR

Age: 21 to 65 years

Agriculturist

A net annual income of Rs. 4,00,000 of the applicant and/or the co-applicant

4 times of Net annual income

*The facts and figures provided above are indicative and liable to change periodically.

You might be interested in: Check Car loan Eligibility requirements for all Major Banks in India

SBI Car Loan Documents Required

These are the required documents to submit to avail the car loan from SBI Bank:

Salaried

Self-Employed

Agriculturist

Car loan application form

Car loan application form

Car loan application form

Bank statement for last 6 months

Bank statement for last 6 months

Bank statement for last 6 months

ID and Address Proof

ID and Address Proof

ID and Address Proof

2 passport size photographs.

2 passport size photographs

2 passport size photographs

Income proof: Salary Slip, Form 16, and ITR for 2 years

Income proof: Form 16 and ITR for 2 years

Bank accepted cropping pattern and land holding documents and documentary proof of cultivation

*The facts and figures provided above are indicative and liable to change periodically.

Also check: Our SBI Car loan EMI calculator

Why Choose Arena Fincorp for SBI Car Loan?

1. Quick approval: We feel proud to say that we are one of the few institutions doing superfast application processing, so that you get to own your dream car faster than ever.

2. 100% transparency: No hidden charges. We’re 100% transparent about the terms of our services.

3. Full Assistance: Rest assured, our experienced team will fully assist you in the entire process from start to finish in getting the best car loan. You just need to breathe and relax while we do the whole work for you.

4. History of Reputation: Having a rich history of providing the best financial solutions, our customers are very happy with working with us & we feel proud to say that they trust us for their future financial needs too.

5. Simple and easy Process: Our experienced team will happily guide you through the entire car loan application process, making it simple, easy and hassle free to own your dream car.

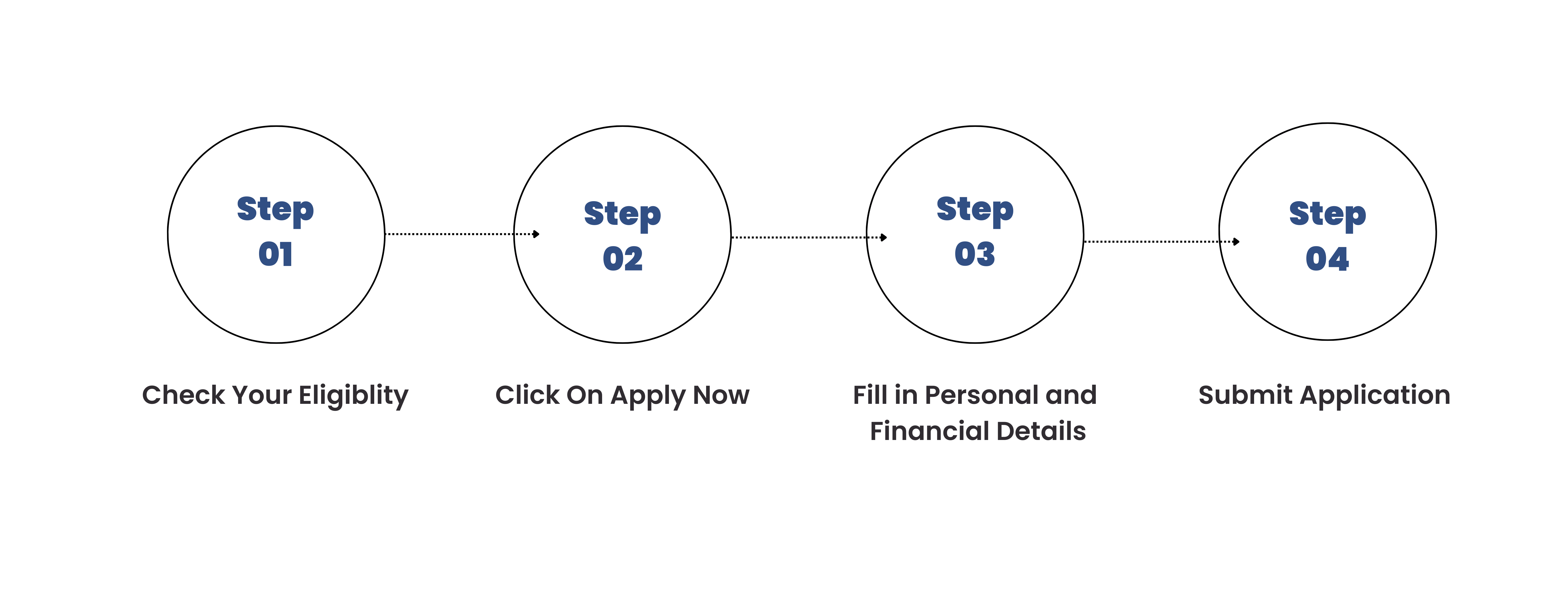

How to Apply for SBI Car Loan at Arena Fincorp

Related Articles -

https://arenafincorp.com/sbi-home-loan-interest-rate-emi-calculator/

Our Customers Love Us

Arena Fincrop provided a seamless SBI car loan experience, with expert guidance, competitive interest rates, and flexible repayment options. Highly recommended.

Arena Fincorp's SBI car loan services are highly satisfactory, with efficient application and disbursement, knowledgeable staff, and prompt queries. I didn't expect them to make things this simpler!

I'm a businessman. I have so many important things to do rather than spending days researching for the cheapest car loan. Delegating this work to Arena Fincorp saved so much of my time.

Someone who is always confused about which bank to choose for any of my loans, this company helped me a lot in deciding! Not only that, but they operated my entire loan process to avail the loan for me. I didn't have to do any work!

Arena Fincorp provided a hassle-free SBI car loan experience, offering customer-centric approach and tailored options to meet individual needs, making the purchase process smooth.

SBI Car Loan FAQs

-

How do I apply for an instant SBI car loan online?

To apply for an Instant loan for your dream car, you can get in touch with us or click on the apply now button above .

-

How do I calculate my car loan EMI?

You can calculate the EMI of your car loan by using our Car loan EMI calculator.

-

What is the maximum loan amount offered by SBI for car loans?

The maximum loan amount offered by SBI for car loans depends on various factors, such as your income, credit history, and the type of car you intend to purchase. Generally, SBI offers car loans ranging from a minimum of Rs. 25,000 to a maximum of several lakhs.

-

What is the repayment period for SBI car loans?

SBI car loans typically come with a repayment period of up to 7 years. However, the exact tenure may vary depending on the specific terms and conditions of the loan, the loan amount, and your repayment capacity.

-

Can I get a car loan from SBI if I have a low credit score?

Your SBI car loan eligibility depends on various factors, including your credit score. While a low credit score may affect your chances of approval, it does not necessarily disqualify you from getting a car loan. SBI may consider other factors like income, employment stability, and collateral to assess your loan application.